Concept explainers

Use the following information for Problems 9-67 through 9-69:

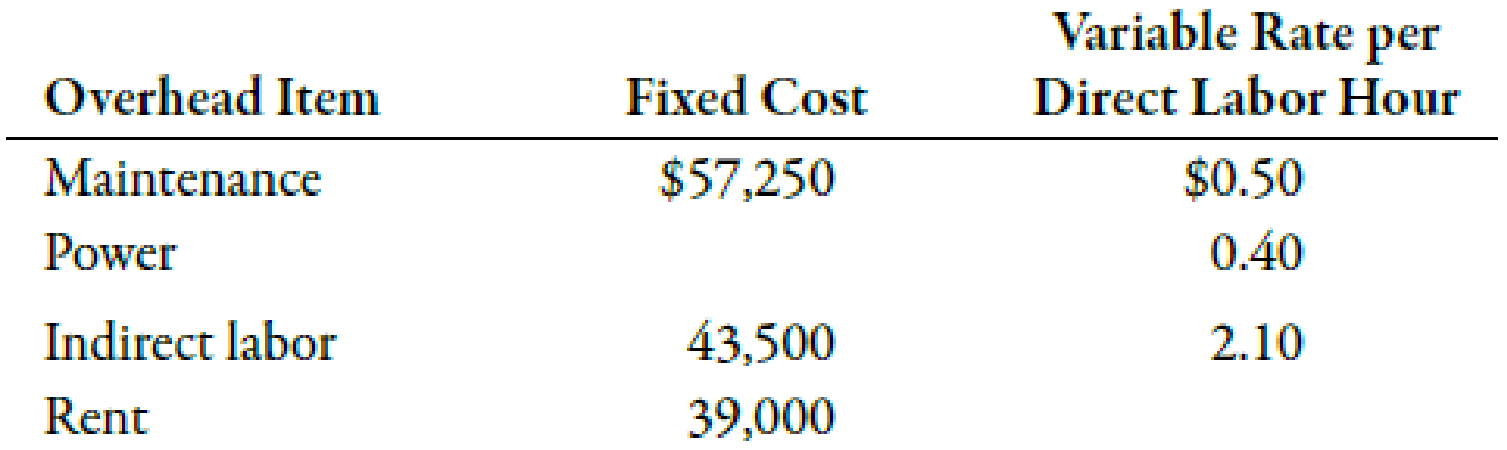

Ladan Suriman, controller for Healthy Pet Company, has been instructed to develop a flexible budget for

Problem 9-69 Performance Report Based on Actual Production

Refer to the information for Healthy Pet Company on the previous page. Assume that Healthy Pet actually produced 100,000 bags of BasicDiet and 90,000 bags of SpecialDiet. The actual overhead costs incurred were as follows:

Required:

- 1. Calculate the number of direct labor hours budgeted for actual production of the two products.

- 2. Prepare a performance report for the period based on actual production.

- 3. CONCEPTUAL CONNECTION Based on the report, would you judge any of the variances to be significant? Can you think of some possible reasons for the variances?

Trending nowThis is a popular solution!

Chapter 9 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College