In 2011, Kevin Jones, Texas Tigers quarterback, agreed to an eight-year, $50 million contract that at the time made him the highest-paid player in professional football history. The contract included a signing bonus of $11 million and called for annual salaries of $2.5 million in 2011, $1.75 million in 2012, $4.15 million in 2013, $4.90 million in 2014, $5.25 million in 2015, $6.2 million in 2016, $6.75 million in 2017, and $7.5 million in 2018. The $11 million signing bonus was prorated over the course of the contract so that an additional $1.375 million was paid each year over the eight-year contract period. With the salary paid at the beginning of each season, what is the worth of his contract at an interest rate of 6%?

In 2011, Kevin Jones, Texas Tigers quarterback, agreed to an eight-year, $50 million contract that at the time made him the highest-paid player in professional football history. The contract included a signing bonus of $11 million and called for annual salaries of $2.5 million in 2011, $1.75 million in 2012, $4.15 million in 2013, $4.90 million in 2014, $5.25 million in 2015, $6.2 million in 2016, $6.75 million in 2017, and $7.5 million in 2018. The $11 million signing bonus was prorated over the course of the contract so that an additional $1.375 million was paid each year over the eight-year contract period. With the salary paid at the beginning of each season, what is the worth of his contract at an interest rate of 6%?

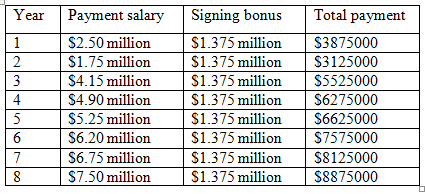

It is given that the annual cash flows of the player are equal to $2.5 million in the first year, $1.75 million in the second year, $4.15 million in the third year, $4.90 million in the fourth year, $5.25 million in the fifth year, $6.2 million in the sixth year, $6.75 million in the seventh year and $7.5 million in the eighth year. Other than the payments, the player also received $1.375 million each year. Thus, the total payments each year can be tabulated as follows:

Step by step

Solved in 2 steps with 2 images