Concept explainers

Critical Thinking: Analyzing the Effects of

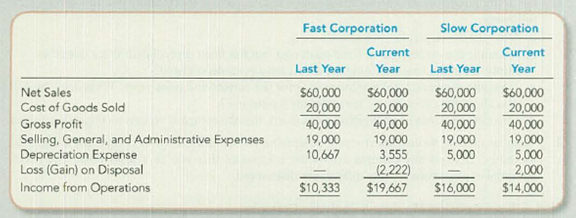

As an aspiring financial analyst, you have applied to a major Wall Street firm for a summer job. To screen potential applicants, the firm provides you a short case study and asks you to evaluate the financial success of two hypothetical companies that started operations last year on January 1. Both companies operate in the same industry, use very similar assets, and have very similar customer bases. Among the additional information provided about the companies are the following comparative income statements.

Required:

Prepare an analysis of the two companies with the goal of determining which company is better managed. If you could request two additional pieces of information from these companies’ financial statements, describe specifically what they would be and explain how they would help you to make a decision.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Connect 1 Semester Access Card for Fundamentals of Financial Accounting

- Pam Pet Foods Co. reported net income of $52,000 for the year ended December 31, 2005. January 1 balances in accounts receivable and accounts payable were $30,000 and $28,000, respectively. Year-end balances in these accounts were $27,000 and $31,000, respectively. Assuming that all relevant information has been presented, Pam's cash flows from operating activities would be__.arrow_forwardThe following company information is availablearrow_forwardwhat is the profit marginarrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning