Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 10E

Manufacturing company

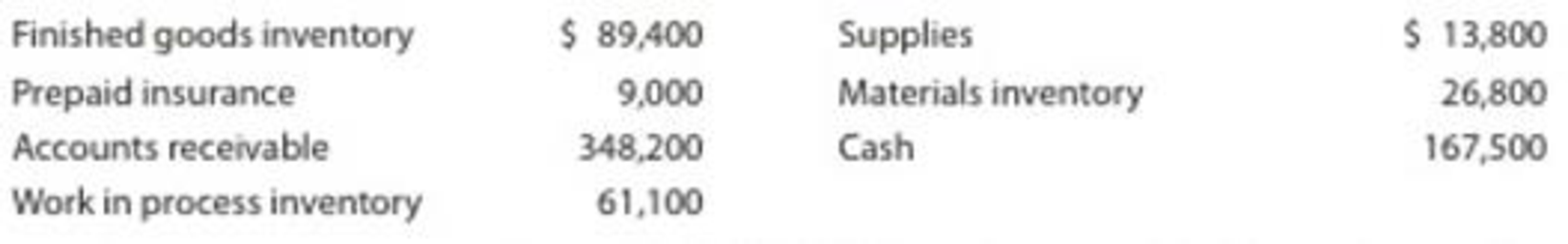

Partial balance sheet data for Diesel Additives Company at August 31 are as follows:

Prepare the “Current assets” section of Diesel Additives Company’s balance sheet at August 31.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need guidance with this general accounting problem using the right accounting principles.

Can you solve this general accounting question with the appropriate accounting analysis techniques?

Can you explain the correct approach to solve this general accounting question?

Chapter 1 Solutions

Managerial Accounting

Ch. 1 - Prob. 1DQCh. 1 - Prob. 2DQCh. 1 - What manufacturing cost term is used to describe...Ch. 1 - Distinguish between prime costs and conversion...Ch. 1 - What is the difference between a product cost and...Ch. 1 - Name the three inventory accounts for a...Ch. 1 - In what order should the three inventories of a...Ch. 1 - What are the three categories of manufacturing...Ch. 1 - How do the manufacturing costs incurred during a...Ch. 1 - How does the Cost of goods sold section of the...

Ch. 1 - Management process Three phases of the management...Ch. 1 - Prob. 2BECh. 1 - Prime and conversion costs Identify the following...Ch. 1 - Product and period costs Identify the following...Ch. 1 - Cost of goods sold, cost of goods manufactured...Ch. 1 - Jakes Cabins is a small motel chain with locations...Ch. 1 - Indicate whether each of the following costs of an...Ch. 1 - Indicate whether the following costs of Procter ...Ch. 1 - Prob. 3ECh. 1 - For apparel manufacturer Abercrombie Fitch, Inc....Ch. 1 - From the choices presented in parentheses, choose...Ch. 1 - Prob. 6ECh. 1 - Classifying costs In a service company A partial...Ch. 1 - Classifying costs The following is a manufacturing...Ch. 1 - Financial statements of a manufacturing firm The...Ch. 1 - Manufacturing company balance sheet Partial...Ch. 1 - Cost of direct materials used in production for a...Ch. 1 - Prob. 12ECh. 1 - Cost of goods manufactured for a manufacturing...Ch. 1 - Income statement for a manufacturing company Two...Ch. 1 - Statement of cost of goods manufactured for a...Ch. 1 - Cost of goods sold, profit margin, and net income...Ch. 1 - Cost flow relationships The following information...Ch. 1 - The following is a list of costs that were...Ch. 1 - The following is a list of costs incurred by...Ch. 1 - A partial list of Foothills Medical Centers costs...Ch. 1 - Manufacturing income statement, statement of cost...Ch. 1 - Statement of cost of goods manufactured and income...Ch. 1 - Prob. 1PBCh. 1 - The following is a list of costs incurred by...Ch. 1 - A partial list of The Grand Hotels costs follows:...Ch. 1 - Several items are omitted from the income...Ch. 1 - Statement of cost of goods manufactured and income...Ch. 1 - Comfort Plus, Inc., has a hotel with 300 rooms in...Ch. 1 - Prob. 2MADCh. 1 - Comparing occupancy for two hotels Sunrise Suites...Ch. 1 - Prob. 4MADCh. 1 - Prob. 5MADCh. 1 - Prob. 1TIFCh. 1 - Communication Todd Johnson is the Vice President...Ch. 1 - For each of the following managers, describe how...Ch. 1 - The following situations describe scenarios that...Ch. 1 - Geek Chic Company provides computer repair...Ch. 1 - Which of the following items would not be...Ch. 1 - Prob. 2CMACh. 1 - A firm has 100,000 in direct materials costs,...Ch. 1 - In practice, items such as wood screws and glue...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Joe and Ethan each own 50% of JH Corporation, a calendar year taxpayer. Distributions from JH are: $750,000 to Joe on April 1 and $250,000 to Ethan on May 1. JH’s current E & P is $300,000 and its accumulated E & P is $600,000. How much of the accumulated E & P is allocated to Ethan’s distribution? a. $0b. $75,000c. $150,000d. $300,000e. None of the above b or c?arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forward

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

- SUBJECT = GENERAL ACCOUNTINGarrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardJH Corporation is a calendar year taxpayer formed in 2014 JH’s E & P before distributions for each of the past 5 years is listed below. 2018 $28,000 2017 $40,000 2016 $39,000 2015 $68,000 2014 $16,000 JH Corporation made the following distributions in the previous 5 years. 2017 Land (basis of $70,000, fair market value of $80,000) 2014 $20,000 cash JH’s accumulated E & P as of January 1, 2019 is: a. $91,000.b. $95,000.c. $101,000. d. $105,000.e. None of the above.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

IAS 29 Financial Reporting in Hyperinflationary Economies: Summary 2021; Author: Silvia of CPDbox;https://www.youtube.com/watch?v=55luVuTYLY8;License: Standard Youtube License