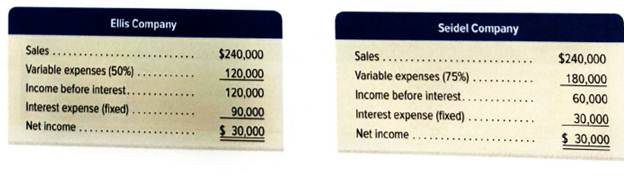

Shown here are condensed income statements for two different companies (both are organized as LLCs and pay no income taxes).

Required

- Compute times interest earned for Ellis Company.

- Compute times interest earned for Seidel Company.

- What happens to each company’s net income if sales increase by 10%?

- What happens to each company’s net income if sales increase by 40%?

- What happens to each company’s net income if sales increase by 90%?

- What happens to each company’s net income if sales decrease by 20%?

- What happens to each company’s net income if sales decrease by 50%?

- What happens to each company’s net income if sales decrease by 80%? Analysis Component

- Comment on the results from parts 3 through 8 in relation to the fixed-cost strategies of the two companies and the ratio values you computed in parts 1 and 2.

1.

Introduction: The times interest earned refer to the ratio of income before interest and taxes to interest earned.

To calculate: Times interest earned for company E.

Explanation of Solution

Computation of times interest earned for company E:

2.

Introduction: The times interest earned refer to the ratio of income before interest and taxes to interest earned.

To calculate: Times interest earned for company S.

Explanation of Solution

Computation of times interest earned for company S:

3.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales increased by 10%.

Explanation of Solution

If sales increased by 10% for each company,

For company E;

For company S:

Computing net income for company E:

| Particular | Amount |

| Sales | $264,000 |

| Less: variable expense (50%) | (132,000) |

| Income before interest | 132,000 |

| Less: Interest expense(fixed) | (90,000) |

| Net income | $42,000 |

Computing net income for company S:

| Particular | Amount |

| Sales | $264,000 |

| Less: variable expense (75%) | (180,000) |

| Income before interest | 84,000 |

| Less: Interest expense(fixed) | (30,000) |

| Net income | $54,000 |

4.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales increased by 40%.

Explanation of Solution

If sales increased by 40% for each company,

For company E;

For company S:

Computing net income for company E:

| Particular | Amount |

| Sales | $336,000 |

| Less: variable expense (50%) | (168,000) |

| Income before interest | 168,000 |

| Less: Interest expense(fixed) | (90,000) |

| Net income | $78,000 |

Computing net income for company S:

| Particular | Amount |

| Sales | $336,000 |

| Less: variable expense (75%) | (252,000) |

| Income before interest | 84,000 |

| Less: Interest expense(fixed) | (30,000) |

| Net income | $54,000 |

5.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales increased by 90%.

Explanation of Solution

If sales increased by 90% for each company,

For company E;

For company S:

Computing net income for company E:

| Particular | Amount |

| Sales | $456,000 |

| Less: variable expense (50%) | (228,000) |

| Income before interest | 228,000 |

| Less: Interest expense(fixed) | (90,000) |

| Net income | $138,000 |

Computing net income for company S:

| Particular | Amount |

| Sales | $456,000 |

| Less: variable expense (75%) | (342,000) |

| Income before interest | 114,000 |

| Less: Interest expense(fixed) | (30,000) |

| Net income | $84,000 |

6.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales decreased by 20%.

Explanation of Solution

If sales decreased by 20% for each company,

For company E;

For company S:

Computing net income for company E:

| Particular | Amount |

| Sales | $192,000 |

| Less: variable expense (50%) | (96,000) |

| Income before interest | 96,000 |

| Less: Interest expense(fixed) | (90,000) |

| Net income | $6,000 |

Computing net income for company W:

| Particular | Amount |

| Sales | $192,000 |

| Less: variable expense (75%) | (144,000) |

| Income before interest | 48,000 |

| Less: Interest expense(fixed) | (30,000) |

| Net income | $18,000 |

7.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales decreased by 50%.

Explanation of Solution

If sales decreased by 50% for each company,

For company E;

For company S:

Computing net income for company E:

| Particular | Amount |

| Sales | $120,000 |

| Less: variable expense (50%) | (60,000) |

| Income before interest | 60,000 |

| Less: Interest expense(fixed) | (90,000) |

| Net income | ($30,000) |

Computing net income for company S:

| Particular | Amount |

| Sales | $120,000 |

| Less: variable expense (75%) | (90,000) |

| Income before interest | 30,000 |

| Less: Interest expense(fixed) | (30,000) |

| Net income | $0 |

8.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

To calculate: The net income of each company if the sales decreased by 80%.

Explanation of Solution

If sales decreased by 80% for each company,

For company E;

For company S:

Computing net income for company M:

| Particular | Amount |

| Sales | $48,000 |

| Less: variable expense (50%) | (24,000) |

| Income before interest | 24,000 |

| Less: Interest expense(fixed) | (90,000) |

| Net income | ($74,000) |

Computing net income for company W:

| Particular | Amount |

| Sales | $48,000 |

| Less: variable expense (75%) | (36,000) |

| Income before interest | 12,000 |

| Less: Interest expense(fixed) | (30,000) |

| Net loss | ($18,000) |

9.

Introduction: The net income refers to that part of income which is generated after subtracting all expenses such as cost of goods sold and other non-operating expenses, depreciation and taxes.

The time's interest earned refers to the ratio of income before interest and taxes to interest earned.

To comment: On the result for interest earned by both the companies and for part 3 to 8.

Explanation of Solution

Comments on times interest earned by both the companies are:

For company E:

The time's interest earned by company E is 1.3 times which is lesser than 2.5 times this indicates that it is difficult for the company to meet its debt and to invest in the company is riskier from the investor's point of view.

For company S:

The time's interest earned by company E is 2times which lesser than 2.5 times but the situation is better than company S, this indicates the riskier to invest in the company from an investor point of view.

Comments on the fixed cost strategies for the company The company fixed cost does not affect the net income as the sales increase but when sales start decreasing the net income is falling down and lead to losses for the company. Thus the company should increase sales or maintain sales to generate profit for the firm.

Want to see more full solutions like this?

Chapter 9 Solutions

Connect Access Card for Financial Accounting: Information and Decisions

- Financial Accounting Questionarrow_forwardFlorida Kitchens produces high-end cooking ranges. The costs to manufacture and market the ranges at the company’s volume of 3,000 units per quarter are shown in the following table: Unit manufacturing costs Variable costs $ 1,440 Fixed overhead 720 Total unit manufacturing costs $ 2,160 Unit nonmanufacturing costs Variable 360 Fixed 840 Total unit nonmanufacturing costs 1,200 Total unit costs $ 3,360 The company has the capacity to produce 3,000 units per quarter and always operates at full capacity. The ranges sell for $4,000 per unit. Required: a. Florida Kitchens receives a proposal from an outside contractor, Burns Electric, who will manufacture 1,200 of the 3,000 ranges per quarter and ship them directly to Florida’s customers as orders are received from the sales office at Florida. Florida would provide the materials for the ranges, but Burns would assemble, box, and ship the ranges. The variable manufacturing costs would be…arrow_forwardCan you please solve this general accounting problem?arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning