INTERM.ACCT.:REPORTING...-CENGAGENOWV2

3rd Edition

ISBN: 9781337909358

Author: WAHLEN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 7RE

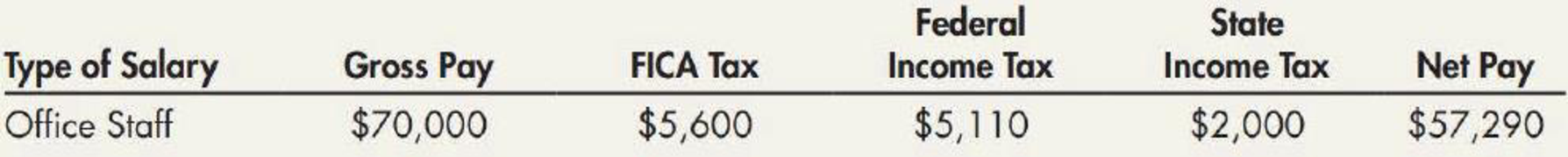

Wallace Corporation summarizes the following information from its weekly payroll records during April.

Prepare the two

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

TechTools has a standard of 1.8 pounds of materials per unit, at $3.50 per pound. In producing 2,500 units, TechTools used 4,700 pounds of materials at a total cost of $16,450. TechTools' materials quantity variance is _.help

4 POINTS

Need help this question solution

Chapter 9 Solutions

INTERM.ACCT.:REPORTING...-CENGAGENOWV2

Ch. 9 - Prob. 1GICh. 9 - Prob. 2GICh. 9 - List the three characteristics of a liability....Ch. 9 - Prob. 4GICh. 9 - Prob. 5GICh. 9 - Prob. 6GICh. 9 - Prob. 7GICh. 9 - Prob. 8GICh. 9 - How does materiality affect the accounting for...Ch. 9 - Distinguish between an interest-bearing note and a...

Ch. 9 - Prob. 11GICh. 9 - How should long-term debt that is callable by a...Ch. 9 - Prob. 13GICh. 9 - Prob. 14GICh. 9 - Prob. 15GICh. 9 - Prob. 16GICh. 9 - Prob. 17GICh. 9 - Prob. 18GICh. 9 - Prob. 19GICh. 9 - Prob. 20GICh. 9 - Prob. 21GICh. 9 - Prob. 22GICh. 9 - Prob. 23GICh. 9 - Prob. 24GICh. 9 - Prob. 25GICh. 9 - Prob. 26GICh. 9 - Prob. 27GICh. 9 - Prob. 28GICh. 9 - The balance in Ashwood Companys accounts payable...Ch. 9 - On September 1, 2019, a company borrowed cash and...Ch. 9 - When a company receives a deposit from a customer...Ch. 9 - Bronson Apparel Inc. operates a retail store and...Ch. 9 - Prob. 5MCCh. 9 - Prob. 6MCCh. 9 - Prob. 7MCCh. 9 - Prob. 8MCCh. 9 - Prob. 9MCCh. 9 - Prob. 10MCCh. 9 - Rescue Sequences LLC purchased inventory by...Ch. 9 - Use the same information in RE9-1 except that the...Ch. 9 - Cee Co.s fiscal year begins April 1. At the...Ch. 9 - Prob. 4RECh. 9 - Prob. 5RECh. 9 - Smith Company is required to charge customers an...Ch. 9 - Wallace Corporation summarizes the following...Ch. 9 - Borat Company gives annual bonuses after the end...Ch. 9 - Prob. 9RECh. 9 - Prob. 10RECh. 9 - After years of experience, Dilcort Company...Ch. 9 - Prob. 1ECh. 9 - Notes Payable On December 1, 2019, Insto Photo...Ch. 9 - Non-Interest-Bearing Notes Payable On November 16,...Ch. 9 - Discounting of Notes Payable On October 30, 2019,...Ch. 9 - Disclosure of Debt On May 1, 2019, Ramden Company...Ch. 9 - Short-Term Debt Expected to Be Refinanced On...Ch. 9 - Short-Term Debt Expected to Be Refinanced On...Ch. 9 - Refundable Deposits Party Warehouse Inc. rents a...Ch. 9 - Prob. 9ECh. 9 - Property Taxes Family Practice Associates has an...Ch. 9 - Prob. 11ECh. 9 - Prob. 12ECh. 9 - Prob. 13ECh. 9 - Prob. 14ECh. 9 - Prob. 15ECh. 9 - Prob. 16ECh. 9 - Prob. 17ECh. 9 - Prob. 18ECh. 9 - Prob. 19ECh. 9 - Prob. 20ECh. 9 - Cash Rebates On January 1, 2020, Fro-Yo Inc. began...Ch. 9 - Prob. 22ECh. 9 - Prob. 1PCh. 9 - Notes Payable and Effective Interest On November...Ch. 9 - Trade Note Transactions Adjusto Corporation (which...Ch. 9 - Prob. 4PCh. 9 - Short-Term Debt Expected to Be Refinanced On...Ch. 9 - Non-Interest-Bearing Note Payable: Present Value...Ch. 9 - Prob. 7PCh. 9 - Prob. 8PCh. 9 - Payroll and Payroll Taxes Bailey Dry Cleaners has...Ch. 9 - Bonus Obligation and Income Tax Expense James...Ch. 9 - Prob. 11PCh. 9 - Contingencies Fallon Company, a toy manufacturer...Ch. 9 - Prob. 13PCh. 9 - Assurance-Type Warranty Clean-All Inc. sells...Ch. 9 - Prob. 15PCh. 9 - Premium Obligation Yummy Cereal Company is...Ch. 9 - Comprehensive Selected transactions of Lizard Lick...Ch. 9 - Comprehensive Selected transactions of Shadrach...Ch. 9 - Prob. 1CCh. 9 - Prob. 2CCh. 9 - Prob. 3CCh. 9 - Pending Damage Suit Disclosure On December 15,...Ch. 9 - Various Contingency Issues Skinner Company has the...Ch. 9 - Prob. 6CCh. 9 - Prob. 7CCh. 9 - Prob. 8CCh. 9 - Prob. 10C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Carter Company disposed of an asset at the end of the eighth year of its estimated life for $16,000 cash. The asset's life was originally estimated to be 10 years. The original cost was $85,000 with an estimated residual value of $8,500. The asset was being depreciated using the straight-line method. What was the gain or loss on the disposal? Questionarrow_forwardNeed help with this question solution general accountingarrow_forwardCash and cash equivalents:3200, Accounts receivable:210arrow_forward

- Quick answer of this accounting questionsarrow_forwardToones Industries is planning to sell 1,050 boxes of porcelain tiles, with production estimated at 1,020 boxes during June. Each box of tile requires 38 pounds of clay compound and 0.3 hours of direct labor. Clay compound costs $0.45 per pound, and employees of the company are paid $13.50 per hour. Manufacturing overhead is applied at a rate of 105% of direct labor costs. Toones has 4,200 pounds of clay compound in beginning inventory and wants to have 4,900 pounds in ending inventory. What is the total amount to be budgeted in pounds for direct materials to be purchased for the month?helparrow_forwardCarter Company disposed of an asset at the end of the eighth year of its estimated life for $16,000 cash. The asset's life was originally estimated to be 10 years. The original cost was $85,000 with an estimated residual value of $8,500. The asset was being depreciated using the straight-line method. What was the gain or loss on the disposal?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

How JOURNAL ENTRIES Work (in Accounting); Author: Accounting Stuff;https://www.youtube.com/watch?v=Y-_Q3rANyxU;License: Standard Youtube License