Financial Accounting

14th Edition

ISBN: 9781305088436

Author: Carl Warren, Jim Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 26E

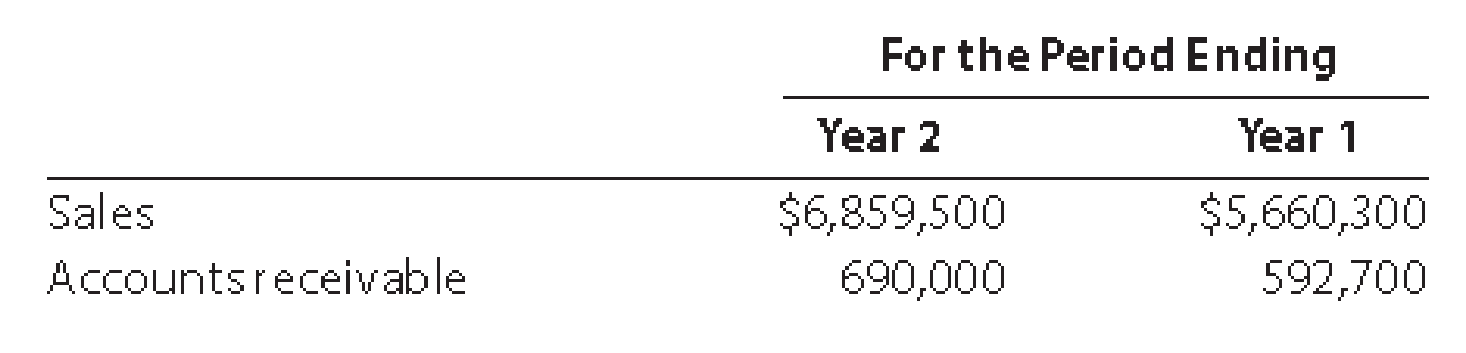

Polo Ralph Lauren Corporation designs, markets, and distributes a variety of apparel, home decor, accessory, and fragrance products. The company’s products include such brands as Polo by Ralph Lauren, Ralph Lauren Purple Label, Ralph Lauren, Polo Jeans Co., and Chaps. Polo Ralph Lauren reported the following (in thousands) for two recent years:

Assume that

- a. Compute the accounts receivable turnover for Year 2 and Year 1. Round to one decimal place.

- b. Compute the days’ sales in receivables for Year 2 and Year 1. Use 365 days and round to one decimal place.

- c. What conclusions can be drawn from these analyses regarding Ralph Lauren’s efficiency in collecting receivables?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

None

I need assistance with this general accounting question using appropriate principles.

I am trying to find the accurate solution to this general accounting problem with appropriate explanations.

Chapter 9 Solutions

Financial Accounting

Ch. 9 - What are the three classifications of receivables?Ch. 9 - Dans Hardware is a small hardware store in the...Ch. 9 - What kind of an account (asset, liability, etc.)...Ch. 9 - After the accounts are adjusted and closed at the...Ch. 9 - A firm has consistently adjusted its allowance...Ch. 9 - Which of the two methods of estimating...Ch. 9 - Neptune Company issued a note receivable to...Ch. 9 - If a note provides for payment of principal of...Ch. 9 - The maker of a 240,000, 6%, 90-day note receivable...Ch. 9 - The note receivable dishonored in Discussion...

Ch. 9 - Prob. 1PEACh. 9 - Journalize the following transactions, using the...Ch. 9 - Prob. 2PEACh. 9 - Journalize the following transactions, using the...Ch. 9 - At the end of the current year, Accounts...Ch. 9 - At the end of the current year, Accounts...Ch. 9 - At the end of the current year, Accounts...Ch. 9 - At the end of the current year, Accounts...Ch. 9 - Guzman Company received a 60-day, 5% note for...Ch. 9 - Prefix Supply Company received a 120-day, 8% note...Ch. 9 - Financial statement data for years ending December...Ch. 9 - Prob. 6PEBCh. 9 - Prob. 1ECh. 9 - MGM Resorts International owns and operates hotels...Ch. 9 - Journalize the following transactions in the...Ch. 9 - Prob. 4ECh. 9 - Creative Solutions Company, a computer consulting...Ch. 9 - At the end of the current year, the accounts...Ch. 9 - Toot Auto Supply distributes new and used...Ch. 9 - The accounts receivable clerk for Waddell...Ch. 9 - Waddell Industries has a past history of...Ch. 9 - Using data in Exercise 9-9, assume that the...Ch. 9 - Selbys Bike Co. is a wholesaler of motorcycle...Ch. 9 - Using the data in Exercise 9-11, assume that the...Ch. 9 - The following selected transactions were taken...Ch. 9 - The following selected transactions were taken...Ch. 9 - Prob. 15ECh. 9 - Using the data in Exercise 9-15, assume that...Ch. 9 - Casebolt Company wrote off the following accounts...Ch. 9 - Seaforth International wrote off the following...Ch. 9 - Determine the due date and the amount of interest...Ch. 9 - Master Designs Decorators issued a 180-day, 6%...Ch. 9 - Prob. 21ECh. 9 - Prob. 22ECh. 9 - Journalize the following transactions of Trapper...Ch. 9 - Journalize the following transactions in the...Ch. 9 - Prob. 25ECh. 9 - Polo Ralph Lauren Corporation designs, markets,...Ch. 9 - Prob. 27ECh. 9 - Prob. 28ECh. 9 - Prob. 29ECh. 9 - The following transactions were completed by The...Ch. 9 - Trophy Fish Company supplies flies and fishing...Ch. 9 - Call Systems Company, a telephone service and...Ch. 9 - Flush Mate Co. wholesales bathroom fixtures....Ch. 9 - The following data relate to notes receivable and...Ch. 9 - The following were selected from among the...Ch. 9 - The following transactions were completed by The...Ch. 9 - Wig Creations Company supplies wigs and hair care...Ch. 9 - Prob. 3PBCh. 9 - Gen-X Ads Co. produces advertising videos. During...Ch. 9 - The following data relate to notes receivable and...Ch. 9 - The following were selected from among the...Ch. 9 - Prob. 1CPCh. 9 - For several years, Xtreme Co.s sales have been on...Ch. 9 - Prob. 3CPCh. 9 - Prob. 4CPCh. 9 - Prob. 5CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY