Concept explainers

Integrating Case 9–3

FIFO and lower of cost or net realizable value

• LO9–1

York Co. sells one product, which it purchases from various suppliers. York’s

| Sales (33,000 units @ $16) | $528,000 |

| Sales discounts | 7,500 |

| Purchases | 368,900 |

| Purchase discounts | 18,000 |

| Freight-in | 5,000 |

| Freight-out | 11,000 |

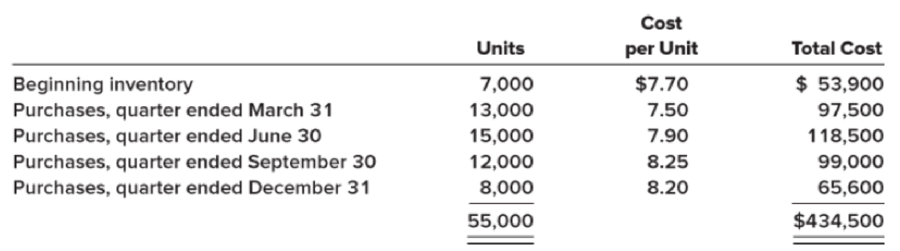

York Co.’s inventory purchases during 2018 were as follows:

Additional Information:

a. York’s accounting policy is to report inventory in its financial statements at the lower of cost or net realizable value, applied to total inventory. Cost is determined under the first-in, first-out (FIFO) method.

b. York has determined that, at December 31, 2018, the net realizable value was $8.00 per unit.

Required:

1. Prepare York’s schedule of cost of goods sold, with a supporting schedule of ending inventory. York includes inventory write-down losses in cost of goods sold.

2. Explain the rule of lower of cost or net realizable value and its application in this situation.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

INTERMEDIATE ACCOUNTING (LL) W/CONNECT

- Please provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning