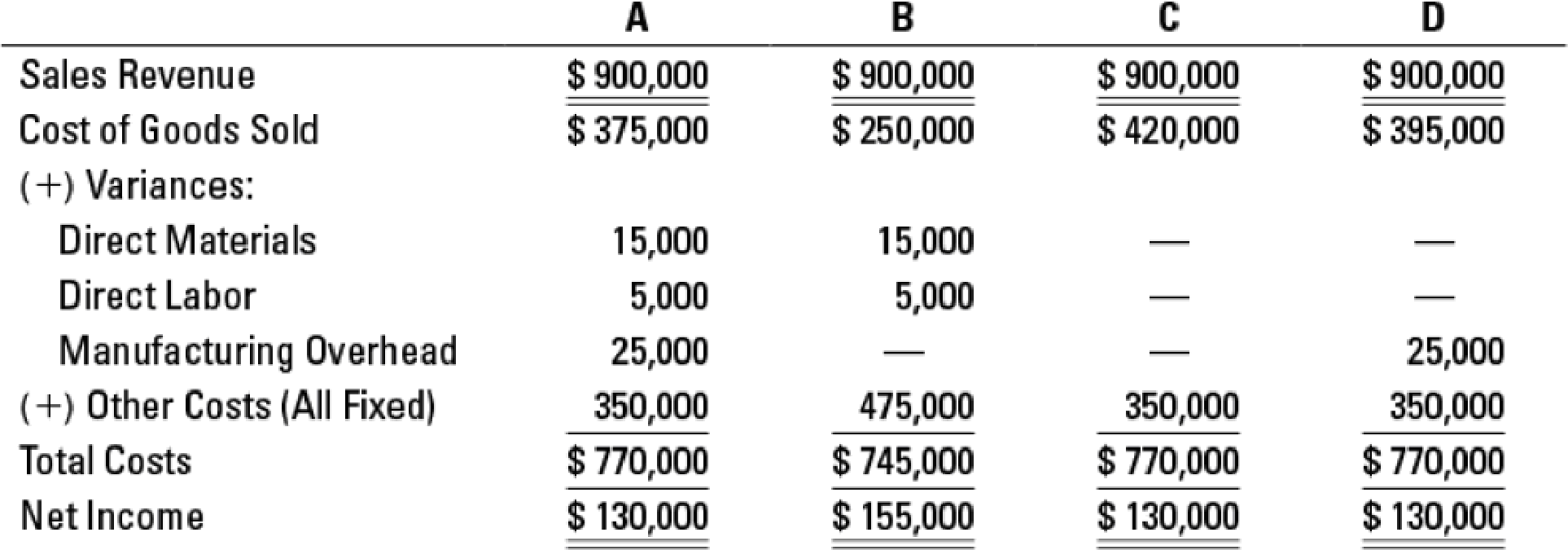

Costing methods and variances, comprehensive. Rob Kapito, the controller of Blackstar Paint Supply Company, has been exploring a variety of internal accounting systems. Rob hopes to get the input of Blackstar’s board of directors in choosing one. To prepare for his presentation to the board, Rob applies four different cost accounting methods to the firm’s operating data for 2017. The four methods are actual absorption costing, normal absorption costing, standard absorption costing, and standard variable costing. With the help of a junior accountant, Rob prepares the following alternative income statements:

Where applicable, Rob allocates both fixed and variable manufacturing

- 1. Match each method below with the appropriate income statement (A, B, C, or D):

Required

| Actual Absorption costing | _____ |

| Normal Absorption costing | _____ |

| Standard Absorption costing | _____ |

| Standard Variable costing | _____ |

- 2. During 2017, how did Blackstar’s level of finished-goods inventory change? In other words, is it possible to know whether Blackstar’s finished-goods inventory increased, decreased, or stayed constant during the year?

- 3. From the four income statements, can you determine how the actual volume of production during the year compared to the denominator (expected) volume level?

- 4. Did Blackstar have a favorable or unfavorable variable overhead spending variance during 2017?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

EBK HORNGREN'S COST ACCOUNTING

- What is this firm debt equity ratio? General accountingarrow_forwardPlease accounting answerarrow_forwardWhat are the differences of gross profit and retail inventory methods? What are the similiarities of gross profit and retail inventory methods? Does a company need to take a physical inventory if the gross profit method or retail inventory method is used? Why or why not?arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning  Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning