Financial Accounting

7th Edition

ISBN: 9781118162286

Author: Kimmel, Paul D.

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 9.5DIR

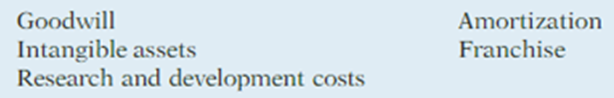

Match the statement with the term most directly associated with it.

1. ______ Rights, privileges, and competitive advantages that result from the ownership of long-lived assets that do not possess physical substance.

2. ______ The allocation of the cost of an intangible asset to expense in a rational and systematic manner.

3. ______ A right to sell certain products or services, or use certain trademarks or trade names within a designated geographic area.

4. ______ Costs incurred by a company that often lead to patents or new products. These costs must be expensed as incurred.

5. ______ The excess of the cost of a company over the fair value of the net assets required.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Subject = General Account

Need help

Financial Accounting

Chapter 9 Solutions

Financial Accounting

Ch. 9 - Prob. 1QCh. 9 - Prob. 2QCh. 9 - Prob. 3QCh. 9 - Prob. 10QCh. 9 - Prob. 4QCh. 9 - Prob. 5QCh. 9 - Prob. 6QCh. 9 - Prob. 7QCh. 9 - Prob. 8QCh. 9 - In the fourth year of an assets 5-year useful...

Ch. 9 - Prob. 11QCh. 9 - Prob. 12QCh. 9 - Prob. 13QCh. 9 - Prob. 14QCh. 9 - Prob. 15QCh. 9 - Prob. 16QCh. 9 - Prob. 17QCh. 9 - Prob. 18QCh. 9 - Prob. 19QCh. 9 - Prob. 20QCh. 9 - Prob. 21QCh. 9 - Prob. 22QCh. 9 - Give an example of an industry that would be...Ch. 9 - Prob. 24QCh. 9 - Prob. 25QCh. 9 - Prob. 26QCh. 9 - Prob. 27QCh. 9 - Prob. 9.1BECh. 9 - Prob. 9.2BECh. 9 - Prob. 9.6BECh. 9 - Prob. 9.3BECh. 9 - Prob. 9.4BECh. 9 - Prob. 9.5BECh. 9 - Prob. 9.7BECh. 9 - Prob. 9.8BECh. 9 - Prob. 9.9BECh. 9 - Prob. 9.10BECh. 9 - Prob. 9.11BECh. 9 - Prob. 9.12BECh. 9 - Prob. 9.13BECh. 9 - Prob. 9.14BECh. 9 - Prob. 9.1DIRCh. 9 - Prob. 9.2DIRCh. 9 - Prob. 9.3DIRCh. 9 - Prob. 9.4DIRCh. 9 - Match the statement with the term most directly...Ch. 9 - Prob. 9.1ECh. 9 - Prob. 9.2ECh. 9 - Prob. 9.3ECh. 9 - Prob. 9.4ECh. 9 - Prob. 9.5ECh. 9 - Prob. 9.6ECh. 9 - Prob. 9.7ECh. 9 - Prob. 9.8ECh. 9 - Prob. 9.9ECh. 9 - Prob. 9.10ECh. 9 - Prob. 9.11ECh. 9 - E9-12 Bakel Company reports the following...Ch. 9 - Prob. 9.13ECh. 9 - Prob. 9.14ECh. 9 - Prob. 9.15ECh. 9 - Prob. 9.16ECh. 9 - Prob. 9.17ECh. 9 - Prob. 9.18ECh. 9 - Prob. 9.19ECh. 9 - Prob. 9.1APCh. 9 - Prob. 9.2APCh. 9 - Prob. 9.3APCh. 9 - Prob. 9.4APCh. 9 - Prob. 9.5APCh. 9 - Prob. 9.6APCh. 9 - Prob. 9.7APCh. 9 - P9-8A Boscan Corporation purchased machinery on...Ch. 9 - Prob. 9.1BPCh. 9 - P9-2B At December 31, 2013, Tong Corporation...Ch. 9 - Prob. 9.3BPCh. 9 - Prob. 9.4BPCh. 9 - Prob. 9.5BPCh. 9 - Prob. 9.6BPCh. 9 - Prob. 9.7BPCh. 9 - P9-8B Miriam Corporation purchased machinery on...Ch. 9 - Prob. 1CPCh. 9 - Financial Reporting and Analysis

FINANCIAL...Ch. 9 - Prob. 9.2BYPCh. 9 - Prob. 9.4BYPCh. 9 - Prob. 9.3BYPCh. 9 - Prob. 9.6BYPCh. 9 - Prob. 9.7BYPCh. 9 - Prob. 9.8BYPCh. 9 - Prob. 9.9BYPCh. 9 - CONSIDERING PEOPLE, PLANET, AND PROFIT The March...Ch. 9 - Prob. 9.1IFRSCh. 9 - Prob. 9.2IFRSCh. 9 - Prob. 9.3IFRSCh. 9 - Prob. 9.7IFRSCh. 9 - Prob. 9.4IFRSCh. 9 - Prob. 9.5IFRSCh. 9 - Prob. 9.6IFRS

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Accurate answerarrow_forwardA piece of equipment is purchased for $23,500 and has a salvage value of $3,200. The estimated life is 10 years and the method of depreciation is straight-line. Shipping costs total $750 and installation costs are $630. The book value at the end of year 10 is: a. $3,110 b. $3,200 c. $2,000 d. $1,110 Answer: b. $3,200arrow_forwardMCQarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Asset impairment explained; Author: The Finance Storyteller;https://www.youtube.com/watch?v=lWMDdtHF4ZU;License: Standard Youtube License