Profitability metrics

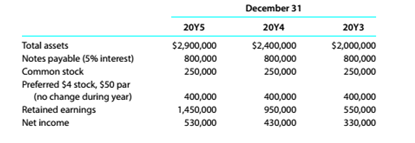

The following selected data were taken from the financial statements of The O'Malley Group Inc. for December 31, 20Y5. 20Y4. and 20Y3:

No dividends on common stock were declared between 20Y3 and 20Y5.

a.Determine the return on total assets, the return on

b. What conclusions can be drawn from these data as to the company's profitability?

(a)

Concept Introduction:

Profitability analysis:

Ithelps to evaluate the ability of a company to generate income relative to revenue, assets, operating cost and shareholders' equity during a specific period.

It measures how efficiently the resources have been utilised to generate profit.

To calculate:

Return on total assets, return on common stockholders' equity and return on stockholders' equity for the year 20Y4 and 20Y5

Explanation of Solution

| Particulars | 20Y5 | 20Y4 |

| Net income | $530,000 | $430,000 |

| Interest on Notes Payable | ||

| Preferred Dividends | $30,000 | $30,000 |

| Particulars | 20Y5 | 20Y4 |

| Common Stock (A) | $250,000 | $250,000 |

| Preferred Stock (B) | $400,000 | $400,000 |

| Retained Earnings (C) | $1,450,000 | $950,000 |

| Total Stockholders' Equity (A+B+C) | $2,100,000 | $1,600,000 |

| Total Common Stockholders' Equity (A+C) | $1,700,000 | $1,200,000 |

| Total Assets (Beginning) | $2,400,000 | $2,000,000 |

| Total Assets (Ending) | $2,900,000 | $2,400,000 |

| Total Assets (Average) | ||

| Return on Total Assets | ||

| Return on Shareholders' Equity | ||

| Return on Common Shareholders' Equity |

Retained Earnings (ending) = Retained Earnings (beginning) + Net Income − Dividends

Retained Earnings (20Y5) = Retained Earnings (20Y4) + Net Income (20Y5) − Dividends (20Y5)

$1,450,000 = $950,000 + $530,000 − Dividends (20Y5)

$1,480,000 - $1,450,000 = Dividends (20Y5)

Dividends (20Y5) = $30,000

Retained Earnings (20Y4) = Retained Earnings (20Y3) + Net Income (20Y4) − Dividends (20Y4)

$950,000 = $550,000 + $430,000 − Dividends (20Y4)

$980,000 - $950,000 = Dividends (20Y4)

Dividends (20Y4) = $30,000

(b)

Concept Introduction:

Profitability analysis:

It is used to evaluate the ability of a company to generate income relative to revenue, assets, operating cost and shareholders' equity during a specific period.

It measures how efficiently the resources have been utilised to generate profit.

To analyze:

The calculated ratios to evaluate company's profitability.

Explanation of Solution

Over the past three years company's profitability has steady increase in terms of return on total assets but a steady decline has been noticed in return on equity and return on common stock.

This is due to the earnings retained each year by the company. Though, the company is unable to utilise it to increase its profitability. Thus, the retained earnings should be utilisedaccurately to generate revenue which will in return improve the profitability of the company.

Want to see more full solutions like this?

Chapter 9 Solutions

Survey of Accounting (Accounting I)

- ANALY SIS OF PROFITABILITY Based on the financial statement data in Exercise 24-1A, compute the following profitability measures for 20-2 (round all calculations to two decimal places): (a) Profit margin ratio (b) Return on assets (c) Return on common stockholders equity (d) Earnings per share of common stockarrow_forwardMeasures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was 82.60 on December 31, 20Y2. Instructions Determine the following measures for 20Y2, rounding to one decimal place, including percentages, except for per-share amounts: 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days sales in receivables 6. Inventory turnover 7. Number of days sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders equity 14. Return on common stockholders equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yieldarrow_forwardMeasures of liquidity, solvency, and profitability The comparative financial statements of Marshall Inc. are as follows. The market price of Marshall common stock was 82.60 on December 31, 20Y2. Instructions Determine the following measures for 20Y2 (round to one decimal place, including percentages, except for per-share amounts): 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Number of days sales in receivables 6. Inventory turnover 7. Number of days sales in inventory 8. Ratio of fixed assets to long-term liabilities 9. Ratio of liabilities to stockholders equity 10. Times interest earned 11. Asset turnover 12. Return on total assets 13. Return on stockholders equity 14. Return on common stockholders equity 15. Earnings per share on common stock 16. Price-earnings ratio 17. Dividends per share of common stock 18. Dividend yieldarrow_forward

- Stockholder Profitability Ratios The following information pertains to Montague Corporation Required: Calculate the return on common equity and the earnings per share. (Note: Round answers to two decimal places.)arrow_forwardRatio of liabilities to stockholders equity and times interest earned The following data were taken from the financial statements of Hunter Inc. for December 31 of two recent years: The income before income tax expense was 480,000 and 420,000 for the current and previous years, respectively. A. Determine the ratio of liabilities to stockholders equity at the end of each year. Round to one decimal place. B. Determine the times interest earned ratio for both years. Round to one decimal place. C. What conclusions can be drawn from these data as to the companys ability to meet its currently maturing debts?arrow_forwardFinancial leverage Costco Wholesale Corporation (COST) and Wel-Mart Stroes Inc. (WMT)reported the following data (in milllions) for a recent year: Compute the return on stockholders equity. Round to one decimal place.arrow_forward

- Five measures of solvency or profitability The balance sheet for Garcon Inc. at the end of the current fiscal year indicated the following: Income before income tax was 3,000,000, and income taxes were 1,200,000 for the current year. Cash dividends paid on common stock during the current year totaled 1,200,000. The common stock was selling for 32 per share at the end of the year. Determine each of the following: (a) times interest earned ratio, (b) earnings per share on common stock, (c) price-earnings ratio, (d) dividends per share of common stock, and (e) dividend yield. Round ratios and percentages to one decimal place, except for per-share amounts.arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Required: 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forwardJuroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: 1. Calculate the return on sales. (Note: Round the percent to two decimal places.) 2. CONCEPTUAL CONNECTION Briefly explain the meaning of the return on sales ratio, and comment on whether Juroes return on sales ratio appears appropriate.arrow_forward

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the market price per share for Rebert is 51.50. Required: 1. Compute the dollar amount of preferred dividends. 2. Compute the number of common shares. 3. Compute earnings per share. (Note: Round to two decimals.) 4. Compute the price-earnings ratio. (Note: Round to the nearest whole number.)arrow_forwardThe income statement, statement of retained earnings, and balance sheet for Somerville Company are as follows: Includes both state and federal taxes. Brief Exercise 15-20 Calculating the Average Common Stockholders Equity and the Return on Stockholders Equity Refer to the information for Somerville Company on the previous pages. Required: Note: Round answers to four decimal places. 1. Calculate the average common stockholders equity. 2. Calculate the return on stockholders equity.arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning