Concept explainers

Calculating Direct Materials and Direct Labor Variances

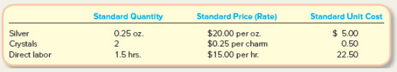

Crystal Charm Company makes handcrafted silver charms that attach to jewelry such as a necklace or bracelet. Each charm is adorned with two crystals of various colors.

During the month of January Crystal Charm made 1,800 charms. The company used 420 ounces of silver (total cost of $9,240) and 3,650 crystals (total cost of $803), and paid for 2,880 actual direct labor hours (cost of $42,480).

Required:

1. Calculate Crystal Charm’s direct materials variances for silver and crystals for the month of January.

2. Calculate Crystal Charm’s direct labor variances for the month of January.

3. Identify a possible cause of each variance.

(a)

Concept introduction:

Price variance:

It is the difference between price per unit in standard and actual price of product and multiplying that with quantity purchased in actual.

Quantity variance:

It is referred to the amount which is computed by multiplying the standard price per unit with the difference between quantity in actual term and standard term of product.

Direct Material spending variance:

This is calculated by combining material price variance and material quantity variance.

To compute:

The direct material variances for silver and crystals for the month of January.

Answer to Problem 5E

Direct material variances for Silver:

Direct material price variance

Direct material quantity variance

Direct material spending variance

Direct material variances for Crystal:

Direct material price variance

Direct material quantity variance

Direct material spending variance

Explanation of Solution

Direct material variances for Silver:

Number of charms

Standard quantity of silver used

Standard rate

Actual quantity of silver used

Computation of Direct material price variance is as follows:

Computation of Direct material quantity variance is as follows:

Computation of Direct material spending variance is as follows:

Direct material variances for Crystals:

Number of charms

Standard quantity of crystals used

Standard rate

Actual quantity of crystal used

Computation of Direct material price variance is as follows:

Computation of Direct material quantity variance is as follows:

Computation of Direct material spending variance is as follows:

(b)

Concept introduction:

Rate variance:

It is referred to the amount which is computed by multiplying the number of actual hours with the difference between actual rate and standard rate per hour of direct labour.

Time variance:

It is referred to the amount which is computed by multiplying the standard rate per hours with the difference between the number of actual hours and standard hours of direct labour.

Direct labour spending variance:

This is calculated by combining material price variance and material quantity variance.

To compute:

The direct labor variances for the month of January.

Answer to Problem 5E

Direct labor rate variance

Direct labor efficiency variance

Direct labor spending variance

Explanation of Solution

Number of charms

Standard hours

Standard rate

Actual hours used

Computation of Direct labor rate variance is as follows:

Computation of Direct labor efficiency variance is as follows:

Computation of Direct labor spending variance is as follows:

(c)

Concept introduction:

Rate variance:

It is referred to the amount which is computed by multiplying the number of actual hours with the difference between actual rate and standard rate per hour of direct labour.

Time variance:

It is referred to the amount which is computed by multiplying the standard rate per hours with the difference between the number of actual hours and standard hours of direct labour.

Direct labour spending variance:

This is calculated by combining material price variance and material quantity variance.

The possible causes of each variance.

Answer to Problem 5E

The possible cause of the variances is the difference between the actual and standard or budgeted figures.

Explanation of Solution

The direct material price variance of silver is unfavorable which means the price paid in actual is more than the standard price. The direct material quantity variance of silver is favorable which means the quantity used in actual is less than the standard quantity.

The direct material price variance of crystal is favorable which means the price paid in actual is less than the standard price. The direct material quantity variance of crystal is unfavorable which means the quantity used in actual is more than the standard quantity.

The direct labor rate variance of crystal is favorable which means the rate paid in actual is less than the standard rate. The direct labor time variance of crystal is unfavorable which means the hours used in actual is more than the standard hours.

Want to see more full solutions like this?

Chapter 9 Solutions

Managerial Accounting

- 1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstated Need helparrow_forward1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstatedarrow_forward1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstatedarrow_forward

- No ai What happens to the accounting equation when a company issues common stock for cash?A. Assets increase, liabilities increaseB. Assets increase, equity increasesC. Assets decrease, equity decreasesD. Assets increase, liabilities decreasearrow_forwardWhat happens to the accounting equation when a company issues common stock for cash?A. Assets increase, liabilities increaseB. Assets increase, equity increasesC. Assets decrease, equity decreasesD. Assets increase, liabilities decreasehelparrow_forwardWhat happens to the accounting equation when a company issues common stock for cash?A. Assets increase, liabilities increaseB. Assets increase, equity increasesC. Assets decrease, equity decreasesD. Assets increase, liabilities decreasearrow_forward

- Please provide Accurate Answer of this Financial Accounting Questionarrow_forwardNeed General Accounting Question Solutionarrow_forwardIvanhoe Equipment Company sells computers for $1,620 each and also gives each customer a 2-year warranty that requires the company to perform periodic services and to replace defective parts. In 2025, the company sold 860 computers on account. Based on experience, the company has estimated the total 2-year warranty costs as $40 for parts and $60 for labor per unit. (Assume sales all occur at December 31, 2025.) In 2026, Ivanhoe incurred actual warranty costs relative to 2025 computer sales of $13,200 for parts and $19,800 for labor. What balance will be reported as a current liability in the 2025 balance sheet with regard to these transactions? Current Liabilities- eTextbook and Media List of Accounts Assistance Usedarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,