Concept explainers

Cash budgets under two alternatives (Learning Objectives 2 & 3)

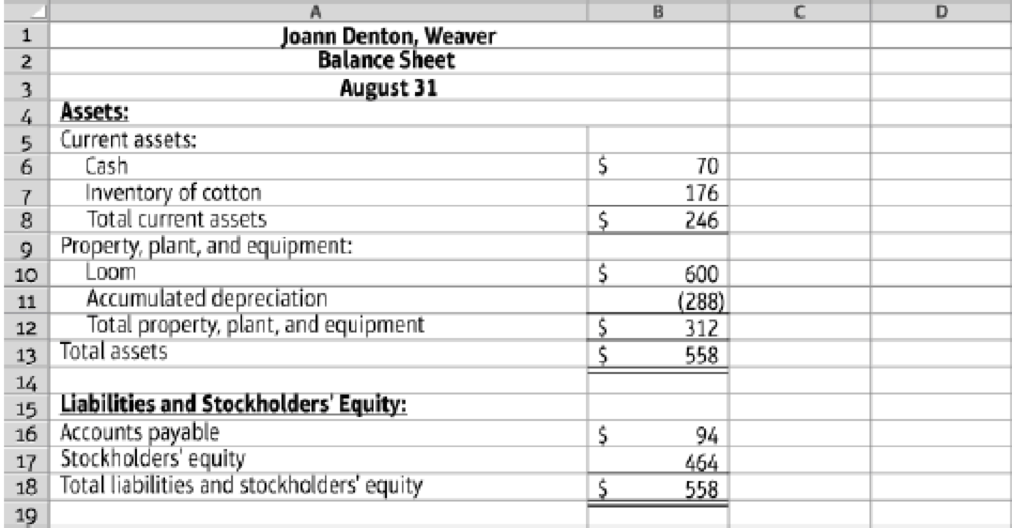

Each autumn, as a hobby, Joann Denton weaves cotton placemats to sell at a local craft shop. The mats sell for $20 per set of four mats. The shop charges a 15% commission and remits the net proceeds to Denton at the end of December. Denton has woven and sold 22 sets in each of the last two years. She has enough cotton in inventory to make another 22 sets. She paid $8 per set for the cotton. Denton uses a four-harness loom that she purchased for cash exactly two years ago. It is

Denton is considering buying an eight-harness loom so that she can weave more intricate patterns in linen. The new loom costs $1,000; it would be depreciated at $20 per month. Her bank has agreed to lend her $1,000 at 9% interest, with $200 principal plus accrued interest payable each December 31. Denton believes she can weave 10 linen place mat sets in time for the Christmas rush if she does not weave any cotton mats. She predicts that each linen set will sell for $40. Linen costs $5 per set. Denton’s supplier will sell her linen on credit, payable December 31.

Denton plans to keep her old loom whether or not she buys the new loom. The

9.5-70 Full Alternative Text

Requirements

- 1. Prepare a combined

cash budget for the four months ending December 31, for two alternatives: weaving the placemats in cotton using the existing loom and weaving the placemats in linen using the new loom. For each alternative, prepare abudgeted income statement for the four months ending December 31 and a budgeted balance sheet at December 31. - 2. On the basis of financial considerations only, what should Denton do? Give your reason.

9.6 What nonfinancial factors might Denton consider in her decision?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Managerial Accounting, Student Value Edition (5th Edition)