Concept explainers

JOURNALIZING AND POSTING PAYROLL ENTRIES Oxford Company has five employees, All are paid on a monthly basis. The fiscal year of the business is June 1 to May 31.

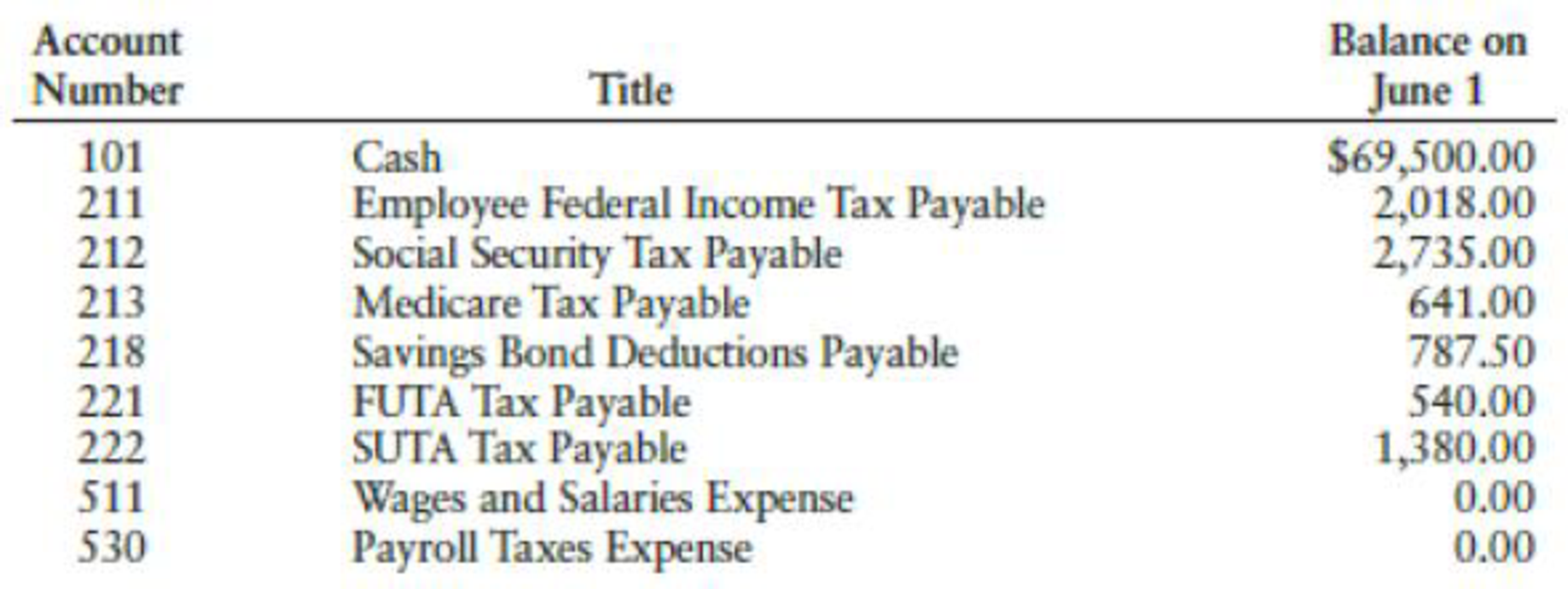

The accounts kept by Oxford Company include the following:

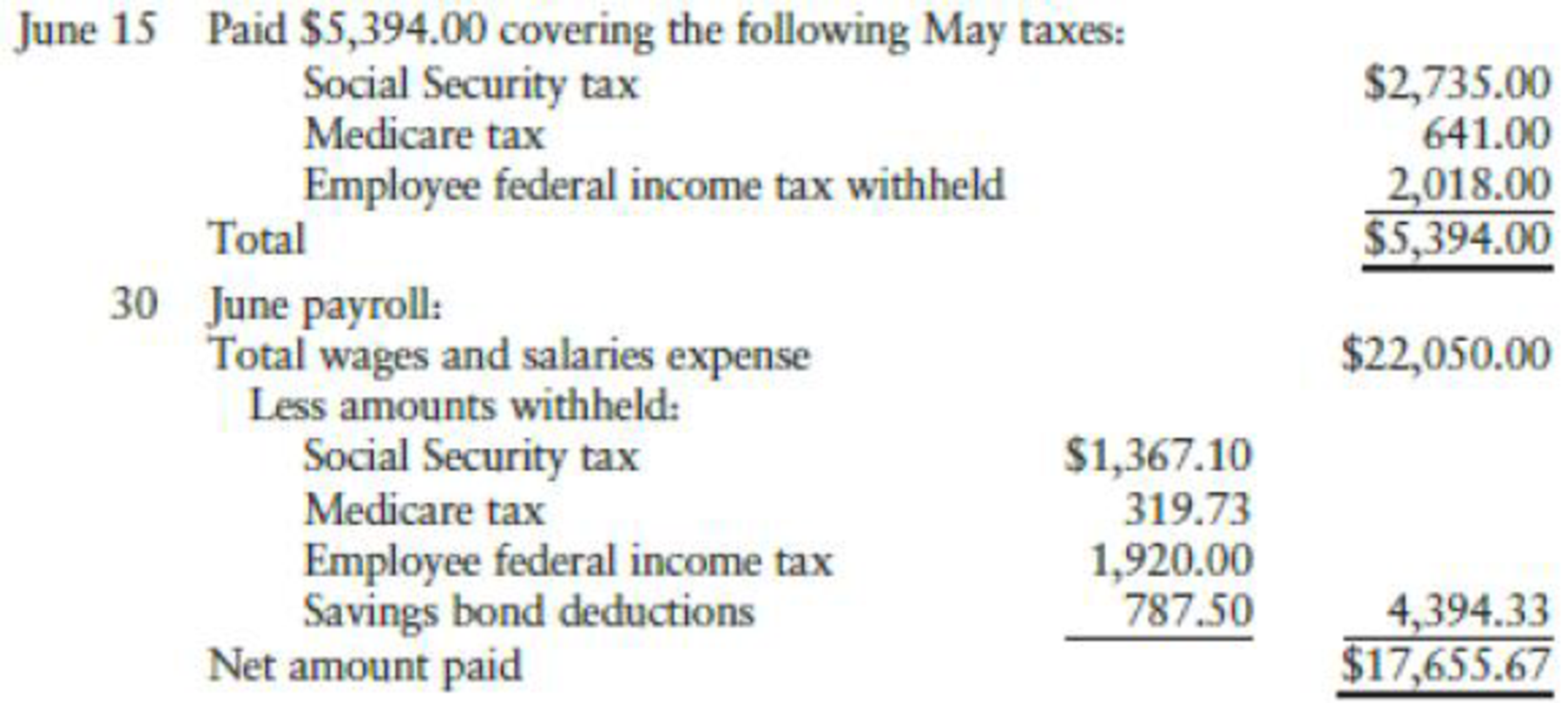

The following transactions relating to payrolls and payroll taxes occurred during June and July:

REQURED

- 1. Journalize the preceding transactions using a general journal.

- 2. Open Τ accounts for the payroll expenses and liabilities. Enter the beginning balances and post the transactions recorded in the journal.

1.

Prepare journal entry to record the given transactions.

Explanation of Solution

Payroll tax:

Payroll tax refers to the tax that are equally contributed by employees and employer based on the salary and wages of an employee. Payroll tax includes taxes like federal tax, local income tax, state tax, social security tax and federal and state unemployment tax.

Prepare journal entry to record the payment of payroll tax of May on June 15.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| June 15 | Employee Federal income tax payable | 211 | 2,018.00 | |

| FICA-Social Security taxes payable | 212 | 2,735.00 | ||

| FICA-Medicare Taxes payable | 213 | 641.00 | ||

| Cash | 101 | 5,394.00 | ||

| (To record the deposit of employee federal income tax and Social security and Medicare taxes) |

Table (1)

- Employee federal income tax payable is a liability and it is decreased. Hence, debit employee federal income tax payable by $2,018.00.

- FICA tax – social and security tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – social and security tax payable by $2,735.00.

- FICA tax – medical tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – medical tax payable by $641.00.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $5,394.00.

Prepare journal entry to record the June payroll.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| June 30 | Wages and Salaries expense | 511 | 22,050.00 | |

| Employee federal income tax payable | 211 | 1,920.00 | ||

| FICA-Social Security taxes payable | 212 | 1,367.10 | ||

| FICA-Medicare Taxes payable | 213 | 319.73 | ||

| Savings bonds deductions payable | 218 | 787.50 | ||

| Cash | 101 | 17,655.67 | ||

| (To record the payroll for the week ended June 30) |

Table (2)

- Wages and Salaries expense is an expense account and it is increased. Hence, debit wages and salaries expense with $22,050.00.

- Employee Federal income tax payable is a liability and there is an increase in the value of liability. Hence, credit the employee Federal income tax payable by $1,920.00.

- FICA tax – social and security tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – social and security tax payable by $1,367.10.

- FICA tax – medical tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – medical tax payable by $319.73.

- Savings bonds deductions payable is a liability and it is increased. Hence, credit savings bonds deductions payable by $787.50.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $17,655.67.

Prepare journal entry to record the purchase of bonds for employees.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| June 30 | Savings bonds deductions payable | 218 | 1,575.00 | |

| Cash | 101 | 1,575.00 | ||

| (To record the purchase of U.S savings bonds for employees.) |

Table (3)

- Savings bonds deductions payable is a liability and it is decreased. Hence, debit savings bonds deductions payable by $1,575.00.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $1,575.00.

Prepare journal entry to record the employer payroll tax expense.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| June 30 | Payroll tax expense | 530 | 2,105.33 | |

| FICA-Social Security taxes payable | 212 | 1,367.10 | ||

| FICA-Medicare Taxes payable | 213 | 319.73 | ||

| FUTA tax payable | 221 | 54.00 | ||

| SUTA tax payable | 222 | 364.50 | ||

| (To record the employer payroll taxes expense) |

Table (4)

- Payroll taxes expense is an expense account and it is increased. Hence, debit payroll taxes expense with $2,105.33.

- FICA tax – social and security tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – social and security tax payable by $1,367.10.

- FICA tax – medical tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – medical tax payable by $319.73.

- FUTA tax payable is a liability and it is increased. Hence, credit FUTA tax payable by $54.00.

- SUTA tax payable is a liability and it is increased. Hence, credit SUTA tax payable by $364.50.

Prepare journal entry to record the payment of June taxes.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| July 15 | Employee Federal income tax payable | 211 | 1,920.00 | |

| FICA-Social Security taxes payable | 212 | 2,734.20 | ||

| FICA-Medicare Taxes payable | 213 | 639.46 | ||

| Cash | 101 | 5,293.66 | ||

| (To record the deposit of employee federal income tax and Social security and Medicare taxes) |

Table (5)

- Employee federal income tax payable is a liability and it is decreased. Hence, debit employee federal income tax payable by $1,920.00.

- FICA tax – social and security tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – social and security tax payable by $2,734.20.

- FICA tax – medical tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – medical tax payable by $639.46.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $5,293.66.

Prepare journal entry to record the payment of SUTA tax.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| July 31 | SUTA tax payable | 222 | 1,744.50 | |

| Cash | 101 | 1,744.50 | ||

| (To record the payment of SUTA tax) |

Table (6)

- SUTA tax payable is a liability and it is decreased. Hence, debit SUTA tax payable by $1,744.50.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $1,744.50.

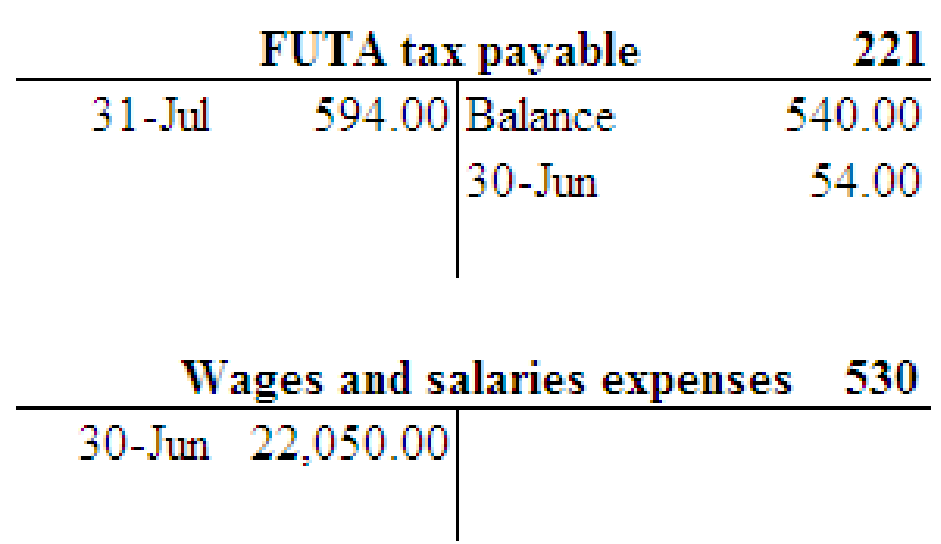

Prepare journal entry to record the payment of FUTA tax.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| July 31 | FUTA tax payable | 221 | 594 | |

| Cash | 101 | 594 | ||

| (To record the payment of FUTA tax) |

Table (7)

- FUTA tax payable is a liability and it is decreased. Hence, debit FUTA tax payable by $594.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $594.

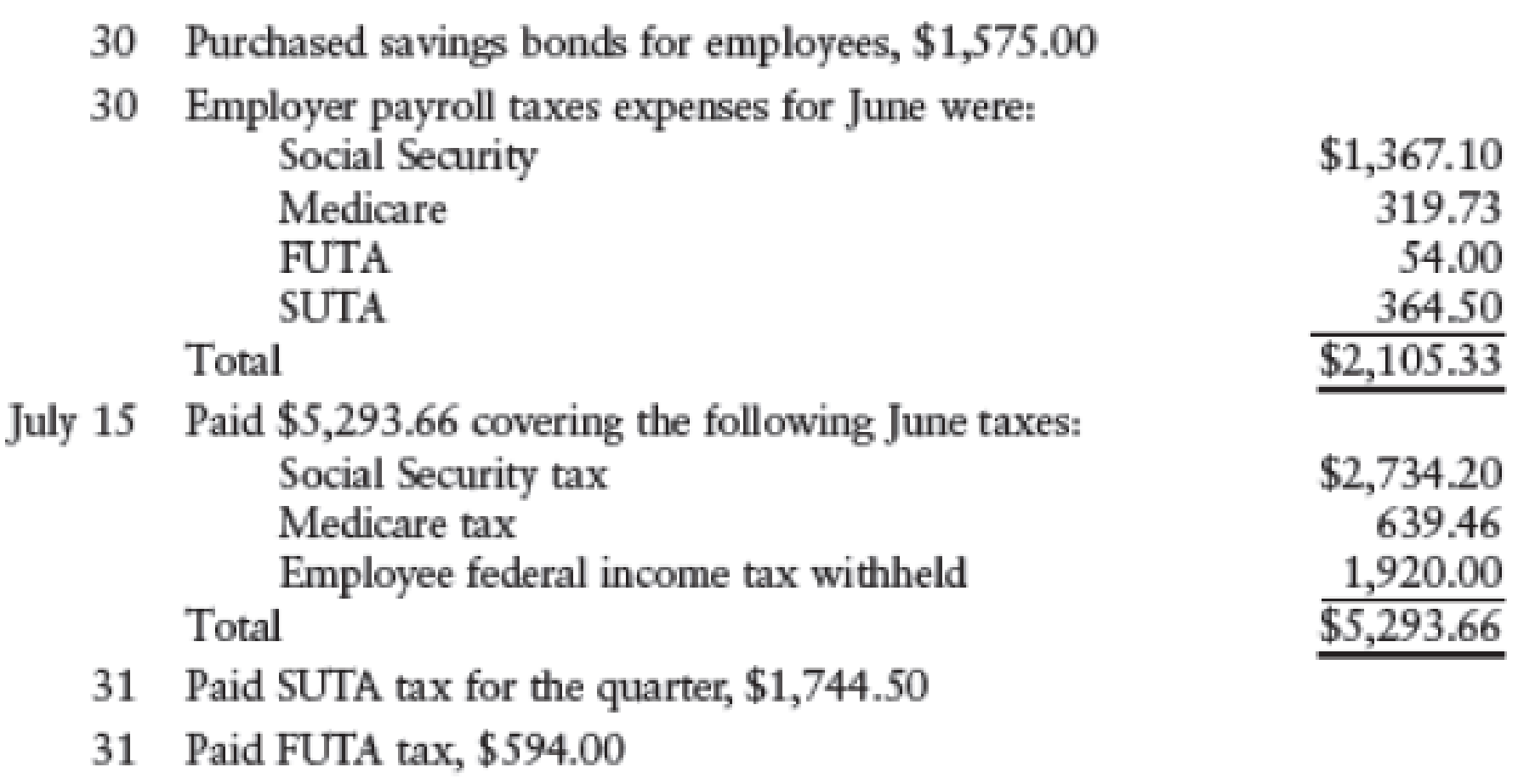

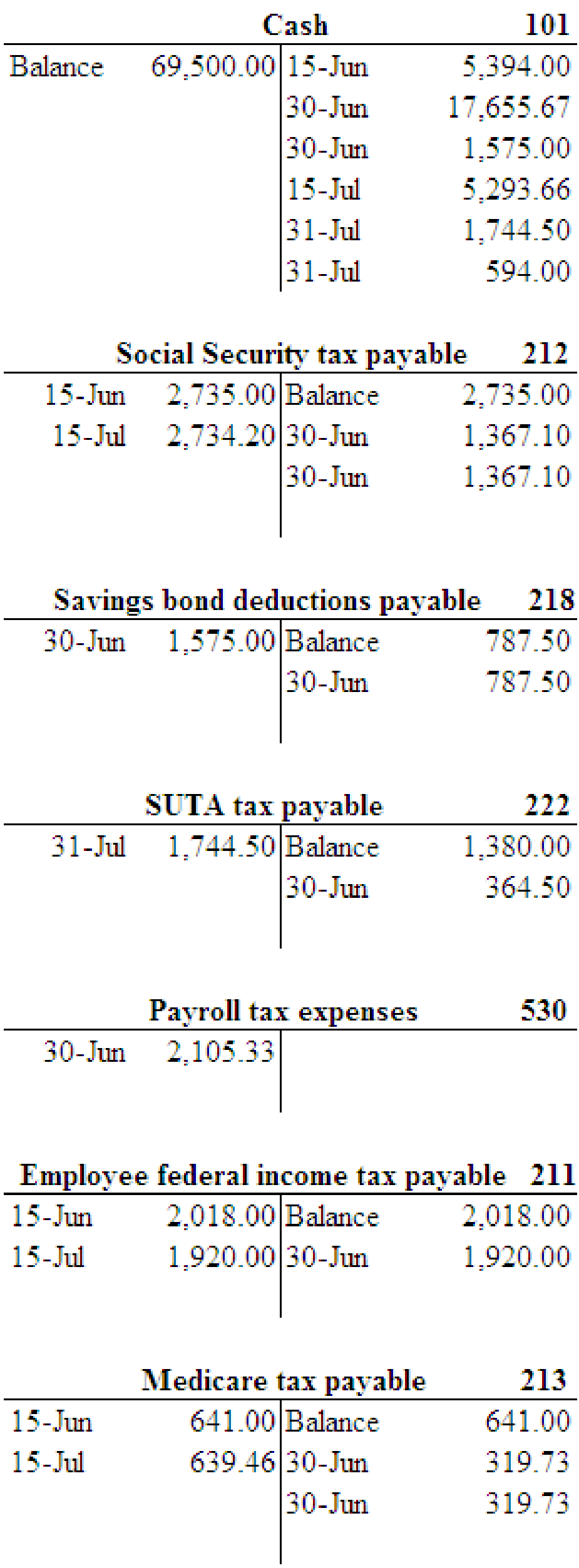

2.

Prepare T-Account for the payroll expenses and liabilities.

Explanation of Solution

Prepare T-Account for the payroll expenses and liabilities.

Want to see more full solutions like this?

Chapter 9 Solutions

Bundle: College Accounting, Chapters 1-27, Loose-leaf Version, 22nd + Cengagenowv2™, 2 Terms Printed Access Card For Heintz/parry's College ... Set For College Accounting, 22nd + Cenga

- On June 30, 2009, Straight Movers had $243,000 in current assets and $211,000 in current liabilities. On August 1, 2009, Straight received $50,000 from an issue of promissory notes that will mature in 2012. The notes pay interest on February 1 at an annual rate of 6 percent. Straights' fiscal year ends on December 31. What is the interest expense for December 31?arrow_forwardWhat was the company's revenue for the year? Provide correct answer general accountingarrow_forwardSolve and give proper working answer.arrow_forward

- Darden Corporation uses the weighted-average method in its process costing system. a. The first processing department, the Welding Department, started the month with 18,000 units in its beginning work in process inventory that were 10% complete with respect to conversion costs. b. The conversion cost in this beginning work-in-process inventory was $16,200. c. An additional 84,000 units were started into production during the month. d. There were 17,000 units in the ending work-in-process inventory of the Welding Department that were 70% complete with respect to conversion costs. e. A total of $836,880 in conversion costs were incurred in the department during the month. What is the cost per equivalent unit for the month?arrow_forwardGeneral Accounting:- What determines the valuation basis for assets acquired in debt restructuring? a) Future market value b) Carrying amount of debt c) Fair value of assets received d) Original asset costarrow_forwardGeneral Accounting questionarrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning