Fundamentals of Cost Accounting

6th Edition

ISBN: 9781260708783

Author: LANEN, William

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 45P

Cost Data for Managerial Purposes

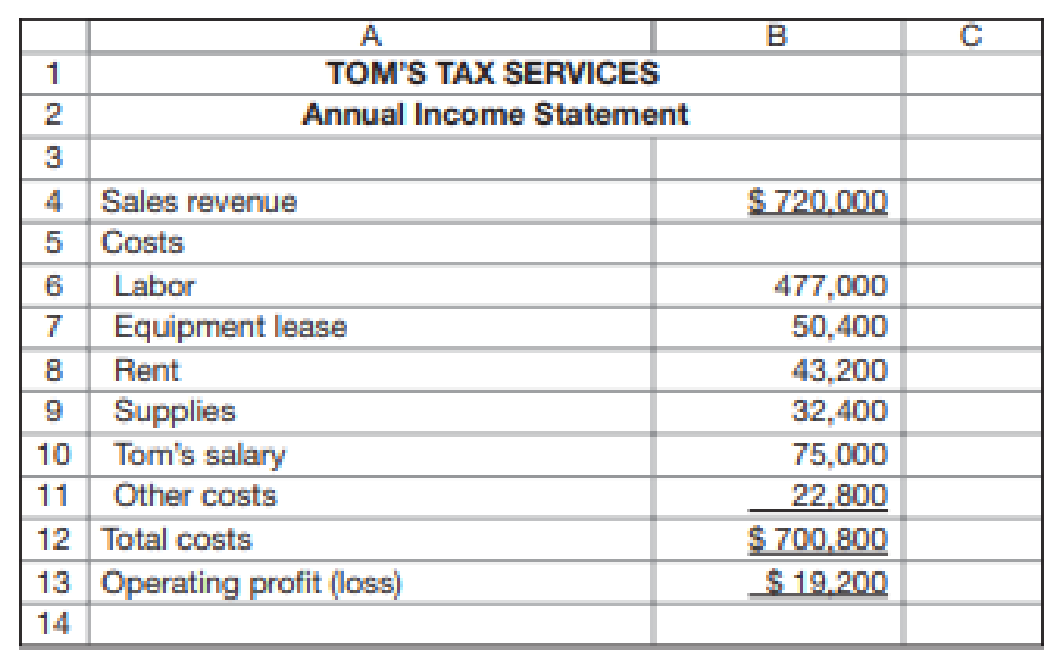

Tom’s Tax Services is a small accounting firm that offers tax services to small businesses and individuals. A local store owner has approached Tom about doing his taxes but is concerned about the fees Tom normally charges. The costs and revenues at Tom’s Tax Services follow.

If Tom gets the store’s business, he will incur an additional $60,000 in labor costs. Tom also estimates that he will have to increase equipment leases by about 10 percent, supplies by 5 percent, and other costs by 15 percent.

Required

- a. What are the differential costs that would be incurred as a result of adding this new client?

- b. Tom would normally charge about $75,000 in fees for the services the store would require. How much could he offer to charge and still not lose money on this client?

- c. What considerations, other than costs, are necessary before making this decision?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Provide correct solution and accounting

I need help with this problem is accounting

General accounting

Chapter 1 Solutions

Fundamentals of Cost Accounting

Ch. 1 - Explain why it is important to consider the...Ch. 1 - Explain the differences between financial...Ch. 1 - Place the letter of the appropriate accounting...Ch. 1 - Distinguish among the value chain, the supply...Ch. 1 - Who are the customers of cost accounting?Ch. 1 - How can cost accounting information together with...Ch. 1 - Prob. 7RQCh. 1 - Does the passage of Sarbanes-Oxley mean that codes...Ch. 1 - Prob. 9CADQCh. 1 - Prob. 10CADQ

Ch. 1 - Prob. 11CADQCh. 1 - Its not the job of accounting to determine...Ch. 1 - Prob. 13CADQCh. 1 - How would cost accounting information help...Ch. 1 - Airlines are well known for using complex pricing...Ch. 1 - Hostess Brands makes a variety of baked goods just...Ch. 1 - What potential conflicts might arise between...Ch. 1 - Refer to the Business Application discussion of...Ch. 1 - Prob. 19CADQCh. 1 - Why does a cost accountant need to be familiar...Ch. 1 - Will studying cost accounting increase the chances...Ch. 1 - Prob. 22CADQCh. 1 - Value Chain and Classification of Costs Apple...Ch. 1 - Pfizer Inc., a pharmaceutical firm, incurs many...Ch. 1 - Tesla, Inc., incurs many types of costs in its...Ch. 1 - Prob. 26ECh. 1 - Accounting Systems McDonalds is a major company in...Ch. 1 - Accounting Systems Ford Motor Company manufactures...Ch. 1 - Cost Data for Managerial Purposes As an analyst at...Ch. 1 - Prob. 30ECh. 1 - Prob. 31ECh. 1 - Refer to the information in Exercise 1-31. The...Ch. 1 - Refer to Exhibit 1.5, which shows budgeted versus...Ch. 1 - Trends in Cost Accounting Required For each cost...Ch. 1 - Prob. 35ECh. 1 - Prob. 36ECh. 1 - Refer to the information in Exercise 1-32. Jon...Ch. 1 - Prob. 38PCh. 1 - Cost Data for Managerial Purposes Imperial Devices...Ch. 1 - Cost Data for Managerial Purposes You have been...Ch. 1 - Prob. 41PCh. 1 - Cost Data for Managerial Purposes Campus Package...Ch. 1 - Cost Data for Managerial Purposes KC Services...Ch. 1 - Cost Data for Managerial Purposes B-You is a...Ch. 1 - Cost Data for Managerial Purposes Toms Tax...Ch. 1 - Gilman’s Café is a popular restaurant in a local...Ch. 1 - Prob. 47PCh. 1 - Prob. 48PCh. 1 - Refer to Exhibit 1.5, which shows budgeted versus...Ch. 1 - Cost Data for Managerial PurposesFinding Unknowns...Ch. 1 - Prob. 51PCh. 1 - Prob. 52PCh. 1 - Prob. 53ICCh. 1 - Miller Cereals is a small milling company that...Ch. 1 - Before Miller Cereals can introduce the new...Ch. 1 - The following story is true except that all names...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Incorrect Question 6 0 / 10 pts Audit Organization ABC is evaluating the different non-audit services it provides to its various clients. Indicate which of the following non-audit services would impair its independence. There are multiple answers. (Hint: There are five non-audit services that would impair the firm's independence). Hiring or terminating the audited entity's employees. Preparing financial statements in their entirety from a client-provided trial balance. Evaluation of an entity's system of internal control performed outside the audit. Approving entity transactions. Supervising ongoing monitoring procedures over an entity's system of internal control. Preparing certain line items or sections of the financial statements based on information in the trial balance. Preparing account reconciliations that identify reconciling items for the audited entity management's evaluation. Changing journal entries without management approval. Posting coded transactions to an audited…arrow_forwardFinancial Accountingarrow_forwardGeneral Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY