Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter MJ, Problem 1IFRS

IFRS Activity 1

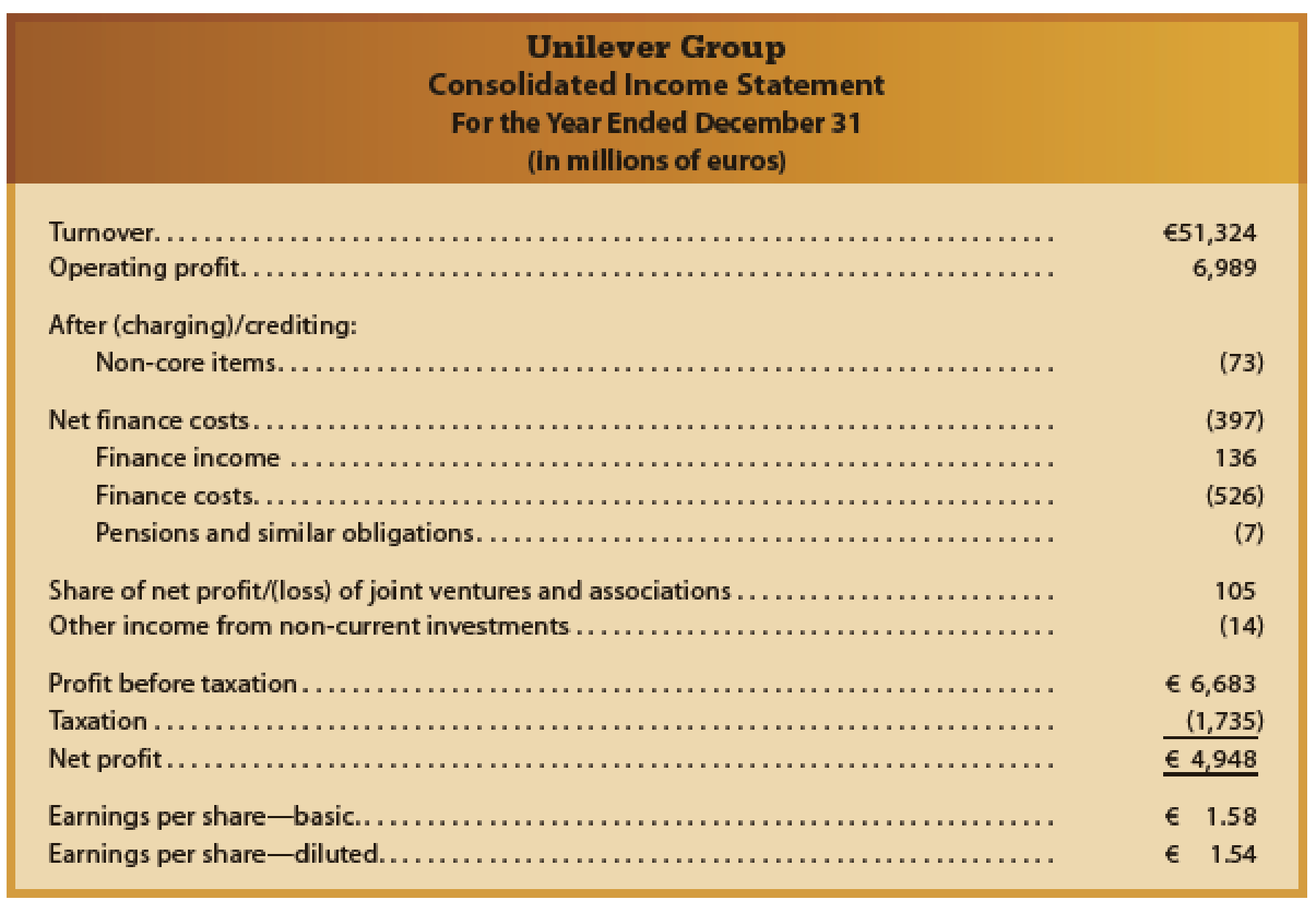

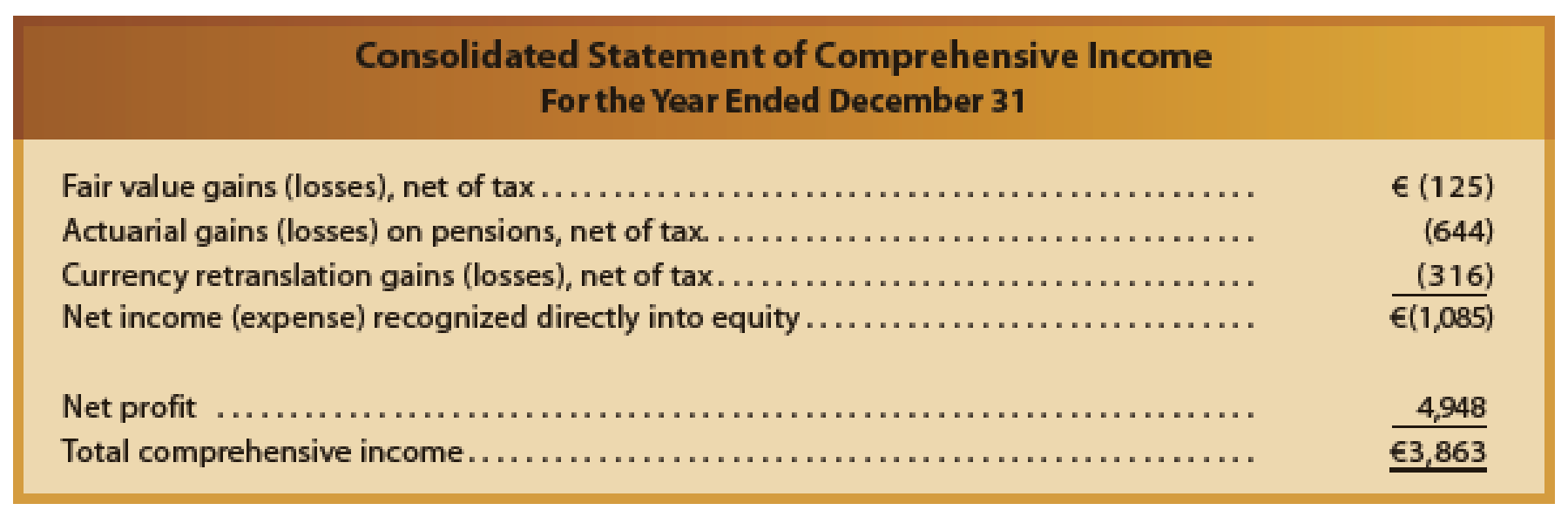

Unilever Group is a global company that markets a wide variety of products, including Lever® soap, Breyer’s® ice cream, and Hellman’s® mayonnaise. A recent income statement and statement of comprehensive income for the Dutch company, Unilever Group, follow:

- a. What do you think is meant by “turnover”?

- b. How does Unilever’s income statement presentation differ significantly from that of Mornin’ Joe?

- c. How is the total for net finance costs presented differently from what typically would be found under U.S. GAAP?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

None

Hudson's actual manufacturing overhead for the year was $140,600 and its actual total direct labor was 19,000 hours.

Please explain the solution to this financial accounting problem with accurate explanations.

Chapter MJ Solutions

Financial Accounting

Ch. MJ - Prob. 1DQCh. MJ - What is the difference between classifying an...Ch. MJ - If a functional expense classification is used for...Ch. MJ - Prob. 4DQCh. MJ - What are two main differences in inventory...Ch. MJ - Prob. 6DQCh. MJ - Prob. 7DQCh. MJ - Prob. 8DQCh. MJ - Prob. 9DQCh. MJ - IFRS Activity 1

Unilever Group is a global company...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forwardHendrix Manufacturing's cost of goods sold includes $510,000 variable and $295,000 fixed costs. The company's selling and administrative expenses include $365,000 variable and $410,000 fixed costs. If the company's total sales revenue is $1,820,000, what is its net income?arrow_forward

- I want the correct answer with accountingarrow_forwardReef Corporation sells its product for $22 per unit. Next year, fixed expenses are expected to be $385,000 and variable expenses are expected to be $13 per unit. How many units must the company sell to generate a net operating income of $115,000? (Round your answer to nearest unit) Need answerarrow_forwardI am searching for the correct answer to this financial accounting problem with proper accounting rules.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License