Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter MJ, Problem 2IFRS

IFRS Activity 2

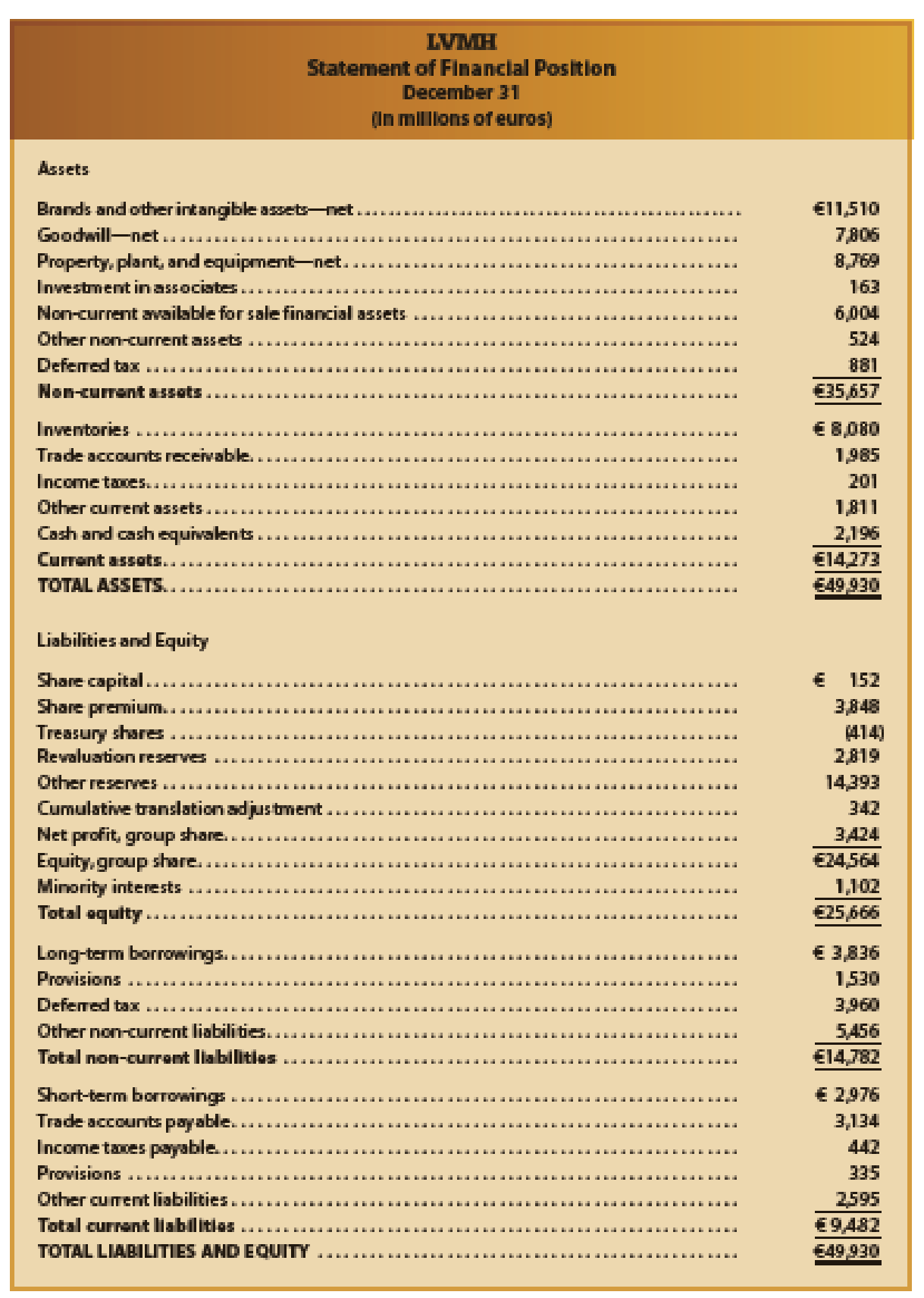

The following is a recent consolidated

- a. Identify presentation differences between the balance sheet of LVMH and a balance sheet prepared under U.S. GAAP. Use the Mornin’ Joe balance sheet (Exhibit 2) as an example of a U.S. GAAP balance sheet. (Ignore minority interests and cumulative translation adjustment.)

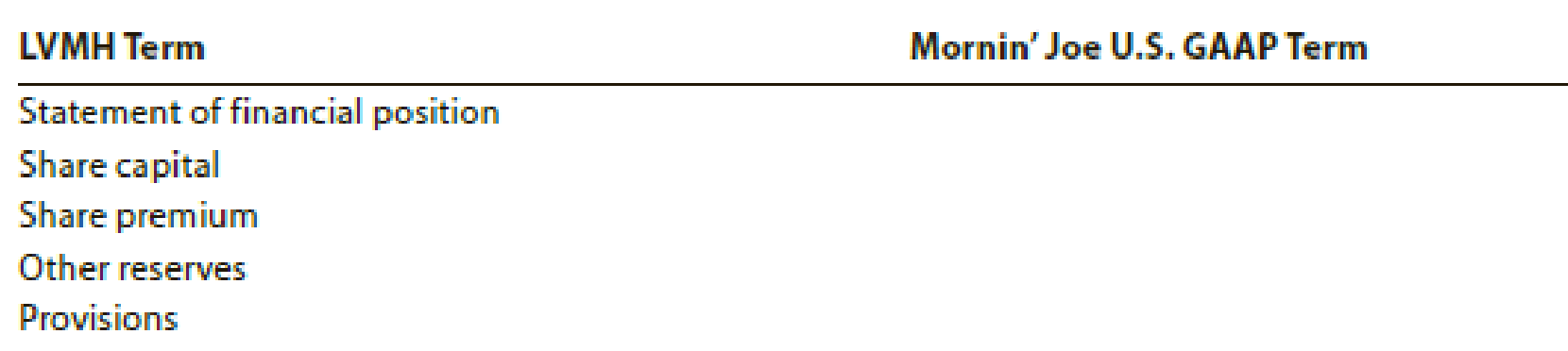

- b. Compare the terms used in this balance sheet with the terms used by Mornin’ Joe (Exhibit 2), using the table that follows:

- c. What does the “Revaluation reserves” in the Equity section of the balance sheet represent?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

help this answer

What is the payback period of this financial accounting question?

financial answer this

Chapter MJ Solutions

Financial Accounting

Ch. MJ - Prob. 1DQCh. MJ - What is the difference between classifying an...Ch. MJ - If a functional expense classification is used for...Ch. MJ - Prob. 4DQCh. MJ - What are two main differences in inventory...Ch. MJ - Prob. 6DQCh. MJ - Prob. 7DQCh. MJ - Prob. 8DQCh. MJ - Prob. 9DQCh. MJ - IFRS Activity 1

Unilever Group is a global company...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Pam Pet Foods Co. reported net income of $52,000 for the year ended December 31, 2005. January 1 balances in accounts receivable and accounts payable were $30,000 and $28,000, respectively. Year-end balances in these accounts were $27,000 and $31,000, respectively. Assuming that all relevant information has been presented, Pam's cash flows from operating activities would be__.arrow_forwardThe following company information is availablearrow_forwardwhat is the profit marginarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Business Diversification; Author: GreggU;https://www.youtube.com/watch?v=50-d__Pn_Ac;License: Standard Youtube License