Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 9E

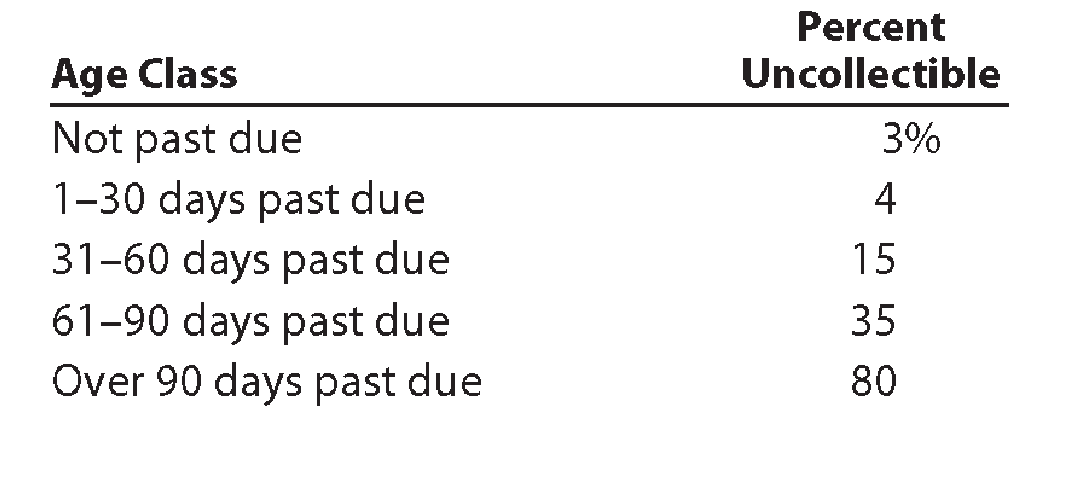

Waddell Industries has a past history of uncollectible accounts, as follows. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule you completed in Exercise 9-8.

The

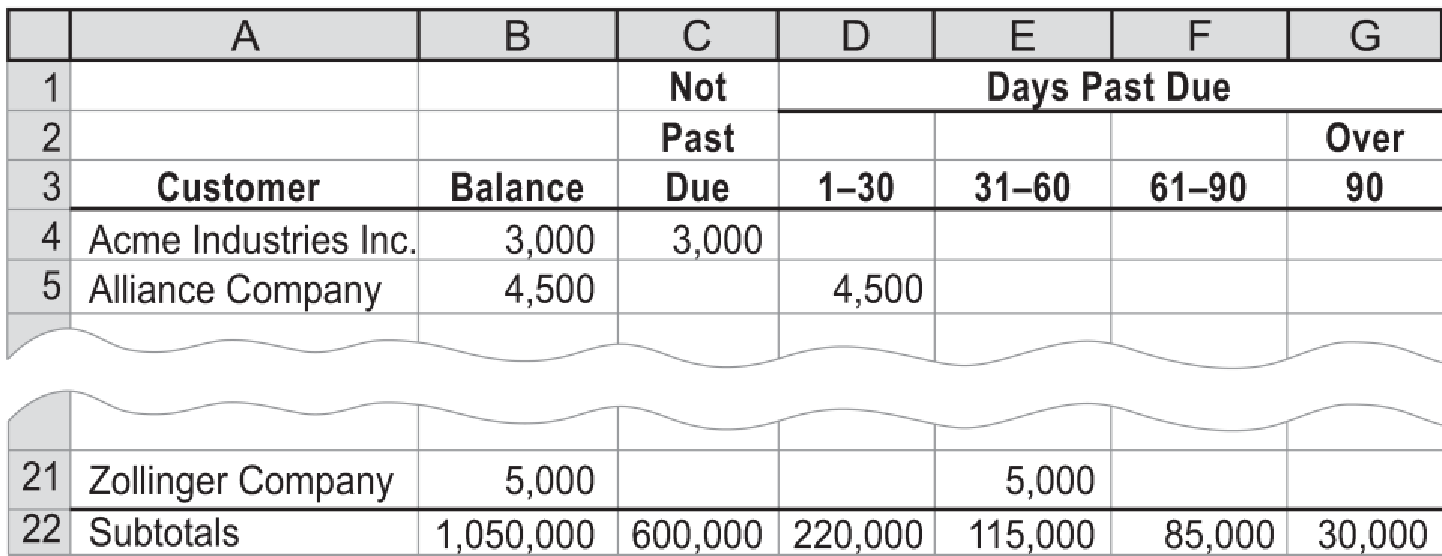

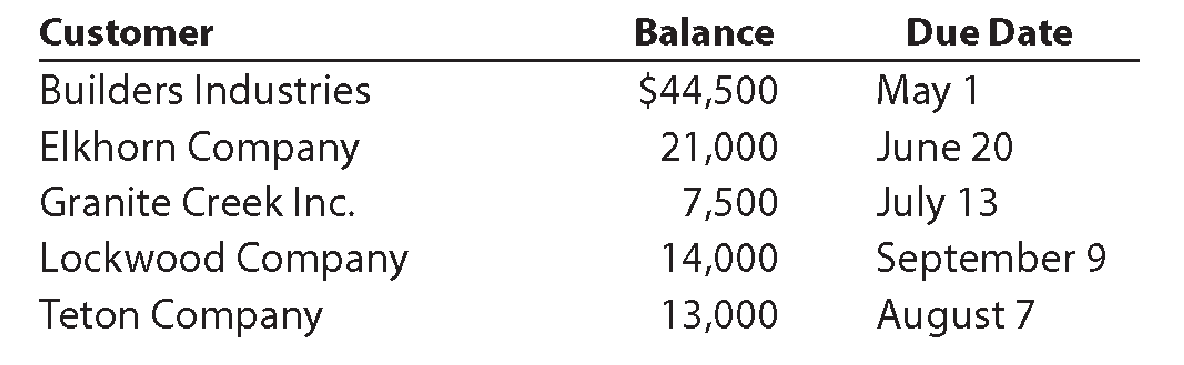

The following accounts were unintentionally omitted from the aging schedule and not included in the preceding subtotals:

- a. Determine the number of days past due for each of the preceding accounts as of August 31.

- b. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you solve this general accounting problem using appropriate accounting principles?

I need help with this general accounting question using standard accounting techniques.

None

Chapter 9 Solutions

Financial Accounting

Ch. 9 - What are the three classifications of receivables?Ch. 9 - Dans Hardware is a small hardware store in the...Ch. 9 - What kind of an account (asset, liability, etc.)...Ch. 9 - After the accounts are adjusted and closed at the...Ch. 9 - A firm has consistently adjusted its allowance...Ch. 9 - Which of the two methods of estimating...Ch. 9 - Neptune Company issued a note receivable to...Ch. 9 - If a note provides for payment of principal of...Ch. 9 - The maker of a 240,000, 6%, 90-day note receivable...Ch. 9 - The note receivable dishonored in Discussion...

Ch. 9 - Prob. 1PEACh. 9 - Journalize the following transactions, using the...Ch. 9 - Prob. 2PEACh. 9 - Journalize the following transactions, using the...Ch. 9 - At the end of the current year, Accounts...Ch. 9 - At the end of the current year, Accounts...Ch. 9 - At the end of the current year, Accounts...Ch. 9 - At the end of the current year, Accounts...Ch. 9 - Guzman Company received a 60-day, 5% note for...Ch. 9 - Prefix Supply Company received a 120-day, 8% note...Ch. 9 - Financial statement data for years ending December...Ch. 9 - Prob. 6PEBCh. 9 - Prob. 1ECh. 9 - MGM Resorts International owns and operates hotels...Ch. 9 - Journalize the following transactions in the...Ch. 9 - Prob. 4ECh. 9 - Creative Solutions Company, a computer consulting...Ch. 9 - At the end of the current year, the accounts...Ch. 9 - Toot Auto Supply distributes new and used...Ch. 9 - The accounts receivable clerk for Waddell...Ch. 9 - Waddell Industries has a past history of...Ch. 9 - Using data in Exercise 9-9, assume that the...Ch. 9 - Selbys Bike Co. is a wholesaler of motorcycle...Ch. 9 - Using the data in Exercise 9-11, assume that the...Ch. 9 - The following selected transactions were taken...Ch. 9 - The following selected transactions were taken...Ch. 9 - Prob. 15ECh. 9 - Using the data in Exercise 9-15, assume that...Ch. 9 - Casebolt Company wrote off the following accounts...Ch. 9 - Seaforth International wrote off the following...Ch. 9 - Determine the due date and the amount of interest...Ch. 9 - Master Designs Decorators issued a 180-day, 6%...Ch. 9 - Prob. 21ECh. 9 - Prob. 22ECh. 9 - Journalize the following transactions of Trapper...Ch. 9 - Journalize the following transactions in the...Ch. 9 - Prob. 25ECh. 9 - Polo Ralph Lauren Corporation designs, markets,...Ch. 9 - Prob. 27ECh. 9 - Prob. 28ECh. 9 - Prob. 29ECh. 9 - The following transactions were completed by The...Ch. 9 - Trophy Fish Company supplies flies and fishing...Ch. 9 - Call Systems Company, a telephone service and...Ch. 9 - Flush Mate Co. wholesales bathroom fixtures....Ch. 9 - The following data relate to notes receivable and...Ch. 9 - The following were selected from among the...Ch. 9 - The following transactions were completed by The...Ch. 9 - Wig Creations Company supplies wigs and hair care...Ch. 9 - Prob. 3PBCh. 9 - Gen-X Ads Co. produces advertising videos. During...Ch. 9 - The following data relate to notes receivable and...Ch. 9 - The following were selected from among the...Ch. 9 - Prob. 1CPCh. 9 - For several years, Xtreme Co.s sales have been on...Ch. 9 - Prob. 3CPCh. 9 - Prob. 4CPCh. 9 - Prob. 5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please help me solve this general accounting question using the right accounting principles.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License