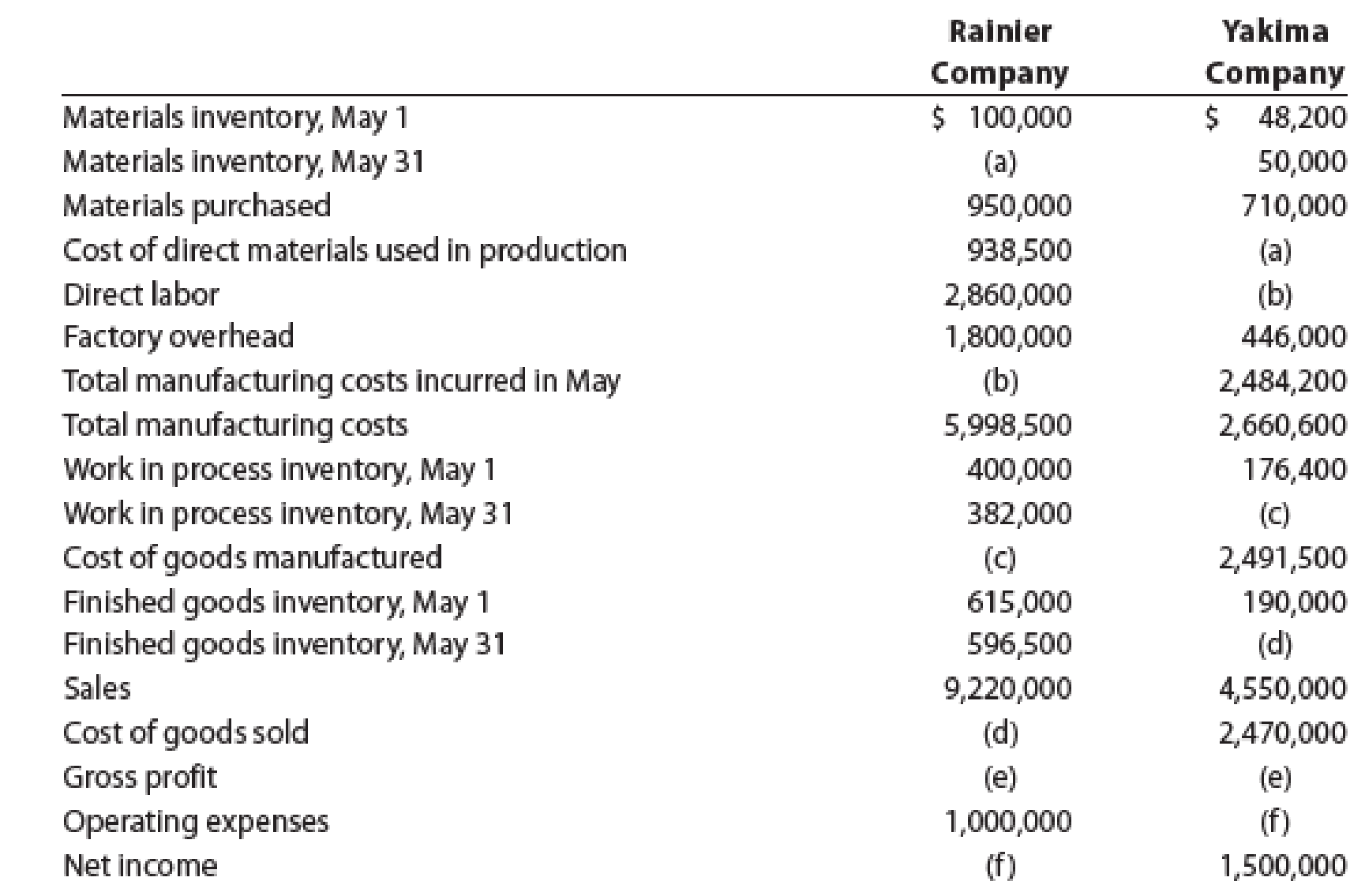

Several items are omitted from the income statement and cost of goods manufactured statement data for two different companies for the month of December:

Instructions

- 1. For both companies, determine the amounts of the missing items (a) through (f), identifying them by letter.

- 2. Prepare Yakima Company’s statement of cost of goods manufactured for December.

- 3. Prepare Yakima Company’s income statement for December.

1.

Calculate the amounts of the missing items (a) through (f).

Explanation of Solution

Cost of goods manufactured:

Cost of goods manufactured refers to the costs incurred for manufacturing the goods during the period. A statement of cost of goods manufactured is prepared in order to determine the cost of goods manufactured, which in turn is used to determine the cost of goods sold, and prepare the income statement.

Income statement:

The income statement is a financial statement that shows the net income earned or net loss suffered by a company through reporting all the revenues earned, and expenses incurred by the company over a specific period of time. An income statement is also known as an operation statement, an earning statement, a revenue statement, or a profit and loss statement. The net income is the excess of revenue over expenses.

Calculate the amounts of the missing items (a) through (f) as follows:

| Particulars | Company On | Company Off |

| Materials inventory, December 1 | $ 65,800 | $ 195,300 |

| Materials inventory, December 31 |

(a) 30,800 | 91,140 |

| Materials purchased | 282,800 |

(a) 581,560 |

| Cost of direct materials used in production | 317,800 |

(b) 685,720 |

| Direct labor | 387,800 | 577,220 |

| Factory overhead | 148,400 | 256,060 |

| Total manufacturing costs incurred during December |

(b) 854,000 | 1,519,000 |

| Total manufacturing costs | 973,000 | 1,727,320 |

| Work in process inventory, December 1 | 119,000 | 208,320 |

| Work in process inventory, December 31 | 172,200 |

(c) 195,300 |

| Cost of goods manufactured |

(c) 800,800 | 1,532,020 |

| Finished goods inventory, December 1 | 224,000 | 269,080 |

| Finished goods inventory, December 31 | 197,400 |

(d) 256,060 |

| Sales | 1,127,000 | 1,944,320 |

| Cost of goods sold |

(d) 827,400 | 1,545,040 |

| Gross profit |

(e) 299,600 |

(e) 399,280 |

| Operating expenses | 117,600 |

(f) 234,360 |

| Net income |

(f) 182,000 | 164,920 |

Table (1)

Working note (a):

Determine the amount of material inventory for Company On.

Determine the amount of materials purchased for Company Off.

Working note (b):

Determine the amount of total manufacturing cost incurred in December for Company On.

Determine the cost of direct materials used in production for Company Off.

Working note (c):

Determine the amount of work in process at the end of the December for Company Off.

Determine the cost of goods manufactured for Company On.

Working note (d):

Determine the amount of finished goods inventory for December 31 for Company Off.

Determine the cost of goods sold for Company On.

Working note (e):

Determine the amount of gross profit for Company On.

Determine the amount of gross profit for Company Off.

Working note (f):

Determine the amount of operating expense for Company Off.

Determine the amount of net income for Company On.

2.

Prepare Company On’s statement of cost of goods manufactured for December.

Explanation of Solution

Prepare Company On’s statement of cost of goods manufactured for December.

| Company On | |||

| Statement of Cost of Goods Manufactured | |||

| For the month ended December 31 | |||

| Particulars | $ | $ | $ |

| Work in process inventory, December 1 (A) | $ 119,000 | ||

| Direct materials: | |||

| Materials inventory, December 1 | $ 65,800 | ||

| Purchases | 282,800 | ||

| Cost of materials available for use | $348,600 | ||

| Less: Materials inventory, December 31 | 30,800 | ||

| Cost of direct materials used | $317,800 | ||

| Direct labor | 387,800 | ||

| Factory overhead | 148,400 | ||

| Total manufacturing costs incurred (B) | 854,000 | ||

| Total manufacturing costs | $973,000 | ||

| Less: Work in process inventory, December 31 | 172,200 | ||

| Cost of goods manufactured | $800,800 | ||

Table (2)

Therefore, the cost of goods manufactured of Company On for December is $800,800.

3.

Prepare Company On’s income statement for December.

Explanation of Solution

Prepare Company On’s income statement for December.

| Company On | ||

| Income Statement | ||

| For the month ended December 31 | ||

| Sales | $1,127,000 | |

| Cost of goods sold: | ||

| Finished goods inventory, December 1 | $224,000 | |

| Cost of goods manufactured | 800,800 | |

| Cost of finished goods available for sale | $1,024,800 | |

| Less: Finished goods inventory, December 31 | 197,400 | |

| Cost of goods sold | 827,400 | |

| Gross Profit | $299,600 | |

| Less: Operating expenses | 117,600 | |

| Net Income | $182,000 | |

Table (3)

Hence, the net income of Company On for the month of December is $182,000.

Want to see more full solutions like this?

Chapter 1 Solutions

Managerial Accounting

- What Is the correct answer A B ?? General Accounting questionarrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardAccounting questionarrow_forward

- Determine the cost of the patent.arrow_forwardAccounting questionarrow_forwardMs. Sharon Washton was born 26 years ago in Bahn, Germany. She is the daughter of a Canadian High Commissioner serving in that country. However, Ms. Washton is now working in Prague, Czech Republic. The only income that she earns in the year is from her Prague marketing job, $55,000 annually, and is subject to income tax in Czech Republic. She has never visited Canada. Determine the residency status of Sharon Washtonarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning