ADV.FIN.ACCT. CONNECT+PROCTORIO PLUS

12th Edition

ISBN: 9781266379017

Author: Christensen

Publisher: INTER MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 9.12E

Subsidiary Stock Dividend

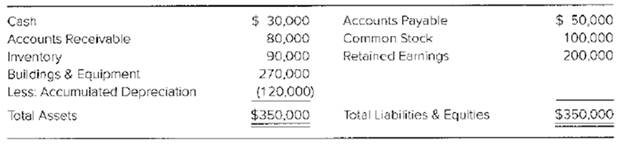

Stake Company reported the following summarized

Stake issues 4.000 additional shares of its $10 par value stock to its shareholders as a stock dividend on April 20, 20X3. The mat1et price of Stake’s shares at the time of the stock dividend is $40. Stake reports net income of $25,000 and pays a $10,000 cash dividend in 20X3. Pole Company acquired 70 percent of Stake’s common shares at book value on January 1, 20X1. At that date, the fair value of the noncontrolling interest was equal to 30 percent of Stake’s book value. Pole uses the equity method in accounting for its investment in Stake.

Required

- Give the

journal entries recorded by Stake and Pole at the time the stock dividend is declared and distributed. - Give the worksheet consolidation entries needed to prepare consolidated financial statements for 20X3.

- Give the worksheet consolidation entry needed to prepare a consolidated balance sheet on January 1, 20X4.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Joe transferred land worth $200,000, with a tax basis of $40,000, to JH Corporation, an existing entity, for 100 shares of its stock. JH Corporation has two other shareholders, Ethan and Young, each of whom holds 100 shares. With respect to the transfer:a. Joe has no recognized gain. b. JH Corporation has a basis of $160,000 in the land.c. Joe has a basis of $200,000 in his 100 shares in JH Corporation. d. Joe has a basis of $40,000 in his 100 shares in JH Corporation. e. None of the above.

I need help with this general accounting problem using proper accounting guidelines.

I am looking for the correct answer to this general accounting problem using valid accounting standards.

Chapter 9 Solutions

ADV.FIN.ACCT. CONNECT+PROCTORIO PLUS

Ch. 9 - Prob. 9.1QCh. 9 - Prob. 9.2QCh. 9 - Prob. 9.3QCh. 9 - Prob. 9.4QCh. 9 - Prob. 9.5QCh. 9 - Prob. 9.6QCh. 9 - Prob. 9.7QCh. 9 - Prob. 9.8QCh. 9 - Prob. 9.9QCh. 9 - Prob. 9.10Q

Ch. 9 - Prob. 9.11QCh. 9 - Prob. 9.12QCh. 9 - Prob. 9.13QCh. 9 - Prob. 9.14QCh. 9 - Prob. 9.15QCh. 9 - Prob. 9.16QCh. 9 - Prob. 9.1CCh. 9 - Prob. 9.2CCh. 9 - Prob. 9.3CCh. 9 - Prob. 9.4CCh. 9 - Prob. 9.5CCh. 9 - Prob. 9.1.1ECh. 9 - Prob. 9.1.2ECh. 9 - Prob. 9.1.3ECh. 9 - Prob. 9.1.4ECh. 9 - Prob. 9.2.1ECh. 9 - Prob. 9.2.2ECh. 9 - Prob. 9.2.3ECh. 9 - Prob. 9.2.4ECh. 9 - Prob. 9.2.5ECh. 9 - Prob. 9.3ECh. 9 - Prob. 9.4ECh. 9 - Prob. 9.5ECh. 9 - Prob. 9.6ECh. 9 - Prob. 9.7ECh. 9 - Prob. 9.8ECh. 9 - Prob. 9.9ECh. 9 - Prob. 9.10ECh. 9 - Prob. 9.11ECh. 9 - Subsidiary Stock Dividend Stake Company reported...Ch. 9 - Prob. 9.13ECh. 9 - Prob. 9.14ECh. 9 - Prob. 9.15ECh. 9 - Prob. 9.16ECh. 9 - Prob. 9.17.1PCh. 9 - Prob. 9.17.2PCh. 9 - Prob. 9.17.3PCh. 9 - Prob. 9.17.4PCh. 9 - Prob. 9.17.5PCh. 9 - Prob. 9.18PCh. 9 - Prob. 9.19PCh. 9 - Prob. 9.20PCh. 9 - Prob. 9.21PCh. 9 - Prob. 9.22PCh. 9 - Prob. 9.23PCh. 9 - Prob. 9.24PCh. 9 - Prob. 9.25PCh. 9 - Prob. 9.26PCh. 9 - Prob. 9.27P

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- accounting question?arrow_forwardThree individuals form JEY Corporation with the following contributions: Joe, cash of $50,000 for 50 shares; Ethan, land worth $20,000 (basis of $11,000) for 20 shares; and Young, cattle worth $9,000 (basis of $6,000) for 9 shares and services worth $21,000 for 21 shares. a. These transfers are fully taxable and not subject to § 351. b. Young’s basis in her stock is $27,000. c. Young’s basis in her stock is $6,000. d. Ethan’s basis in his stock is $20,000. e. None of the above.arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Stockholders Equity: How to Calculate?; Author: Accounting University;https://www.youtube.com/watch?v=2jZk1T5GIlw;License: Standard Youtube License