Concept explainers

Exercise 1-48 Income Statement

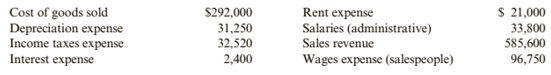

The following information is available for Wright Auto Supply at December 31, 2019.

Required:

1. Prepare a single-step income statement for the year ended December 31, 2019.

2. Prepare a multiple-step income statement for the year ended December 31, 2,019.

3. CONCEPTUAL CONNECTION Comment on the differences between the single-step and the multiple-step income statements.

Concept Introduction:

Income Statement:

Income Statement is the part of the financial statement which is prepared to calculate the net income earned by the organization. In the income statement, all expenses are subtracted from the revenues to calculate the net income. It is prepared for a particular period.

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items.

Requirement-1:

To Prepare:

The single step Income Statement for Wright Auto Supply for the year ended Dec. 31, 2019.

Answer to Problem 48E

The single step Income Statement for Wright Auto Supply for the year ended Dec. 31, 2019 is as follows:

| Wright Auto Supply | ||

| Single Step Income Statement | ||

| For the year ended Dec. 31, 2019 | ||

| Revenues: | ||

| Sales Revenue | $ 585,600 | |

| Total Revenues | ||

| Less: Expenses: | ||

| Cost of goods sold | $ 292,000 | |

| Depreciation expense | $ 31,250 | |

| Interest expense | $ 2,400 | |

| Income tax expense | $ 32,520 | |

| Rent Expense | $ 21,000 | |

| Salaries expenses (Admn.) | $ 33,800 | |

| Wages expense (Sales) | $ 96,750 | |

| Total Expenses | $ 509,720 | |

| Net Income | $ 75,880 | |

Explanation of Solution

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items. The single step Income Statement for Wright Auto Supply for the year ended Dec. 31, 2019 is prepared as follows:

| Wright Auto Supply | ||

| Single Step Income Statement | ||

| For the year ended Dec. 31, 2019 | ||

| Revenues: | ||

| Sales Revenue | $ 585,600 | |

| Total Revenues (A) | ||

| Less: Expenses: | ||

| Cost of goods sold | $ 292,000 | |

| Depreciation expense | $ 31,250 | |

| Interest expense | $ 2,400 | |

| Income tax expense | $ 32,520 | |

| Rent Expense | $ 21,000 | |

| Salaries expenses (Admn.) | $ 33,800 | |

| Wages expense (Sales) | $ 96,750 | |

| Total Expenses (B) | $ 509,720 | |

| Net Income (A-B) | $ 75,880 | |

Concept Introduction:

Income Statement:

Income Statement is the part of the financial statement which is prepared to calculate the net income earned by the organization. In the income statement, all expenses are subtracted from the revenues to calculate the net income. It is prepared for a particular period.

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items.

Requirement-2:

To Prepare:

The multi step Income Statement for Wright Auto Supply for the year ended Dec. 31, 2019.

Answer to Problem 48E

The multi step Income Statement for Wright Auto Supply for the year ended Dec. 31, 2019 is as follows:

| Wright Auto Supply | ||

| Multi Step Income Statement | ||

| For the year ended Dec. 31, 2019 | ||

| Sales Revenue | $ 585,600 | |

| Less: Cost of goods sold | $ 292,000 | |

| Gross Profit | $ 293,600 | |

| Less: Selling and Administrative expenses: | ||

| Depreciation expense | $ 31,250 | |

| Rent Expense | $ 21,000 | |

| Salaries expenses (Admn.) | $ 33,800 | |

| Wages expense (Sales) | $ 96,750 | |

| Total Selling and Administrative expenses: | $ 182,800 | |

| Operating income | $ 110,800 | |

| Less: Interest expense | $ 2,400 | |

| Income before tax | $ 108,400 | |

| Less: Income tax expense | $ 32,520 | |

| Net income | $ 75,880 | |

Explanation of Solution

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items. The multi step Income Statement for Wright Auto Supply for the year ended Dec. 31, 2019 is prepared as follows:

| Wright Auto Supply | ||

| Multi Step Income Statement | ||

| For the year ended Dec. 31, 2019 | ||

| Sales Revenue | $ 585,600 | |

| Less: Cost of goods sold | $ 292,000 | |

| Gross Profit | $ 293,600 | |

| Less: Selling and Administrative expenses: | ||

| Depreciation expense | $ 31,250 | |

| Rent Expense | $ 21,000 | |

| Salaries expenses (Admn.) | $ 33,800 | |

| Wages expense (Sales) | $ 96,750 | |

| Total Selling and Administrative expenses: | $ 182,800 | |

| Operating income | $ 110,800 | |

| Less: Interest expense | $ 2,400 | |

| Income before tax | $ 108,400 | |

| Less: Income tax expense | $ 32,520 | |

| Net income | $ 75,880 | |

Concept Introduction:

Income Statement:

Income Statement is the part of the financial statement which is prepared to calculate the net income earned by the organization. In the income statement, all expenses are subtracted from the revenues to calculate the net income. It is prepared for a particular period.

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items.

Requirement-3:

To Indicate:

The difference between the multi step and single step Income Statements.

Answer to Problem 48E

The difference between the multi step and single step Income Statements is explained as follows:

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items.

Explanation of Solution

The difference between the multi step and single step Income Statements is explained as follows:

There are two ways to present and income statement: Single-step and Multi-step. In the, multi-step income statement the net income calculated after showing multiple steps. In this statement operating and items are separate from non operating items. The multi step Income Statement for Wright Auto Supply for the year ended Dec. 31, 2019 is prepared as follows:

| Wright Auto Supply | ||

| Multi Step Income Statement | ||

| For the year ended Dec. 31, 2019 | ||

| Sales Revenue | $ 585,600 | |

| Less: Cost of goods sold | $ 292,000 | |

| Gross Profit | $ 293,600 | |

| Less: Selling and Administrative expenses: | ||

| Depreciation expense | $ 31,250 | |

| Rent Expense | $ 21,000 | |

| Salaries expenses (Admn.) | $ 33,800 | |

| Wages expense (Sales) | $ 96,750 | |

| Total Selling and Administrative expenses: | $ 182,800 | |

| Operating income | $ 110,800 | |

| Less: Interest expense | $ 2,400 | |

| Income before tax | $ 108,400 | |

| Less: Income tax expense | $ 32,520 | |

| Net income | $ 75,880 | |

The single step Income Statement for Wright Auto Supply for the year ended Dec. 31, 2019 is prepared as follows:

| Wright Auto Supply | ||

| Single Step Income Statement | ||

| For the year ended Dec. 31, 2019 | ||

| Revenues: | ||

| Sales Revenue | $ 585,600 | |

| Total Revenues (A) | ||

| Less: Expenses: | ||

| Cost of goods sold | $ 292,000 | |

| Depreciation expense | $ 31,250 | |

| Interest expense | $ 2,400 | |

| Income tax expense | $ 32,520 | |

| Rent Expense | $ 21,000 | |

| Salaries expenses (Admn.) | $ 33,800 | |

| Wages expense (Sales) | $ 96,750 | |

| Total Expenses (B) | $ 509,720 | |

| Net Income (A-B) | $ 75,880 | |

Want to see more full solutions like this?

Chapter 1 Solutions

Cornerstones of Financial Accounting

- Please explain the correct approach for solving this general accounting question.arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardPlease provide the accurate answer to this general accounting problem using valid techniques.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning  College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning