Concept explainers

Operating Budget, Comprehensive Analysis

Allison Manufacturing produces a subassembly used in the production of jet aircraft engines.

The assembly is sold to engine manufacturers and aircraft maintenance facilities. Projected sales in units for the coming 5 months follow:

The following data pertain to production policies and manufacturing specifications followed by Allison Manufacturing:

- a. Finished goods inventory on January 1 is 32,000 units, each costing $166.06. The desired ending inventory for each month is 80% of the next month’s sales.

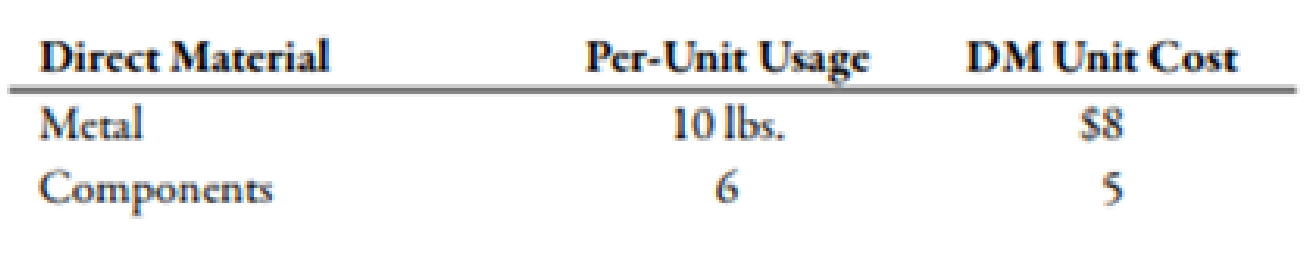

- b. The data on materials used are as follows:

Inventory policy dictates that sufficient materials be on hand at the end of the month to produce 50% of the next month’s production needs. This is exactly the amount of material on hand on December 31 of the prior year.

- c. The direct labor used per unit of output is 3 hours. The average direct labor cost per hour is $14.25.

- d.

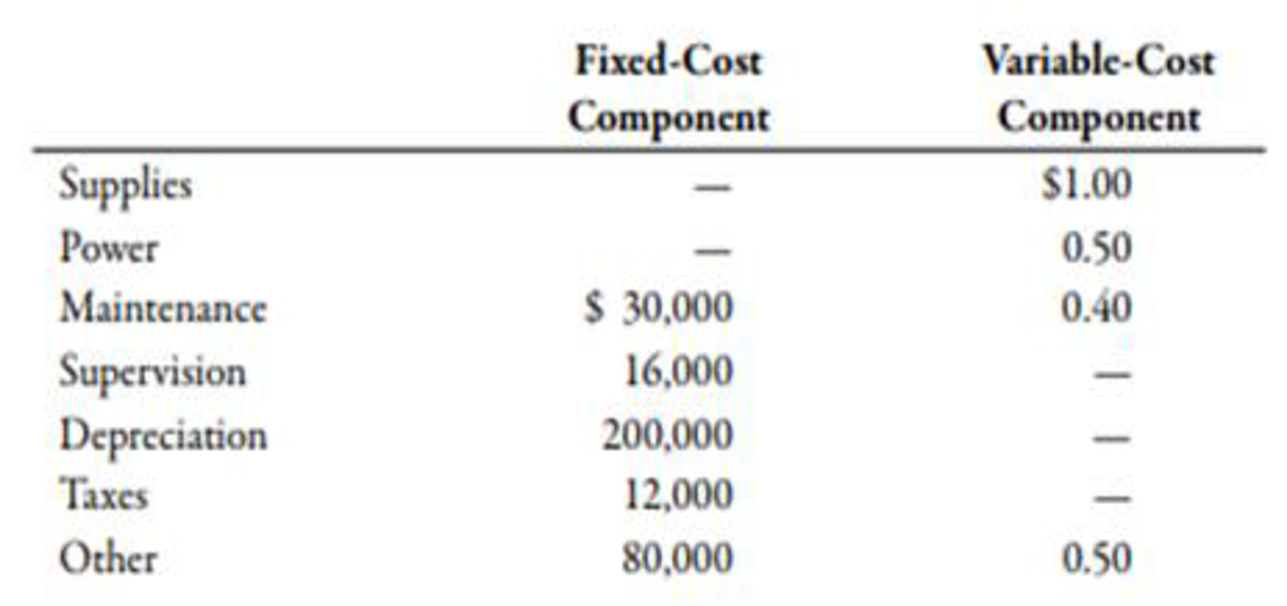

Overhead each month is estimated using a flexible budget formula. (Note: Activity is measured in direct labor hours.)

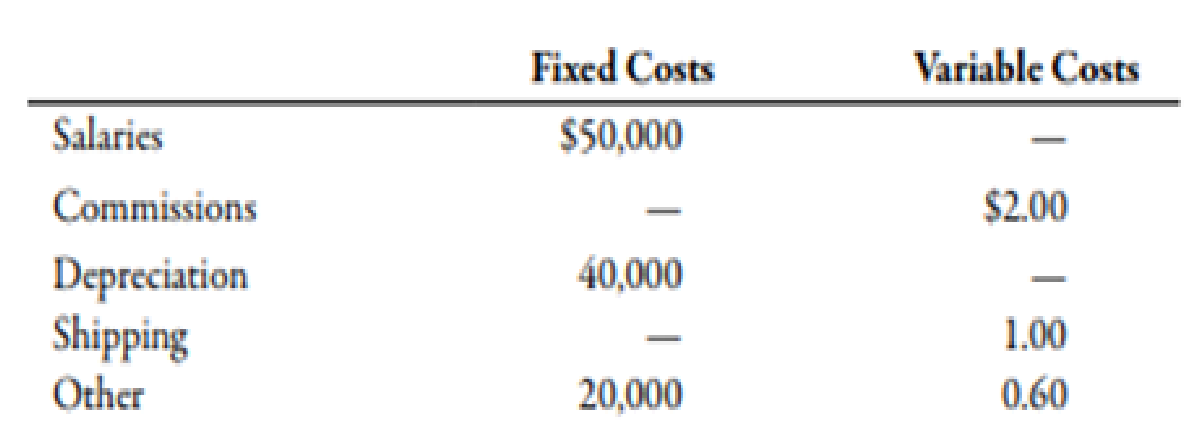

- e. Monthly selling and administrative expenses are also estimated using a flexible budgeting formula. (Note: Activity is measured in units sold.)

- f. The unit selling price of the subassembly is $205.

- g. All sales and purchases are for cash. The cash balance on January 1 equals $400,000. The firm requires a minimum ending balance of $50,000. If the firm develops a cash shortage

by the end of the month, sufficient cash is borrowed to cover the shortage. Any cash borrowed is repaid at the end of the quarter, as is the interest due (cash borrowed at the end of the quarter is repaid at the end of the following quarter). The interest rate is 12% per annum. No money is owed at the beginning of January.

Required:

- 1. Prepare a monthly operating budget for the first quarter with the following schedules. (Note: Assume that there is no change in work-in-process inventories.)

- a. Sales budget

- b. Production budget

- c. Direct materials purchases budget

- d. Direct labor budget

- e. Overhead budget

- f. Selling and administrative expenses budget

- g. Ending finished goods inventory budget

- h. Cost of goods sold budget

- i.

Budgeted income statement - j.

Cash budget

- 2. CONCEPTUAL CONNECTION Form a group with two or three other students. Locate a manufacturing plant in your community that has headquarters elsewhere. Interview the controller for the plant regarding the

master budgeting process. Ask when the process starts each year, what schedules and budgets are prepared at the plant level, how the controllerforecasts the amounts, and how those schedules and budgets fit in with the overall corporate budget. Is the budgetary process participative? Also, find out how budgets are used for performance analysis. Write a summary of the interview.

1.

a.

Prepare sales budget.

Explanation of Solution

Sales budget for the first quarter:

| Particulars |

January ($) |

February ($) |

March ($) |

Total ($) |

| Sales units (A) | 40,000 | 50,000 | 60,000 | 150,000 |

| Selling price (B) | 205 | 205 | 205 | 205 |

| Sales | 8,200,000 | 10,250,000 | 12,300,000 | 30,750,000 |

Table (1)

b.

Prepare production budget.

Explanation of Solution

Production budget for the first quarter:

| Particulars |

January ($) |

February ($) |

March ($) |

Total ($) |

| Expected sales | 40,000 | 50,000 | 60,000 | 150,000 |

| Add: Closing units. 80% of sales units of next month |

40,000 |

48,000 | 136,000 | |

| Less: Opening units. 80% of sales units of the current month | 32,000 | 120,000 | ||

| Production units | 48,000 | 58,000 | 60,000 | 166,000 |

Table (2)

c.

Prepare direct materials purchases budget.

Explanation of Solution

Materials purchases budget:

| Particulars |

January ($) |

February ($) |

March ($) |

Total ($) |

| Expected production (sub-part b) | 48,000 | 58,000 | 60,000 | 166,000 |

| Add: Closing units. 50% of production units of next month 1 |

29,000 |

30,000 | 89,800 | |

| Less: Opening units. 50% of production units of the current month | 83,000 | |||

| Production units for which material is required to be purchased | 53,000 | 59,000 | 60,800 | 172,800 |

|

Metal cost: 10 lbs. per unit @ $8 (A) |

4,240,000 |

4,720,000 |

4,864,000 | 13,824,000 |

| Component cost: 6 per unit @ $5 (B) |

1,590,000 |

1,770,000 |

1,824,000 | 5,184,000 |

| Total material cost | 5,830,000 | 6,490,000 | 6,688,000 | 19,008,000 |

Table (3)

Working Notes:

1. Computation of production units of April:

d.

Prepare direct labor budget.

Explanation of Solution

Direct labor budget:

| Particulars |

January ($) |

February ($) |

March ($) |

Total ($) |

| Expected production (sub-part b) | 48,000 | 58,000 | 60,000 | 166,000 |

| Hours per unit | 3 | 3 | 3 | |

| Number of hours |

144,000 |

174,000 |

180,000 | 498,000 |

| Rate per hour | 14.25 | 14.25 | 14.25 | |

| Labor cost |

2,052,000 |

2,479,500 |

2,565,000 | 7,096,500 |

Table (4)

e.

Prepare overhead budget.

Explanation of Solution

Overhead budget:

| Particulars |

January ($) |

February ($) |

March ($) |

Total ($) |

| Number of hours (sub-part d) | 144,000 | 174,000 | 180,000 | 498,000 |

| Variable overhead1 |

345,600 |

417,600 |

432,000 | 1,195,200 |

| Fixed overhead2 (B) | 338,000 | 338,000 | 338,000 | 1,014,000 |

|

Total overhead | 683,600 | 755,600 | 770,000 | 2,209,200 |

Table (5)

Working Notes:

1. Computation of variable overhead rate per hour per month:

2. Computation of fixed overhead rate per month:

f.

Prepare selling and administrative expenses budget.

Explanation of Solution

Selling and administrative expenses budget:

| Particulars |

January ($) |

February ($) |

March ($) |

Total ($) |

| Number of sales units | 40,000 | 50,000 | 60,000 | 150,000 |

| Variable expense1 |

144,000 |

180,000 |

216,000 | 540,000 |

| Fixed expense2 (B) | 110,000 | 110,000 | 110,000 | 330,000 |

|

Total overhead | 254,000 | 290,000 | 326,000 | 870,000 |

Table (6)

Working Notes:

1. Computation of variable selling and administrative expense rate per unit:

2. Computation of fixed selling and administrative expense per month:

g.

Prepare ending goods inventory budget.

Explanation of Solution

Ending goods inventory budget:

| Particulars |

Amount ($) |

| Material cost: | |

| Metal | 80 |

| Add: Component | 30 |

| Add: Labor cost | 42.75 |

| Add: Variable overheads | 7.2 |

| Add: Fixed overheads1 | 6.11 |

| Unit cost | 166.06 |

| Cost of ending goods | 7,970,880 |

Table (7)

Working Notes:

1. Computation of fixed overhead per unit:

h.

Prepare COGS budget.

Explanation of Solution

Cost of goods sold budget:

| Particulars |

Amount ($) |

| Material cost: | |

| Metal | 13,280,000 |

| Add: Component | 4,980,000 |

| Add: Labor cost | 7,096,500 |

| Add: Variable overheads | 1,195,200 |

| Add: Fixed overheads | 1,014,000 |

| Manufacturing cost (A) | 27,565,700 |

| Add: Beginning finished goods | 5,313,920 |

| Cost of goods available for sale | 32,879,620 |

| Less: Ending goods (sub-part g) (D) | 7,970,880 |

| COGS | 24,908,740 |

Table (8)

i.

Prepare budgeted income statement.

Explanation of Solution

Budgeted income statement:

| Particulars |

Amount ($) |

| Sales | 30,750,000 |

| Less: COGS (sub-part h) | 24,908,740 |

| Operating profit | 5,841,260 |

| Less: Selling and administrative expenses | 870,000 |

| Income | 4,971,260 |

Table (9)

i.

Prepare budgeted income statement.

Explanation of Solution

Budgeted income statement:

| Particulars |

Amount ($) |

| Sales | 30,750,000 |

| Less: COGS (sub-part h) | 24,908,740 |

| Operating profit | 5,841,260 |

| Less: Selling and administrative expenses | 870,000 |

| Income | 4,971,260 |

Table (10)

j.

Prepare cash budget.

Explanation of Solution

Cash Budget:

| Particulars |

January ($) |

February ($) |

March ($) |

Total ($) |

| Opening balance | 400,000 | 50,000 | 524,900 | 400,000 |

| Sales (sub-part a) | 8,200,000 | 10,250,000 | 12,300,000 | 30,750,000 |

| Less: Material purchase (sub-part c) | 5,830,000 | 6,490,000 | 6,688,000 | 19,008,000 |

| Less: labor cost (sub-part d) | 2,052,000 | 2,479,500 | 2,565,000 | 7,096,500 |

| Less: Overhead cost (sub-part e) | 483,600 | 555,600 | 570,000 | 1,609,200 |

| Less: Selling and administrative expense (sub-part f) | 214,000 | 250,000 | 286,000 | 750,000 |

| Cash available | 20,400 | 524,900 | 2,715,900 | 2,686,300 |

| Amount borrowed | 29,600 | 0 | 0 | 29,600 |

| Amount repaid1 | 0 | 0 | 30,488 | 30,488 |

| Closing balance | 50,000 | 524,900 | 2,685,412 | 2,685,412 |

Table (11)

Working Notes:

1. Computation of amount repaid:

Depreciation is not considered in cash payments since it is a non-cash expense.

2.

Prepare summary regarding budgets used in ABC incorporation.

Explanation of Solution

In ABC incorporation, participative budgeting is used; all the supervisors and department heads are involved in preparation of the relevant budgets to increase the probability of meeting the budgets.

However, preparation of budgets is not entirely delegated to the sub-ordinate managers and supervisors, their issues and reasonable figures are asked and on that basis, higher management decides budgetary figures.

After expiry of the period, budgets are adjusted according to actual units sold and thereafter, such budget is prepared with actual budget to find out discrepancies.

Thereafter, reasons behind all the variances are observed. Amount of variance, attributable to managerial performances are considered as one of the factors in performance analysis.

All the operating budgets like; sales, production, material purchase, labor, overhead, selling and administrative overhead, finished goods inventory, COGS as well as cash budget is prepared for planning and controlling purposes.

All these budgets help in determination of budgeted income and cash requirements. This can be explained as follows:

- Sales budget is used to prepare production budget and selling and administrative expenses budget.

- Production budget is used to prepare material purchase budget and labor budget.

- Labor budget (labor hours) is used to prepare manufacturing overhead budget.

- Production, material, labor, and production overhead budgets are used to compute ending finished goods inventory budget and based on these budgets COGS budget is prepared.

- Budgeted income statement is prepared by using sales budget, COGS budget and selling and administrative expenses budget.

- Sales, material, labor, production overhead, and selling overhead budgets are used to prepare cash budget.

Budgets are forecasted by using past year data. Past year data is adjusted with inflation and other economic factors like availability of new clients, to prepare budgets for the current year.

Want to see more full solutions like this?

Chapter 9 Solutions

Managerial Accounting: The Cornerstone of Business Decision-Making

- General accounting questionarrow_forwardMona Equipment Inc. had $18.20 million in sales last year. The cost of goods sold was $9.20 million, depreciation expense was $2.80 million, interest payment on outstanding debt was $1.80 million, and the firm's tax rate was 23%. A. What was the firm's net income? B. What was the firm's cash flow?arrow_forwardFind the direct labor hour? Helparrow_forward

- Find the direct labor hour?arrow_forwardOn January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows: Moody Osorio Cash $ 180 $ 40 Receivables 810 180 Inventories 1,080 280 Land 600 360 Buildings (net) 1,260 440 Equipment (net) 480 100 Accounts payable (450 ) (80 ) Long-term liabilities (1,290 ) (400 ) Common stock ($1 par) (330 ) Common stock ($20 par) (240 ) Additional paid-in capital (1,080 ) (340 ) Retained…arrow_forwardDetermine cash basis net incomearrow_forward

- Subject: general accounting questionarrow_forwardAman Equipment Corporation (AEC) paid $5,200 for direct materials and $9,800 for production workers' wages. Lease payments and utilities on the production facilities amounted to $8,200, while general, selling, and administrative expenses totaled $3,500. The company produced 6,000 units and sold 4,800 units at a price of $8.25 per unit. What was AEC's net income for the first year in operation?arrow_forwardMCQarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT