Concept explainers

Activity-Based Costing for an Administrative Service

The Personnel Department at LastCall Enterprises handles many administrative tasks for the two divisions that make up LastCall: LaidBack and StressedOut. LaidBack division manages the company’s traditional business line. This business, although lucrative, is currently not growing. StressedOut, on the other hand, is the company’s new business, which has experienced double-digit growth for each of the last three years.

The cost allocation system at LastCall allocates all corporate costs to the divisions based on a variety of cost allocation bases. Personnel costs are allocated based on the average number of employees in the two divisions.

There are two basic activities in the Personnel Department. The first, which is called employee maintenance, manages employee records. Virtually all of this activity occurs when employees are hired or leave the company. The other activity is payroll, which is an ongoing activity and requires the same amount of work for each employee regardless of the employee’s salary.

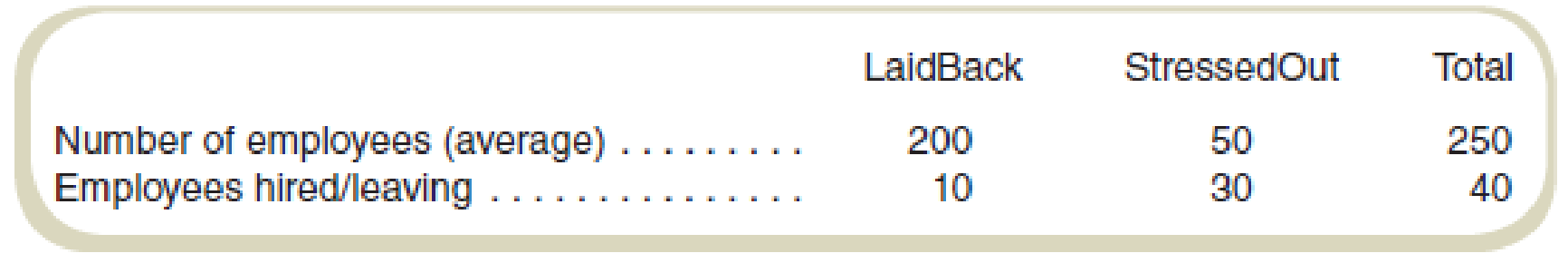

Assorted data for LastCall for the last year follow:

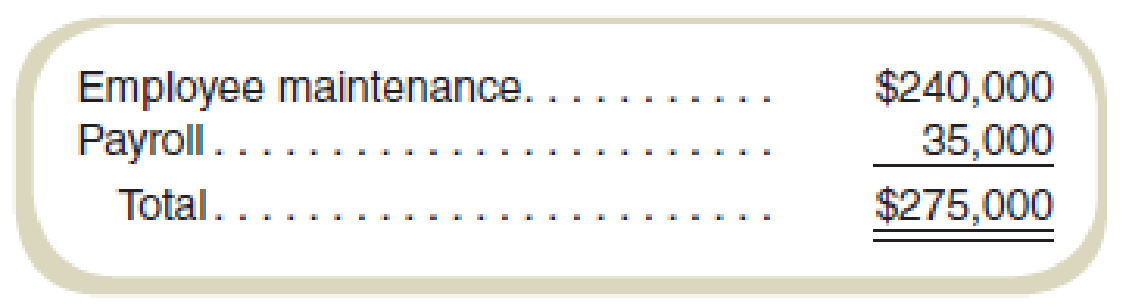

The Personnel Department incurred the following costs during the year:

Required

- a. Under the current allocation system, what are the costs that will be allocated from personnel to LaidBack? To StressedOut?

- b. Suppose the company implements an activity-based cost system for personnel with the two activities, employee maintenance and payroll. Use the number of employees hired/leaving as the cost driver for employee maintenance costs and the average number of employees for payroll costs. What are the costs that will be allocated from personnel to LaidBack? To StressedOut?

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

FUNDAMENTALS OF COST ACCOUNTING

- General Accountingarrow_forwardApsara Beverages Co. uses process costing to account for the production of bottled sports drinks. Direct materials are added at the beginning of the process, and conversion costs are incurred uniformly throughout the process. Equivalent units have been calculated to be 21,600 units for materials and 18,000 units for conversion costs. Beginning inventory consisted of $13,500 in materials and $7,200 in conversion costs. May costs were $62,400 for materials and $72,000 for conversion costs. The ending inventory still in process was 7,000 units (100% complete for materials, 50% for conversion). The cost per equivalent unit for materials using the weighted-average method would be____.arrow_forwardHelparrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning