College Accounting, Chapters 1-9 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666184

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 7SPB

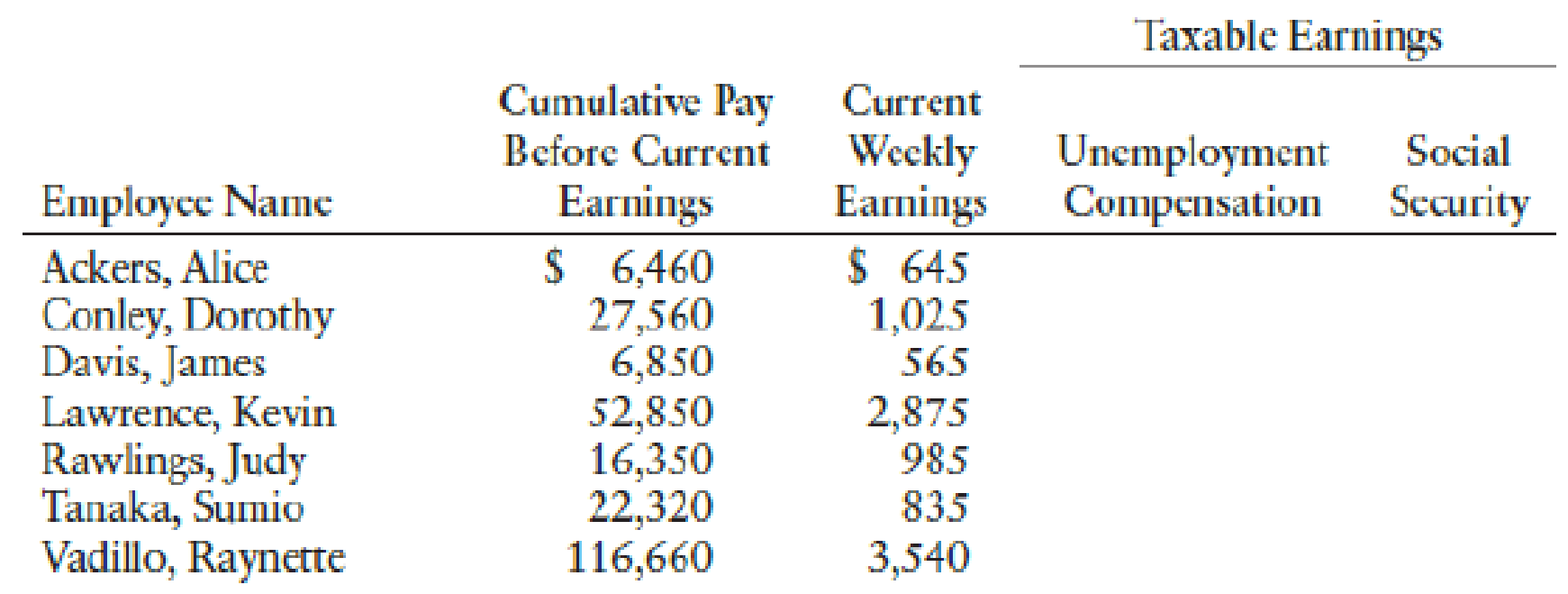

CALCULATING PAYROLL TAXES EXPENSE AND PREPARING

REQUIRED

- 1. Calculate the total employer payroll taxes for these employees.

- 2. Prepare the journal entry to record the employer payroll taxes as of July 14,20--.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Need help with this question solution general accounting

Do fast answer of this accounting questions

Kindly help me with accounting questions

Chapter 9 Solutions

College Accounting, Chapters 1-9 (New in Accounting from Heintz and Parry)

Ch. 9 - Prob. 1TFCh. 9 - Prob. 2TFCh. 9 - Prob. 3TFCh. 9 - Prob. 4TFCh. 9 - The W-4, which shows total annual earnings and...Ch. 9 - Prob. 1MCCh. 9 - LO2 Joyce Lee earns 30,000 a year. Her employer...Ch. 9 - Prob. 3MCCh. 9 - Prob. 4MCCh. 9 - Prob. 5MC

Ch. 9 - Total earnings for the employees of Garys Grill...Ch. 9 - Prob. 2CECh. 9 - Prob. 3CECh. 9 - Prob. 4CECh. 9 - Prob. 1RQCh. 9 - Prob. 2RQCh. 9 - Prob. 3RQCh. 9 - Prob. 4RQCh. 9 - Prob. 5RQCh. 9 - Identify all items that are debited or credited to...Ch. 9 - Prob. 7RQCh. 9 - Prob. 8RQCh. 9 - Prob. 9RQCh. 9 - Prob. 10RQCh. 9 - Prob. 11RQCh. 9 - Prob. 12RQCh. 9 - Prob. 13RQCh. 9 - CALCULATION AND JOURNAL ENTRY FOR EMPLOYER PAYROLL...Ch. 9 - CALCULATION AND JOURNAL ENTRY FOR EMPLOYER PAYROLL...Ch. 9 - CALCULATION OF TAXABLE EARNINGS AND EMPLOYER...Ch. 9 - Prob. 4SEACh. 9 - JOURNAL ENTRIES FOR PAYMENT OF EMPLOYER PAYROLL...Ch. 9 - Prob. 6SEACh. 9 - Prob. 7SPACh. 9 - JOURNALIZING AND POSTING PAYROLL ENTRIES Cascade...Ch. 9 - Prob. 9SPACh. 9 - CALCULATION AND JOURNAL ENTRY FOR EMPLOYER PAYROLL...Ch. 9 - Prob. 2SEBCh. 9 - Prob. 3SEBCh. 9 - TOTAL COST OF EMPLOYEE B. F. Goodson employs...Ch. 9 - JOURNAL ENTRIES FOR PAYMENT OF EMPLOYER PAYROLL...Ch. 9 - Prob. 6SEBCh. 9 - CALCULATING PAYROLL TAXES EXPENSE AND PREPARING...Ch. 9 - JOURNALIZING AND POSTING PAYROLL ENTRIES Oxford...Ch. 9 - Prob. 9SPBCh. 9 - The director of the art department at an...Ch. 9 - Prob. 1ECCh. 9 - The totals line from Nix Companys payroll register...Ch. 9 - Payrex Co. has six employees. All are paid on a...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Answer? ? Financial accounting questionarrow_forwardData for the two departments of Gurley Industries for September of the current fiscal year are as follows: Drawing Department Winding Department Work in process, September 1 4,900 units, 20% completed 3,000 units, 65% completed Completed and transferred to next processing department during September 67,100 units 66,000 units Work in process, September 30 3,700 units, 55% completed 4,100 units, 20% completed Production begins in the Drawing Department and finishes in the Winding Department. Question Content Area a. If all direct materials are placed in process at the beginning of production, determine the direct materials and conversion equivalent units of production for September for the Drawing Department. If an amount is zero, enter in "0". Drawing DepartmentDirect Materials and Conversion Equivalent Units of ProductionFor September Line Item Description Whole Units Direct MaterialsEquivalent Units ConversionEquivalent Units Inventory in process,…arrow_forwardThe charges to Work in Process—Assembly Department for a period, together with information concerning production, are as follows. All direct materials are placed in process at the beginning of production. Work in Process-Assembly Department Transaction Debit amount Transaction Credit amount Bal., 3,000 units, 45% completed 6,900 To Finished Goods, 69,000 units ? Direct materials, 71,000 units @ $1.4 99,400 Direct labor 106,400 Factory overhead 41,440 Bal., ? units, 55% completed ? Cost per equivalent units of $1.40 for Direct Materials and $2.10 for Conversion Costs. a. Based on the above data, determine the different costs listed below. Line Item Description Amount 1. Cost of beginning work in process inventory completed this period fill in the blank 1 of 4$ 2. Cost of units transferred to finished goods during the period fill in the blank 2 of 4$ 3. Cost of ending work in process inventory fill in the blank 3 of 4$ 4. Cost per unit of…arrow_forward

- Hii expert please given correct answer financial accountingarrow_forwardThe following information concerns production in the Baking Department for August. All direct materials are placed in process at the beginning of production. Date Item Debit Credit BalanceDebit BalanceCredit August 1 Bal., 6,300 units, 4/5 completed 16,884 31 Direct materials, 113,400 units 226,800 243,684 31 Direct labor 64,390 308,074 31 Factory overhead 36,212 344,286 31 Goods finished, 114,900 units 332,958 11,328 31 Bal., ? units, 2/5 completed 11,328 a. Based on the above data, determine each cost listed below. Round "cost per equivalent unit" answers to the nearest cent. Line Item Description Amount 1. Direct materials cost per equivalent unit $fill in the blank 1 2. Conversion cost per equivalent unit $fill in the blank 2 3. Cost of the beginning work in process completed during August $fill in the blank 3 4. Cost of units started and completed during August $fill in the blank 4 5. Cost of the ending work in…arrow_forwardWaiting for your solution general accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

How JOURNAL ENTRIES Work (in Accounting); Author: Accounting Stuff;https://www.youtube.com/watch?v=Y-_Q3rANyxU;License: Standard Youtube License