Concept explainers

Calculating Direct Materials and Direct Labor Variances

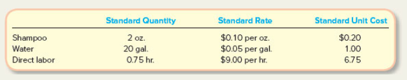

Suds & Cuts is a local pet grooming shop owned by Collin Bark. CoIlin has prepared the following

During the month of July, CoIlin's employees gave 360 baths. The actual results ware 725 ounces of shampoo used (cost of $116). 6,500 gallons of water used (cost of $455), and labor costs for 230 hours (cost of $2.300).

Required:

- Calculate Suds & Cuts direct materials variances for both shampoo and water for the month of July.

(a)

Concept introduction:

Price variance:

It is the difference between price per unit in standard and actual price of product and multiplying that with quantity purchased in actual.

Quantity variance:

It is referred to the amount which is computed by multiplying the standard price per unit with the difference between quantity in actual term and standard term of product.

Direct Material spending variance:

This is calculated by combining material price variance and material quantity variance.

To compute:

The direct material variances for shampoo and water for the month of July.

Answer to Problem 4E

Direct material variances for Shampoo:

Direct material price variance

Direct material quantity variance

Direct material spending variance

Direct material variances for water:

Direct material price variance

Direct material quantity variance

Direct material spending variance

Explanation of Solution

Direct material variances for Shampoo:

Number of baths

Standard quantity of shampoo used

Standard rate

Actual quantity of shampoo used

Computation of Direct material price variance is as follows:

Computation of Direct material quantity variance is as follows:

Computation of Direct material spending variance is as follows:

Direct material variances for water:

Number of baths

Standard quantity of water used

Standard rate

Actual quantity of crystal used

Computation of Direct material price variance is as follows:

Computation of Direct material quantity variance is as follows:

Computation of Direct material spending variance is as follows:

(b)

Concept introduction:

Rate variance:

It is referred to the amount which is computed by multiplying the number of actual hours with the difference between actual rate and standard rate per hour of direct labour.

Time variance:

It is referred to the amount which is computed by multiplying the standard rate per hours with the difference between the number of actual hours and standard hours of direct labour.

Direct labour spending variance:

This is calculated by combining material price variance and material quantity variance.

To compute:

The direct labor variances for the month of January.

Answer to Problem 4E

Direct labor rate variance

Direct labor efficiency variance

Direct labor spending variance

Explanation of Solution

Standard hours

Standard rate

Actual hours used

Computation of Direct labor rate variance is as follows:

Computation of Direct labor efficiency variance is as follows:

Computation of Direct laborspending variance is as follows:

(c)

Concept introduction:

Rate variance:

It is referred to the amount which is computed by multiplying the number of actual hours with the difference between actual rate and standard rate per hour of direct labour.

Time variance:

It is referred to the amount which is computed by multiplying the standard rate per hours with the difference between the number of actual hours and standard hours of direct labour.

Direct labour spending variance:

This is calculated by combining material price variance and material quantity variance.

The possible causes of each variance.

Answer to Problem 4E

The possible cause of the variances is the difference between the actual and standard or budgeted figures.

Explanation of Solution

The direct material price variance of shampoo is unfavorable, which means the price paid in actual is more than the standard price. The direct material quantity variance of shampoo is also unfavorable which means the quantity used in actual is more than the standard quantity.

The direct material price variance of water is unfavorable which means the price paid in actual is more than the standard price. The direct material quantity variance of water is favorable which means the quantity used in actual is less than the standard quantity.

The direct labor rate variance is unfavorable which means the rate paid in actual is more than the standard rate. The direct labor time variance is favorable which means the hours used in actual is less than the standard hours.

Want to see more full solutions like this?

Chapter 9 Solutions

Managerial Accounting

- Can you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,