Concept explainers

Applying

Lane Company manufactures a single product and applies overhead cost to that product using standard direct labor-hours. The budgeted variable manufacturing overhead is S2 per direct labor-hour and the budgeted fixed manufacturing overhead is S480.000 per year.

The standard quantity of materials is 3 pounds per unit and the

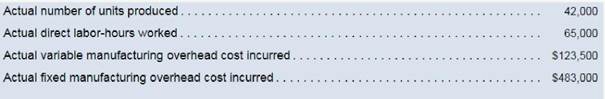

The company planned to operate at a denominator activity level of 60,000 direct labor-hours and to produce 40,000 units of product during the most recent year. Actual activity and costs for the year were as follows:

Required:

1. Compute the predetermined overhead rate for the year. Break the rate down into variable and fixed elements.

2. Prepare a standard cost card for the company's product; show the details for all

3. Do the following:

a. Compute the standard direct labor-hours allowed for the years production.

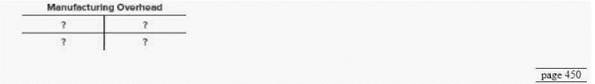

b. Complete the following Manufacturing Overhead T-account for the year:

4. Deteimine the reason for any underapplied or overapplied overhead for the year by computing the variable overhead

rate and efficiency variances and the fixed overhead btidget and volume variances.

5, Suppose the company had chosen 65,000 direct labor-hours as the denominator activity rather than 60.000 hours, State

which, if any, of the variances computed in (4) above would have changed, and explain how the variance(s) would have changed. No computations are necessary.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Introduction to Managerial Accounting - Connect Access

- What is the total number of units to be assigned?arrow_forwardGeneral Accountingarrow_forwardApsara Beverages Co. uses process costing to account for the production of bottled sports drinks. Direct materials are added at the beginning of the process, and conversion costs are incurred uniformly throughout the process. Equivalent units have been calculated to be 21,600 units for materials and 18,000 units for conversion costs. Beginning inventory consisted of $13,500 in materials and $7,200 in conversion costs. May costs were $62,400 for materials and $72,000 for conversion costs. The ending inventory still in process was 7,000 units (100% complete for materials, 50% for conversion). The cost per equivalent unit for materials using the weighted-average method would be____.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College