Concept explainers

Determining Financial Statement Effects of an Asset Acquisition and Straight-Line

O’Connor Company ordered a machine on January 1 at a purchase price of $40,000. On the date of delivery, January 2, the company paid $10,000 on the machine and signed a long-term note payable for the balance. On January 3, it paid $350 for freight on the machine. On January 5. O’Connor paid cash for installation costs relating to the machine amounting to $2,400. On December 31 (the end of the accounting period), O’Connor recorded depreciation on the machine using the straight-line method with an estimated useful life of 10 years and an estimated residual value of $4,750.

Required:

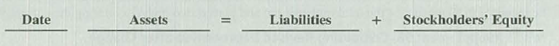

- 1. Indicate the effects (accounts, amounts, and + or −) of each transaction (on January 1, 2, 3, and 5) on the

accounting equation. Use the following schedule:

- 2. Compute the acquisition cost of the machine.

- 3. Compute the depreciation expense to be reported for the first year.

- 4. What should be the book value of the machine at the end of the second year?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Connect 1 Semester Access Card for Fundamentals of Financial Accounting

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning