Concept explainers

Direct Labor and Variable Manufacturing

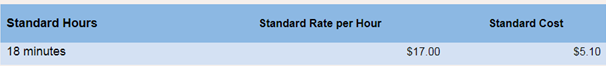

Eric Company manufactures a mobile fitness device called the Jogging Mate. The company uses standards to control its costs. The labor standards that have been set for one Jogging Mate are as follows:

During August, 5,750 hours of direct labor time were needed to make 20.000 units of the Jogging Mate. The direct labor cost totaled $ 102.350 for the month.

Required:

- What is the standard labor-hours allowed (SH) to makes 20.000 Jogging Mates?

1

Standard labor hours

Standard hours represent the number of hours that should have been used by the labors during production in a particular accounting period.

To calculate:Standard labor hours that can be used to produce 20,000 units.

Answer to Problem 10E

Standard labor hours allowed to use for 20,000 units of given product are 6,000 hours.

Explanation of Solution

Standard hours allowed are determined by multiplying actual number of units that a company produce and standard hours available for each unit.

Here, number of units are given as 20,000 and standard time for one unit is 18 minutes. So thw standard hours allowed will be:

So, standard hours allowed are 6,000 hours.

2

Standard labor cost

Standard cost represents the amount of cost that should be incurred on labors during a period.

To calculate: Standard cost allowed for 20,000 units.

Answer to Problem 10E

Standard cost allowed for 20,000 units is $102,000.

Explanation of Solution

Allowed standard labor cost is calculated by the product of allowed standard labor hours and standard rate for one hour.

Here, allowed standard hours are 6,000 (calculated in sub part 1) and standard rate is $17 per hour. So, allowed standard labor cost will be:

Allowed standard labor cost is $102,000.

3

Spending variance

A spending variance represents the difference between actual amount of expense incurred and standard expense.

labor spending variance with the given figures.

Answer to Problem 10E

Labor spending variance is $350 unfavorable.

Explanation of Solution

Labor spending variance is determined by deducting actual labor cost from the standard labor cost.

Here, standard labor cost is $102,000 (calculated in sub part 2) and actual cost of labor is $102,350.

So, required variance will be:

Labor spending variance is $350 unfavorable.

4

Labor rate variance

labor cost variance represents the difference between actual cost incurred on labor and expected cost.

Labor efficiency variance

Labor efficiency variance represents the difference between actual hours worked by labors and the expected hours.

Amount of labor rate and efficiency variances.

Answer to Problem 10E

Labor rate variance is $4,600 unfavorable and labor efficiency variance is $4,250 favorable.

Explanation of Solution

The formula to calculate labor rate variance is:

Here, standard rate is given as $17 per hour and actual labor hours are given as 5,750. Actual rate will be calculated as:

So, actual rate is $17.8 for every hour. Now, variance will be calculated as:

Formula to calculate labor efficiency variance is:

Here, actual hours are given as 5,750, standard hours are 6,000 (calculated in sub part 1) and standard rate is $17 per hour. So, variance will be calculated as:

So, labor rate variance is calculated as $4,600 and labor efficiency variance is calculated as $4,250.

5

Variable overhead rate variance

This variance represents the difference between actual variable cost incurred and standard cost on variable overheads.

Variable overhead efficiency variance

This variance represents the difference between actual hours spent on variable production overhead and the budgeted hours.

Amount of variable overhead rate and efficiency variances.

Answer to Problem 10E

Variable overhead rate variance is $1,150 favorable and variable efficiency variance is 1,000 favorable.

Explanation of Solution

Formula to calculate variable overhead rate variance is:

Here, actual hours worked are 5,750 and standard variable overhead rate is given as $4 per hour. Actual variable overhead rate will be calculated as:

So, actual variable overhead rate is $3.8 per hour. Now, variance will be calculated as:

Formula to calculate variable overhead efficiency variance is:

Here, standard overhead efficiency variance is given as $4 per hour, actual hours are 5,750 and standard hours are 6,000 (calculated in sub part 1). So, the calculation of variance will be:

So, variable overhead rate variance is calculated as $1,150 favorable and variable overhead efficiency variance is calculated as $1,000 favorable.

Want to see more full solutions like this?

Chapter 9 Solutions

Introduction to Managerial Accounting - Connect Access

- Please help me correct my mistakes. for the T account of 2022 and 2023, the ONLY options for accounts names are blank, bad debt expense, collections, credit sales and write offs Jayco Inc. started its operations in 2022. Its sales during 2022, all on account, totalled $700,000. The company collected $500,000 in cash from customers during the year and wrote off $8,000 in uncollectible accounts. The company set up an allowance for doubtful accounts at December 31, 2022, its fiscal year-end, and determined the account balance to be $14,000. The unadjusted balances of selected accounts at December 31, 2023 are as follows: Accounts receivable $ 300,000 Allowance for doubtful accounts (debit) 10,000 Sales revenue (including 80 percent in sales on account) 800,000 Aging of the accounts receivable on December 31, 2023, resulted in an estimate of $11,000 in potentially uncollectible accounts. Required: 1. Prepare the journal entries to record all the…arrow_forward4 PTSarrow_forwardQuick answer of this accounting questionsarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning  Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,