Concept explainers

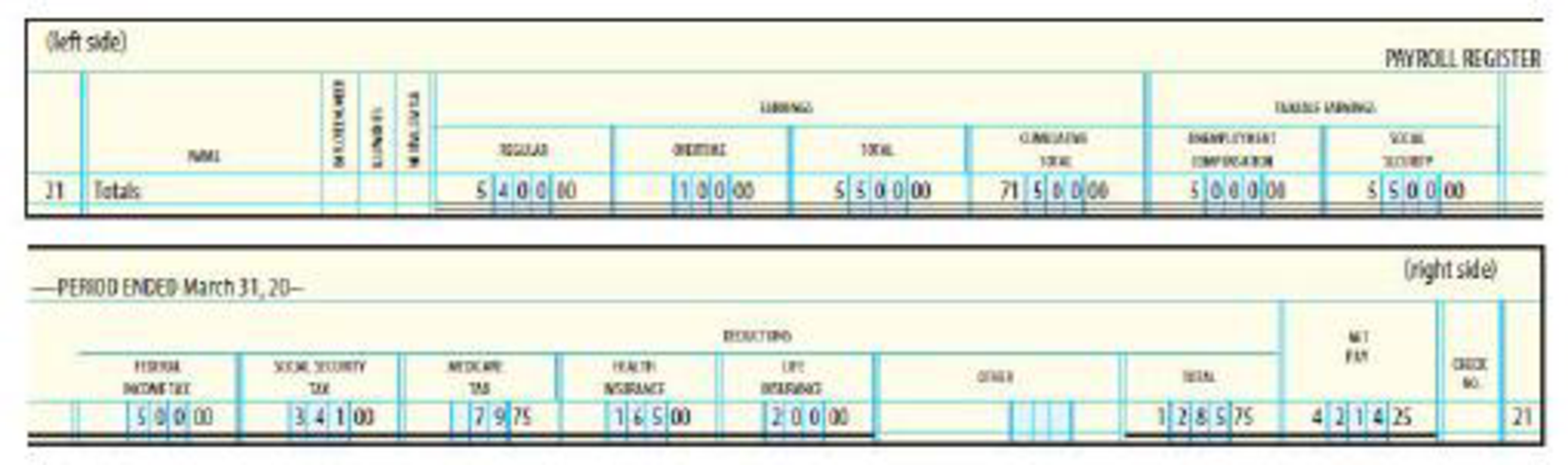

The totals line from Nix Company’s payroll register for the week ended March 31, 20--, is as follows:

Payroll taxes are imposed as follows: Social Security tax, 6.2%; Medicare tax, 1.45%; FUTA tax, 0.6%; and SUTA tax, 5.4%.

REQUIRED

- 1.

- a. Prepare the

journal entry for payment of this payroll on March 31, 20--. - b. Prepare the journal entry for the employer’s payroll taxes for the period ended March 31, 20--.

- a. Prepare the

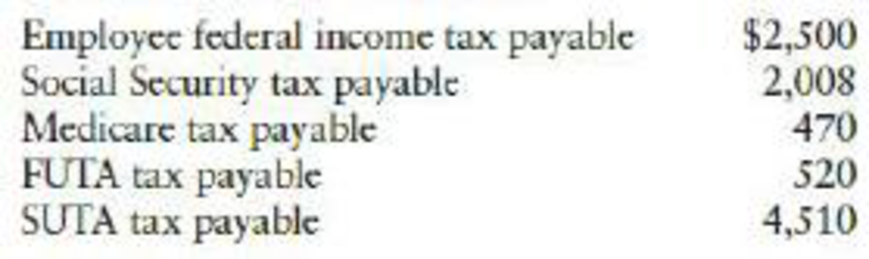

- 2. Nix Company had the following balances in its general ledger before the entries for requirement ( 1 ) were made:

- a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15, 20--.

- b. Prepare the journal entry for payment of the liability for FUTA tax on April 30, 20--.

- c. Prepare the journal entry for payment of the liability for SUTA tax on April 30, 20--.

1.

a. Prepare the journal entry for payment of this payroll on March 31.

b. Prepare the journal entry for the employer’s payroll taxes for the period ended March 31.

Explanation of Solution

Payroll:

Payroll refers to the total amount that is required to be paid by the company to its employees during a week, month or other period. It is the financial record of the wages and bonus, net pay, salary and deductions of a company’s employees.

a. Prepare the journal entry for payment of this payroll on March 31, 20--

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| March 31 | Wages and Salaries expense | 5,500 | ||

| Employee federal income tax payable | 500.00 | |||

| FICA-Social Security taxes payable | 341.00 | |||

| FICA-Medicare Taxes payable | 79.75 | |||

| Health insurance premium payable | 165.00 | |||

| Life insurance premium payable | 200.00 | |||

| Cash | 4,214.25 | |||

| (To record the payroll for the week ended March 31) |

Table (1)

- Wages and Salaries expense is an expense account and it is increased. Hence, debit wages and salaries expense with $5,500.00

- Employee Federal income tax payable is a liability and there is an increase in the value of liability. Hence, credit the employee Federal income tax payable by $500.00

- FICA tax – social and security tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – social and security tax payable by $341.00

- FICA tax – medical tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – medical tax payable by $79.75.

- Health insurance premium payable is a liability and it is increased. Hence, credit health insurance premium payable by $165.00.

- Life insurance premium payable is a liability and it is increased. Hence, credit life insurance premium payable by $200.00

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $4,214.25.

b. Prepare the journal entry for the employer’s payroll taxes for the period ended March 31, 20--

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| March 31 | Payroll tax expense | 720.75 | ||

| FICA-Social Security taxes payable | 341.00 | |||

| FICA-Medicare Taxes payable | 79.75 | |||

| FUTA tax payable | 30.00 | |||

| SUTA tax payable | 270.00 | |||

| (To record the employer payroll taxes for the week ended March 31) |

Table (2)

- Payroll taxes expense is an expense account and it is increased. Hence, debit payroll taxes expense with $720.75.

- FICA tax – social and security tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – social and security tax payable by $341.00.

- FICA tax – medical tax payable is a liability and there is an increase in the value of liability. Hence, credit the FICA tax – medical tax payable by $79.75.

- FUTA tax payable is a liability and it is increased. Hence, credit FUTA tax payable by $30.00.

- SUTA tax payable is a liability and it is increased. Hence, credit SUTA tax payable by $270.00.

2.

a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15.

b. Prepare the journal entry for payment of the liability for FUTA tax on April 30.

c. Prepare the journal entry for payment of the liability for SUTA tax on April 30.

Explanation of Solution

a. Prepare the journal entry for payment of the liabilities for federal income taxes and Social Security and Medicare taxes on April 15.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| April 15 | Employee federal income tax payable (1) | 3,000.00 | ||

| FICA-Social Security taxes payable (2) | 2,690.00 | |||

| FICA-Medicare Taxes payable (3) | 629.50 | |||

| Cash | 6,319.50 | |||

| (To record the deposit of employee federal income tax and social security and Medicare taxes.) |

Table (3)

- Employee federal income tax payable is a liability and it is decreased. Hence, debit employee federal income tax payable by $3,000.00.

- FICA tax – social and security tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – social and security tax payable by $2,690.00.

- FICA tax – medical tax payable is a liability and there is a decrease in the value of liability. Hence, debit the FICA tax – medical tax payable by $629.50.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $6,319.50.

b. Prepare the journal entry for payment of the liability for FUTA tax on April 30.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| April 30 | FUTA tax payable (4) | 550.00 | ||

| Cash | 550.00 | |||

| (To record the payment of FUTA tax) |

Table (4)

- FUTA tax payable is a liability and it is decreased. Hence, debit FUTA tax payable by $550.00.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $550.00.

c. Prepare the journal entry for payment of the liability for SUTA tax on April 30.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| April 30 | SUTA tax payable (5) | 4,780.00 | ||

| Cash | 4,780.00 | |||

| (To record the payment of SUTA tax) |

Table (5)

- SUTA tax payable is a liability and it is decreased. Hence, debit SUTA tax payable by $4,780.00.

- Cash is an asset and there is a decrease in the value of an asset. Hence, credit the cash by $4,780.00

Working Notes:

(1) Calculate the employee federal income tax payable.

(2) Calculate the social security tax payable.

(3) Calculate the Medicare tax payable.

(4) Calculate the FUTA tax payable.

(5) Calculate the SUTA tax payable.

3.

Prepare the adjusting entry to reflect the overpayment of the insurance premium at the end of the year December 31.

Explanation of Solution

Prepare the adjusting entry to reflect the overpayment of the insurance premium at the end of the year December 31.

| Date | Account Title and explanation | Post. ref | Debit ($) | Credit ($) |

| December 31 | Insurance refund receivable (6) | 20.00 | ||

| Workmen’s compensation insurance expense | 20.00 | |||

| (To record the adjustment for insurance premium) |

Table (6)

- Insurance refund receivable is an asset and there is an increase in the value of an asset. Hence, debit the Insurance refund receivable by $20.00.

- Workmen’s compensation insurance expense is a component of stockholder’s equity and the expense has decreased. Hence, credit the workmen’s compensation insurance expense by $20.00

Working Notes:

(6) Calculate the total insurance premium owed.

| Particulars | Amount in $ |

| Actual amount owed | 400.00 |

| Less: Estimated premium paid | 420.00 |

| Refund due | (20.00) |

Table (7)

Want to see more full solutions like this?

Chapter 9 Solutions

College Accounting, Chapters 1-9 (New in Accounting from Heintz and Parry)

- Venture Ltd. used 8,500 machine hours (Driver) on Job # 23. Total machine hours are 25,000. Assume Job # 23 is the only job sold during the accounting period. What is the overhead applied in COGS if the total overhead applied is $175,000?arrow_forwardNashville Company reported the cost of goods sold of $750,000 last year and $780,000 this year. Nashville also reported accounts payable of $270,000 last year and $260,000 this year. Compute this year's accounts payable turnover ratio for Nashville. Help me with thisarrow_forwardThe Palmer School of Business operates a transportation service, solely for the purpose of providing commuting services to off-campus students. You have been hired as accounting students to analyze the cost of providing the transportation services and to develop a cost function which describes the behaviour of the related costs. The schools' administration has assembled the data for a twelve-month period pertaining to the monthly total costs of providing the service and the corresponding number of students who used the transportation system each month. You were recently taught how to use the Excel graphing tool, and a member of the team successfully generated the scattergram given below from the data set provided. Total Transportation Costs PALMER SCHOOL OF BUSINESS SCATTER DIAGRAM 300,000 250,000 200,000 130,000 100,000 50,000 500 1,000 1,500 # of Students Line of Best Fit 2,000 2,500 3,000 The other team members are now tasked to use the graph to provide the administrators with a…arrow_forward

- Aurora Health Center has fixed costs of $240,000. After 32,000 visits, its fixed costs increase by $38,000 since it has to hire an additional front desk person to handle the additional volume. Variable costs are $5 per visit. If you are budgeting for 28,000 visits, what is your average cost per visit?arrow_forwardAurora Health Center has fixed costs of $240,000. After 32,000 visits, its fixed costs increase by $38,000 since it has to hire an additional front desk person to handle the additional volume. Variable costs are $5 per visit. If you are budgeting for 28,000 visits, what is your average cost per visit? Helparrow_forwardFinancial Accountingarrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage