Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter D, Problem 8SE

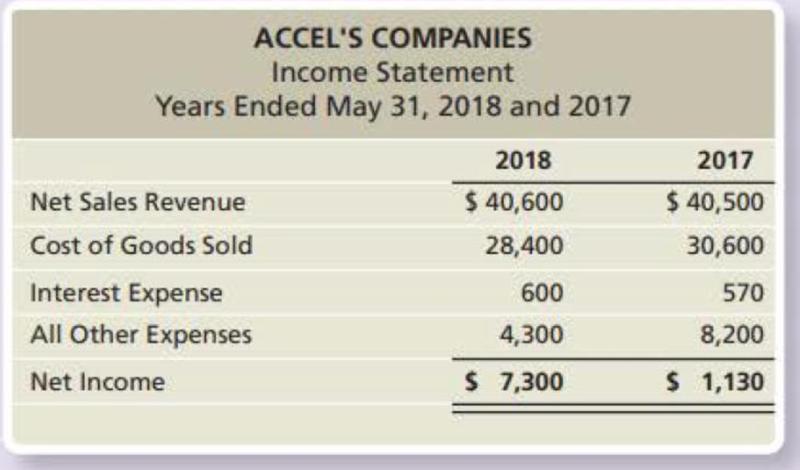

Accel’s Companies, a home improvement store chain, reported the following summarized figures:

Accel’s has 10,000 common shares outstanding during 2018.

Requirements

- 1. Compute the debt ratio and the debt to equity ratio at May 31, 2018, for Accel’s Companies.

- 2. Is Accel’s ability to pay its liabilities strong or weak? Explain your reasoning.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Determine the following requirements of this financial accounting question

Provide correct answer this financial accounting question

Chapter 15 Homework

13

Saved

Help

Save & Exit Submit

Part 1 of 2

0.83

points

eBook

Ask

Required information

Use the following information to answer questions. (Algo)

[The following information applies to the questions displayed below.]

Information on Kwon Manufacturing's activities for its first month of operations follows:

a. Purchased $100,800 of raw materials on credit.

b. Materials requisitions show the following materials used for the month.

Job 201

Job 202

Total direct materials

Indirect materials

Total materials used

$ 49,000

24,400

73,400

9,420

$ 82,820

c. Time tickets show the following labor used for the month.

Print

References

Job 201

$ 40,000

Job 202

13,400

Total direct labor

53,400

25,000

$ 78,400

Indirect labor

Total labor used

d. Applied overhead to Job 201 and to Job 202 using a predetermined overhead rate of 80% of direct materials cost.

e. Transferred Job 201 to Finished Goods Inventory.

f. Sold Job 201 for $166,160 on credit.

g. Incurred the following actual other…

Chapter D Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. D - Prob. 1TICh. D - Prob. 2TICh. D - Prob. 3TICh. D - Prob. 4TICh. D - Prob. 5TICh. D - Prob. 6TICh. D - Prob. 7TICh. D - Prob. 8TICh. D - Prob. 9TICh. D - Prob. 10TI

Ch. D - Prob. 1QCCh. D - Prob. 2QCCh. D - Vertical analysis of Libertys balance sheet for...Ch. D - Prob. 4QCCh. D - Libertys inventory turnover during 2019 was...Ch. D - Prob. 6QCCh. D - Prob. 7QCCh. D - Prob. 8QCCh. D - Prob. 9QCCh. D - Prob. 10QCCh. D - Prob. 1RQCh. D - Prob. 2RQCh. D - Prob. 3RQCh. D - Prob. 4RQCh. D - Prob. 5RQCh. D - Prob. 6RQCh. D - Prob. 7RQCh. D - Prob. 8RQCh. D - Prob. 9RQCh. D - Prob. 10RQCh. D - Prob. 11RQCh. D - Prob. 12RQCh. D - Prob. 13RQCh. D - Prob. 1SECh. D - Verifine Corp. reported the following on its...Ch. D - Prob. 3SECh. D - Prob. 4SECh. D - Prob. 5SECh. D - Prob. 6SECh. D - Prob. 7SECh. D - Accels Companies, a home improvement store chain,...Ch. D - Prob. 9SECh. D - Prob. 10SECh. D - Prob. 11SECh. D - Prob. 12SECh. D - Prob. 13ECh. D - Prob. 14ECh. D - Prob. 15ECh. D - Refer to the data presented for Mulberry Designs,...Ch. D - Prob. 17ECh. D - Prob. 18ECh. D - Prob. 19ECh. D - Micatin, Inc.s comparative income statement...Ch. D - Prob. 21ECh. D - Prob. 22ECh. D - Prob. 23APCh. D - Prob. 24APCh. D - Prob. 25APCh. D - Prob. 26APCh. D - Comparative financial statement data of Sanfield,...Ch. D - Prob. 28APCh. D - Prob. 29APCh. D - Prob. 30BPCh. D - Prob. 31BPCh. D - Prob. 32BPCh. D - Prob. 33BPCh. D - Prob. 34BPCh. D - Prob. 35BPCh. D - In its annual report, XYZ Athletic Supply, Inc....Ch. D - Prob. 38PCh. D - Lance Berkman is the controller of Saturn, a dance...Ch. D - Prob. 1EICh. D - Prob. 1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- quesrion 2arrow_forwardAnti-Pandemic Pharma Co. Ltd. reports the following information in its income statement: Sales = $5,250,000; Costs = $2, 173,000; Other expenses = $187,400; Depreciation expense = $79,000; Interest expense= $53,555; Taxes $76,000; Dividends $69,000. $136,700 worth of new shares were also issued during the year and long-term debt worth $65,300 was redeemed. a) Compute the cash flow from assets b) Compute the net change in working capital (325 marks)arrow_forwardQS 15-18 (Algo) Computing and recording over- or underapplied overhead LO P4 A company applies overhead at a rate of 170% of direct labor cost. Actual overhead cost for the current period is $1,081,900, and direct labor cost is $627,000. 1. Compute the under- or overapplied overhead. 2. Prepare the journal entry to close over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the under- or overapplied overhead.arrow_forward

- Question 6 During 2019, Bitsincoins Corporation had EBIT of $100,000, a change in net fixed assets of $400,000, an increase in net current assets of $100,000, an increase in spontaneous current liabilities of $400,000, a depreciation expense of $50,000, and a tax rate of 30%. Based on this information, what is Bitsincoin's free cash flow? (3 marks)arrow_forwardQuestion 4 Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow? (5 marks)arrow_forwarddiscus extensivery source of bussines finances requaments not less than 4 pages font size 12 spacing 1.5 roman times references must be less thhan 5arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License