Concept explainers

Cost Data for Managerial Purposes

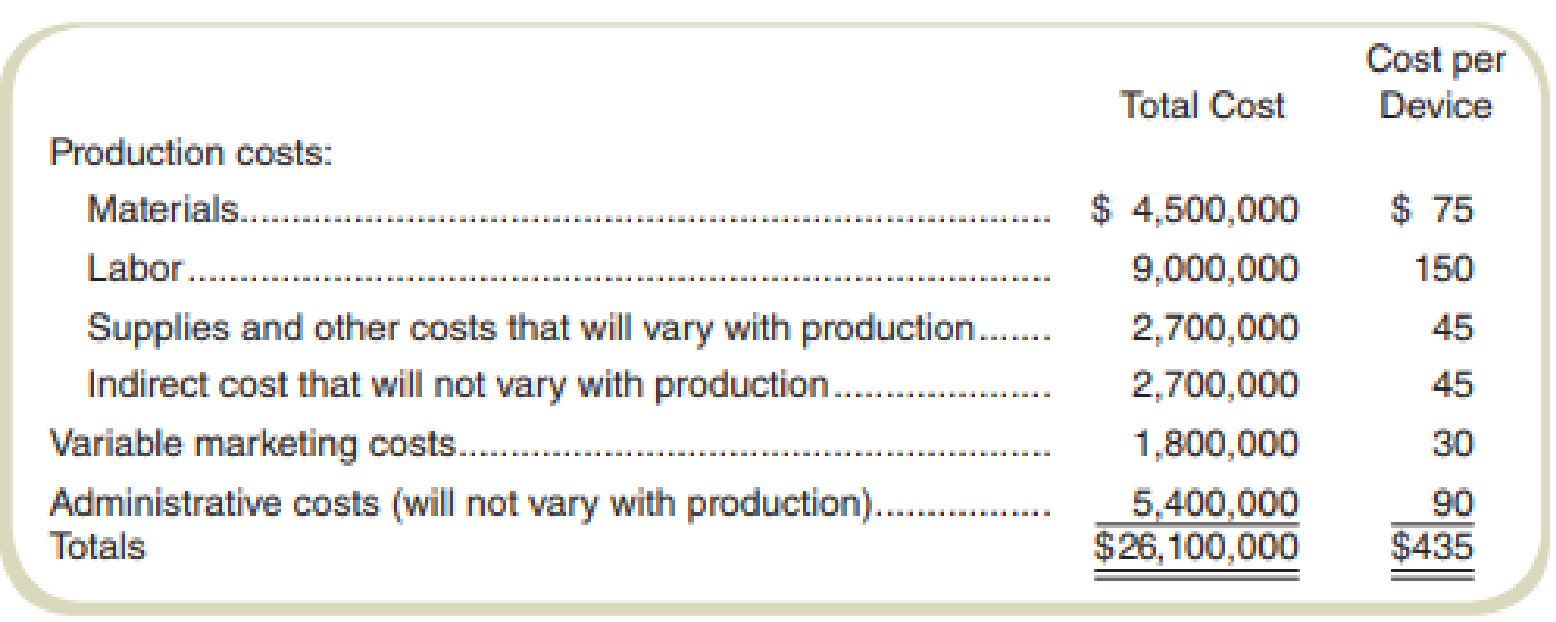

Imperial Devices (ID) has offered to supply the state government with one model of its security screening device at “cost plus 20 percent.” ID operates a manufacturing plant that can produce 66,000 devices per year, but it normally produces 60,000. The costs to produce 60,000 devices follow:

Based on these data, company management expects to receive $522 (= $435 × 120 percent) per monitor for those sold on this contract. After completing 500 monitors, the company sent a bill (invoice) to the government for $261,000 (= 500 monitors × $522 per monitor).

The president of the company received a call from a state auditor, who stated that the per

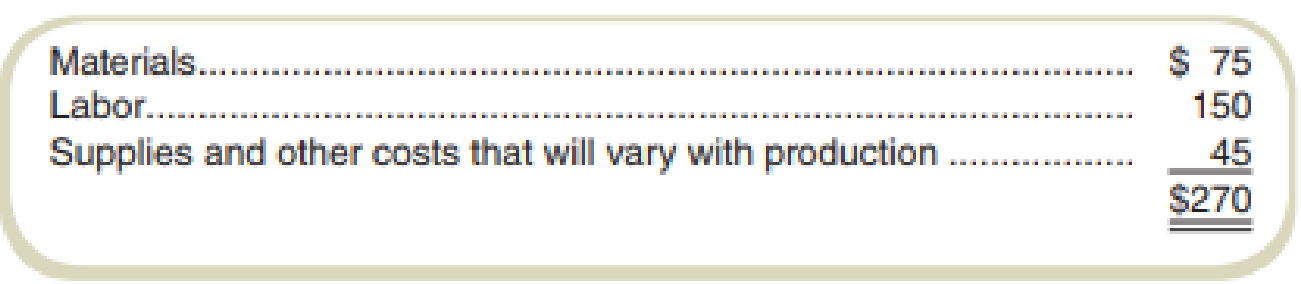

monitor cost should be:

Therefore, the price per monitor should be $324 (= $270 × 120 percent). The state government ignored marketing costs because the contract bypassed the usual selling channels.

Required

What price would you recommend? Why? (Note: You need not limit yourself to the costs selected by the company or by the government auditor.)

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

FUNDAME.OF COST ACCT. W/CONNECT

- Subject:-- general accounting questionsarrow_forwardNozama.com Inc. sells consumer electronics online. For the upcoming period, the budgeted cost of the sales order processing activity is $600,000, and 75,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity (cost per order). b. Determine the total sales order processing cost if Nozama.com processes 50,000 sales orders.arrow_forwardGet correct solution this financial accounting questionarrow_forward

- Mason Manufacturing is preparing its annual profit plan. As part of its cost analysis, management estimates that $150,000 in purchasing support costs should be allocated to individual suppliers based on the number of shipments received. The company has two major suppliers: • Supplier X received 35 shipments during the year. Supplier Y received 105 shipments during the year. Compute the amount of purchasing costs allocated to Supplier Y, assuming Mason Manufacturing uses number of shipments received to allocate costs. a) $30,000 b) $45,000 c) $90,000 d) $112,500arrow_forwardOn January 1, 2020, Superior Manufacturing Company purchased a machine for $50,000,000. Superior's management expects to use the machine for 35,000 hours over the next five years. The estimated residual value of the machine at the end of the fifth year is $60,000. The machine was used for 5,000 hours in 2020 and 6,200 hours in 2021. What is the depreciation expense for 2020 if the company uses the units of the production method of depreciation?arrow_forwardFinancial accountingarrow_forward

- Kinsley Manufacturing estimates that overhead costs for the next year will be $3,600,000 for indirect labor and $850,000 for factory utilities. The company uses direct labor hours as its overhead allocation base. If 125,000 direct labor hours are planned for this next year, what is the company's plantwide overhead rate?arrow_forwardSubject: financial accountingarrow_forwardSubject:-- general accountingarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning