Concept explainers

The following is a list of costs incurred by several manufacturing companies:

a. Bonus for vice president of marketing

b. Costs of operating a research laboratory

c. Cost of unprocessed milk for a dairy

d. Depreciation of factory equipment

e. Entertainment expenses for sales representatives

f. Factory supplies

g. First-aid nurse for factory workersh. Health insurance premiums paid for factory workers

i. Hourly wages of warehouse laborers

j. Lumber used by furniture manufacturer

k. Maintenance

l. Microprocessors for a microcomputer manufacturer

m. Packing supplies for products sold, which are insignificant to the total cost of the product

n. Paper used by commercial printer

o. Paper used in processing various managerial reports

p. Protective glasses for factory machine operators

q. Salaries of quality control personnel

r. Sales commissions

s. Seed for grain farmer

t. Television advertisement

u. Prebuilt transmissions for an automobile manufacturer

v. Wages of a machine operator on the production line

w. Wages of secretary of company controller

x. Wages of telephone operators for a toll-free, customer hotline

Instructions

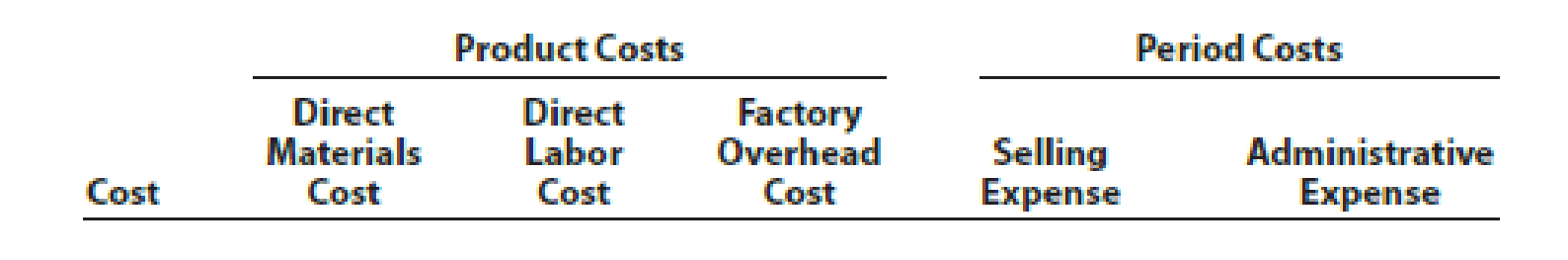

Classify each of the preceding costs as a product cost or period cost. Indicate whether each product cost is a direct materials cost, a direct labor cost, or a factory

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

Managerial Accounting

- Joe transferred land worth $200,000, with a tax basis of $40,000, to JH Corporation, an existing entity, for 100 shares of its stock. JH Corporation has two other shareholders, Ethan and Young, each of whom holds 100 shares. With respect to the transfer:a. Joe has no recognized gain. b. JH Corporation has a basis of $160,000 in the land.c. Joe has a basis of $200,000 in his 100 shares in JH Corporation. d. Joe has a basis of $40,000 in his 100 shares in JH Corporation. e. None of the above.arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning