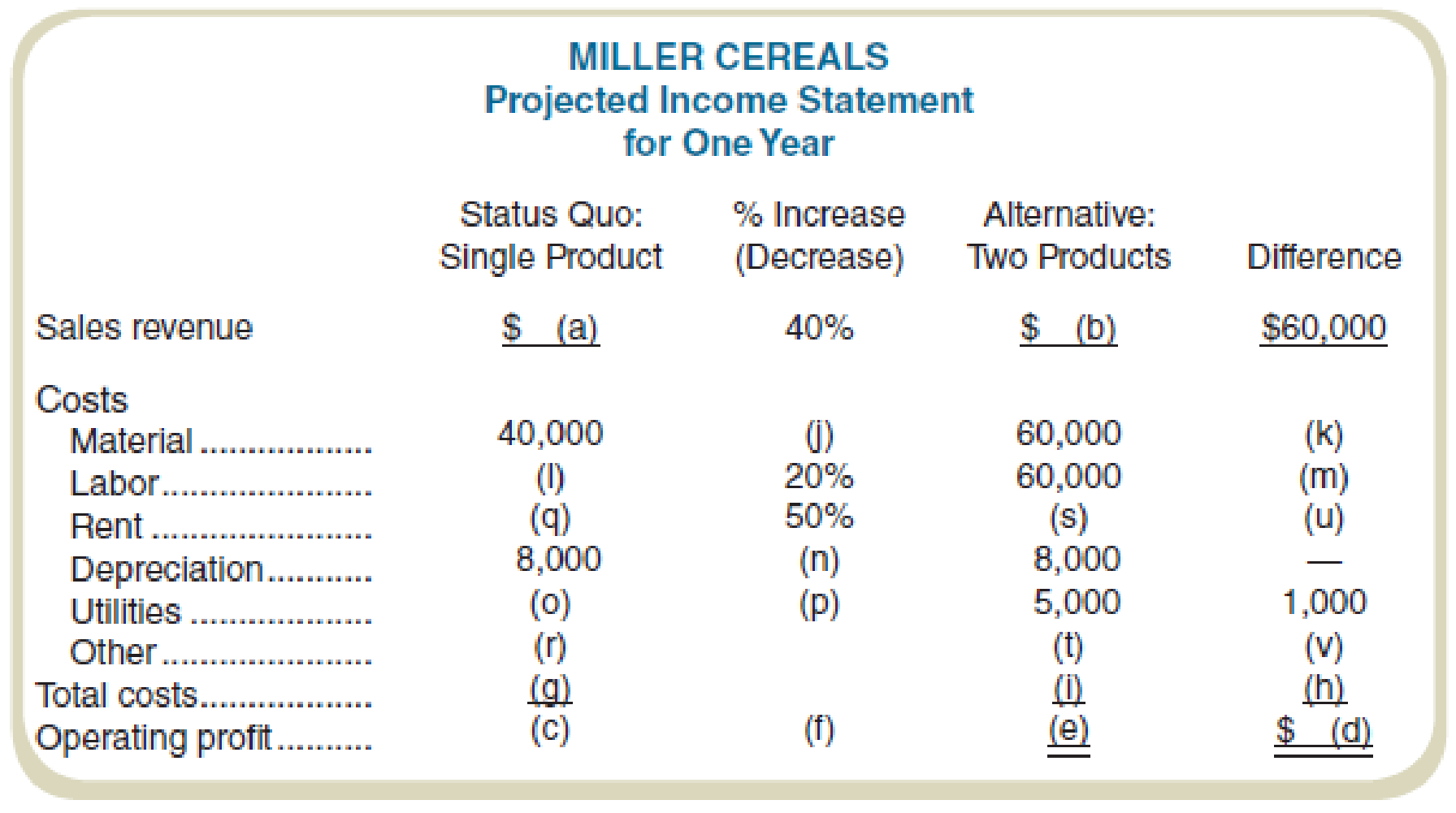

Miller Cereals is a small milling company that makes a single brand of cereal. Recently, a business school intern recommended that the company introduce a second cereal in order to “diversify the product portfolio.” Currently, the company shows an operating profit that is 20 percent of sales. With the single product, other costs were twice the cost of rent.

The intern estimated that the incremental profit of the new cereal would only be 2.5 percent of the incremental revenue, but it would still add to total profit. On his last day, the intern told Miller’s marketing manager that his analysis was on the company laptop in a spreadsheet with a file name, NewProduct.xlsx. The intern then left for a 12-month walkabout in the outback of Australia and cannot be reached.

When the marketing manager opened the file, it was corrupted and could not be opened. She then found an early (incomplete) copy on the company’s backup server. The incomplete spreadsheet is shown following. The marketing manager then called a cost

Required

As the management accountant, fill in the blank cells.

Fill in the blank cells of the projected income statement.

Explanation of Solution

Projected income statement: The projected income statement represents the future financial position of the entity. The projected income statement is prepared with an objective of showing the financial results for a future period of time.

Fill in the blank cells of the projected income statement:

| Company M | ||||

| Projected Income Statement | ||||

| For One Year | ||||

| Status Quo: | % Increase | Alternative | ||

| Single Product | Decrease | Two Products | Difference | |

| Sales revenue | $ 150,000 (a) | 40% | $ 210,000 (b) | $ 60,000 |

| Costs | ||||

| Material | $ 40,000 | 50% (j) | $ 60,000 | $ 20,000 (k) |

| Labor | $ 50,000 (l) | 20% | $ 60,000 | $ 10,000 (m) |

| Rent | $ 6,000 (q) | 50% | $ 9,000 (s) | $ 3,000 (u) |

| Depreciation | $ 8,000 | 0% (n) | $ 8,000 | $ - |

| Utilities | $ 4,000 (o) | 25% (p) | $ 5,000 | $ 1,000 |

| Other | $ 12,000 (r) | $ 36,500 (t) | $ 24,500 (v) | |

| Total costs | $ 120,000 (g) | $ 178,500 (i) | $ 58,500 (h) | |

| Operating profit | $ 30,000 (c) | 5% (f) | $ 31,500 (e) | $ 1,500 (d) |

Table (1)

Working note 1:

Compute the value of (a):

It is given that the profit has increased by 40%. (a) represents the amount of sales revenue.

Working note 2:

Compute the value of (b):

Working note 3:

Compute the value of (c):

Working note 4:

Compute the value of (d):

Working note 5:

Compute the value of (e):

Working note 5:

Compute the value of (f):

Working note 6:

Compute the value of (g):

Working note 6:

Compute the value of (h):

Working note 7:

Compute the value of (i):

Working note 8:

Compute the value of (j):

Working note 9:

Compute the value of (k):

Working note 10:

Compute the value of (l):

Working note 11:

Compute the value of (m):

Working note 12:

Compute the value of (n):

The value of n is 0 as there was no change.

Working note 13:

Compute the value of (o):

Working note 14:

Compute the value of (p):

Working note 15:

Compute the value of (q):

Value of rent:

The value of rent is half of the other costs. Thus, the value of rent will be $6,000, and that of other costs will be $12,000.

Thus,

Working note 16:

Compute the value of (r):

Working note 17:

Compute the value of (s):

Working note 18:

Compute the value of (t):

Working note 19:

Compute the value of (u):

Working note 20:

Compute the value of (v):

Want to see more full solutions like this?

Chapter 1 Solutions

FUNDAME.OF COST ACCT. W/CONNECT

- Question 6During 2019, Bitsincoins Corporation had EBIT of $100,000, a changein net fixed assets of $400,000, an increase in net current assets of$100,000, an increase in spontaneous current liabilities of $400,000,a depreciation expense of $50,000, and a tax rate of 30%. Based onthis information, what is Bitsincoin’s free cash flow?arrow_forwardCariveh Co sells automotive supplies from 25 different locations in one country. Each branch has up to 30 staff working there, although most of the accounting systems are designed and implemented from the company's head office. All accounting systems, apart from petty cash, are computerised, with the internal audit department frequently advising and implementing controls within those systems.Cariveh has an internal audit department of six staff, all of whom have been employed at Cariveh for a minimum of five years and some for as long as 15 years. In the past, the chief internal auditor appoints staff within the internal audit department, although the chief executive officer (CEO) is responsible for appointing the chief internal auditor.The chief internal auditor reports directly to the finance director. The finance director also assists the chief internal auditor in deciding on the scope of work of the internal audit department.You are an audit manager in the internal audit department…arrow_forwardJinkal Sports Co. sells a product for $55 per unit. The variable cost per unit is $28, and monthly fixed costs are $270,000. How many units must be sold to earn a target profit of $120,000?arrow_forward

- return on equity (ROE)? account questionarrow_forwardits net income?arrow_forwardSilver Star Manufacturing has $20 million in sales, an ROE of 15%, and a total assets turnover of 5 times. Common equity on the firm's balance sheet is 30% of its total assets. What is its net income? Round the answer to the nearest cent.arrow_forward

- ???arrow_forwardHorizon Consulting started the year with total assets of $80,000 and total liabilities of $30,000. During the year, the business recorded $65,000 in service revenues and $40,000 in expenses. Additionally, Horizon issued $12,000 in stock and paid $18,000 in dividends. By how much did stockholders' equity change from the beginning of the year to the end of the year?arrow_forwardх chat gpt - Sea Content Content × CengageNOW × Wallet X takesssignment/takeAssignmentMax.co?muckers&takeAssignment Session Loca agenow.com Instructions Labels and Amount Descriptions Income Statement Instructions A-One Travel Service is owned and operated by Kate Duffner. The revenues and expenses of A-One Travel Service Accounts (revenue and expense items) < Fees earned Office expense Miscellaneous expense Wages expense Required! $1,480,000 350,000 36,000 875,000 Prepare an income statement for the year ended August 31, 2016 Labels and Amount Descriptions Labels Expenses For the Year Ended August 31, 20Y6 Check My Work All work saved.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education