Concept explainers

Cash budgets under two alternatives (Learning Objectives 2 & 3)

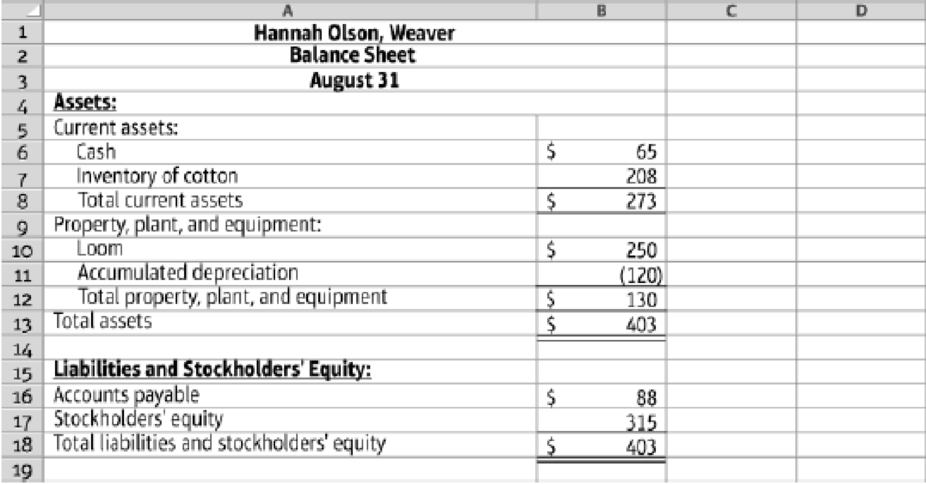

Each autumn, as a hobby, Hannah Olson weaves cotton placemats to sell at a local craft shop. The mats sell for $30 per set of four mats. The shop charges a 20% commission and remits the net proceeds to Olson at the end of December. Olson has woven and sold 26 sets in each of the last two years. She has enough cotton in inventory to make another 26 sets. She paid $8 per set for the cotton. Olson uses a four-harness loom that she purchased for cash exactly two years ago. It is

Olson is considering buying an eight-harness loom so that she can weave more intricate patterns in linen. The new loom costs $1,000; it would be depreciated at $20 per month. Her bank has agreed to lend her $1,000 at 18% interest, with $200 principal plus accrued interest payable each December 31. Olson believes she can weave 16 linen placemat sets in time for the Christmas rush if she does not weave any cotton mats. She predicts that each linen set will sell for $65. Linen costs $20 per set. Olson’s supplier will sell her linen on credit, payable December 31.

Olson plans to keep her old loom whether or not she buys the new loom. The

9.4-59 Full Alternative Text

Requirements

- 1. Prepare a combined

cash budget for the four months ending December 31, for two alternatives: weaving the placemats in cotton using the existing loom and weaving the placemats in linen using the new loom. For each alternative, prepare abudgeted income statement for the four months ending December 31 and a budgeted balance sheet at December 31. - 2. On the basis of financial considerations only, what should Olson do? Give your reason.

- 3. What nonfinancial factors might Olson consider in her decision?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Managerial Accounting, Student Value Edition (5th Edition)

- hi expert please help mearrow_forwardCompute the fixed cost portion using the high low method of estimated costarrow_forwardA firm purchases machinery, which has an estimated useful life of 14 years and no salvage value, for $70,000 at the beginning of the accounting period. What is the adjusting entry for depreciation at the end of one month if the firm uses the straight-line method of depreciation? Don't Use Aiarrow_forward

- Required information [The following information applies to the questions displayed below.] INVOLVE was incorporated as a not-for-profit organization on January 1, 2023. During the fiscal year ended December 31, 2023, the following transactions occurred. 1. A business donated rent-free office space to the organization that would normally rent for $35,000 a year. 2. A fund drive raised $185,000 in cash and $100,000 in pledges that will be paid next year. A state government grant of $150,000 was received for program operating costs related to public health education. 3. Salaries and fringe benefits paid during the year amounted to $208,560. At year-end, an additional $16,000 of salaries and fringe benefits were accrued. 4. A donor pledged $100,000 for construction of a new building, payable over five fiscal years, commencing in 2025. The discounted value of the pledge is expected to be $94,260. 5. Office equipment was purchased for $12,000. The useful life of the equipment is estimated to…arrow_forwardA firm has a return on equity of 22 percent. The total asset turnover is 2.9 and the profit margin is 5 percent. The total equity is $7,500. What is the amount of the net income? Don't Use Aiarrow_forwardTimberline Services Company, a division of a major energy company, provides various services to the operators in the Rocky Mountain oil fields. For the most recent year, the company reported sales of $22,500,000, net operating income of $7,500,000, and average operating assets of $40,000,000. What is the margin for Timberline Services Company?helparrow_forward