Concept explainers

Throughput costing (continuation of 9-23). The variable

- 1. Prepare income statements for EntertainMe in January, February, and March 2017 under throughput costing.

Required

- 2. Contrast the results in requirement 1 of this exercise with those in requirement 1 of Exercise 9-23.

- 3. Give one motivation for EntertainMe to adopt throughput costing.

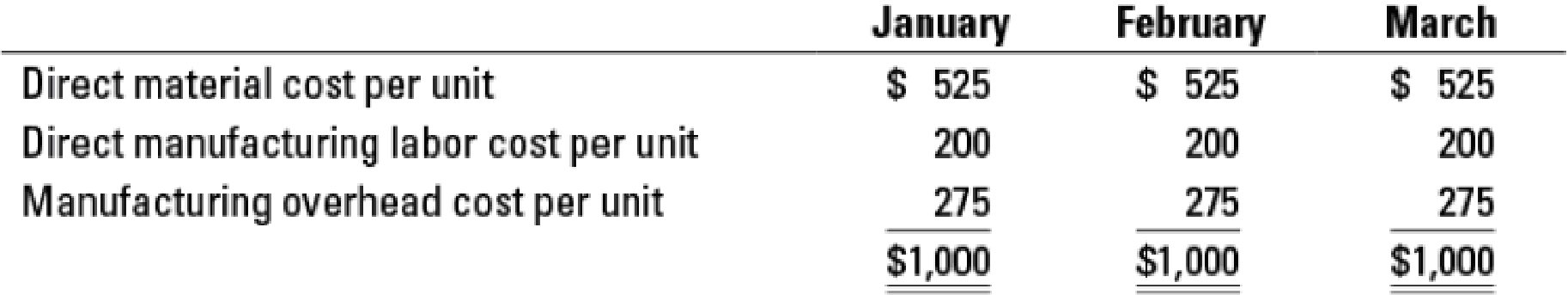

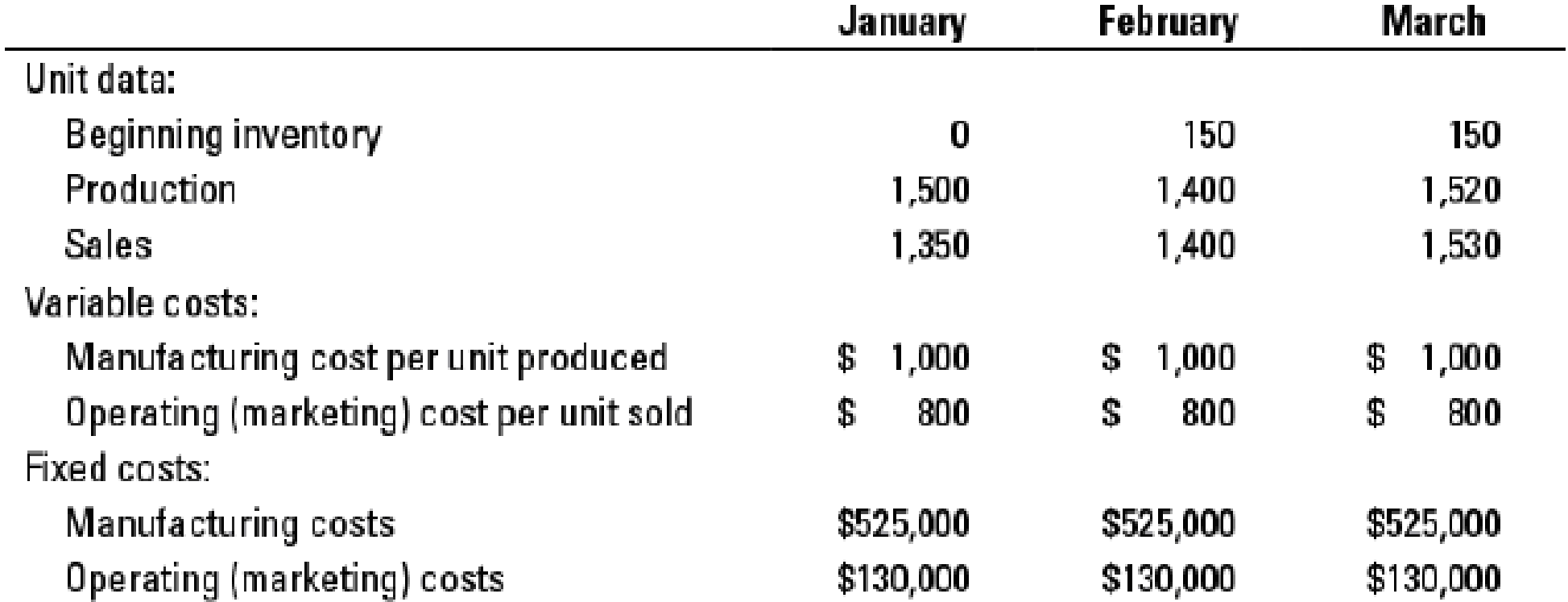

9-23 Variable and absorption costing, explaining operating-income differences. EntertainMe Corporation manufactures and sells 50-inch television sets and uses

The selling price per unit is $3,300. The budgeted level of production used to calculate the budgeted fixed manufacturing cost per unit is 1,500 units. There are no price, efficiency, or spending variances. Any production-volume variance is written off to cost of goods sold in the month in which it occurs.

- 1. Prepare income statements for EntertainMe in January, February, and March 2017 under (a) variable costing and (b) absorption costing.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

EBK HORNGREN'S COST ACCOUNTING

Additional Business Textbook Solutions

Financial Accounting, Student Value Edition (5th Edition)

Principles of Economics (MindTap Course List)

Intermediate Accounting (2nd Edition)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Financial Accounting (12th Edition) (What's New in Accounting)

Managerial Accounting (5th Edition)

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning