Comparative Income Statements and Management Analysis

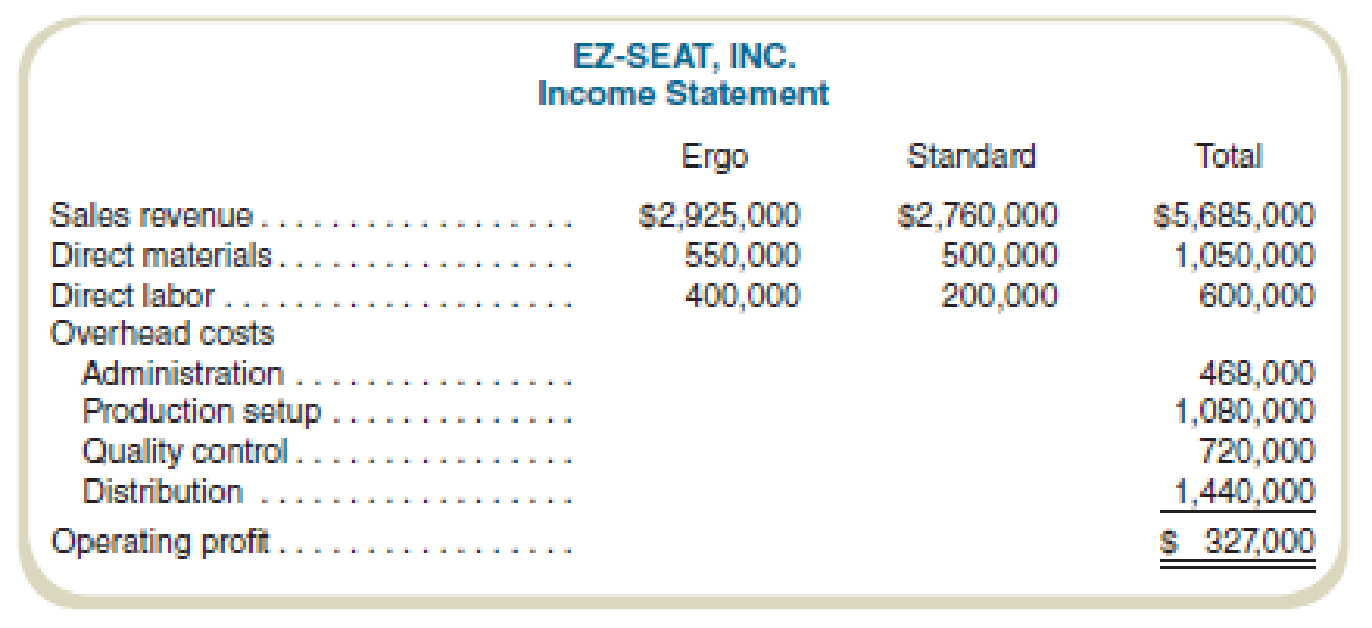

EZ-Seat, Inc., manufactures two types of reclining chairs, Standard and Ergo. Ergo provides support for the body through a complex set of sensors and requires great care in manufacturing to avoid damage to the material and frame. Standard is a conventional recliner, uses standard materials, and is simpler to manufacture. EZ-Seat’s results for the last fiscal year are shown in the statement below.

EZ-Seat currently uses labor costs to allocate all

Required

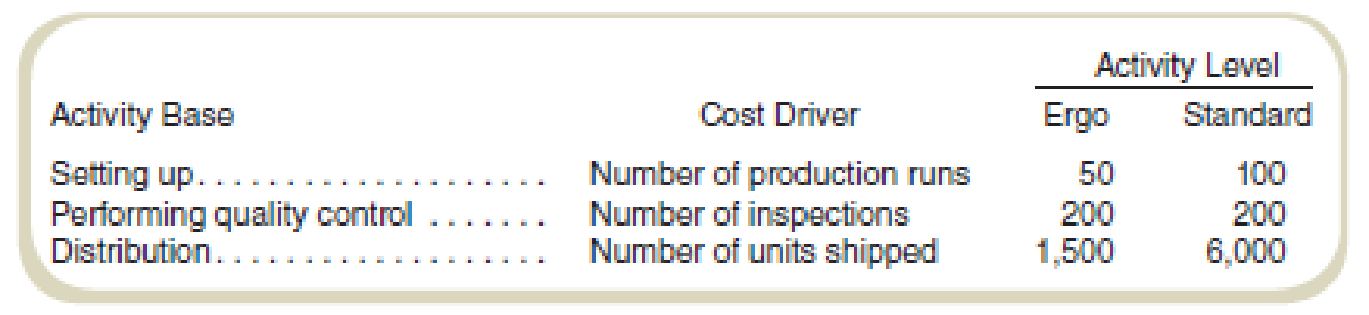

- a. Complete the income statement using the preceding activity bases.

- b. Write a brief report indicating how management could use activity-based costing to reduce costs.

- c. Restate the income statement for EZ-Seat using direct labor costs as the only overhead allocation base.

- d. Write a report to management stating why product line profits differ using activity-based costing compared to the traditional approach. Indicate whether activity-based costing provides more accurate information and why (if you believe it does provide more accurate information). Indicate in your report how the use of labor-based overhead allocation could cause EZ-Seat management to make suboptimal decisions.

a.

Complete the income statement using preceding activity bases.

Explanation of Solution

Activity-based costing:

Activity-based costing refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

Complete the income statement using preceding activity bases:

| Particulars | Ergo | Standard | Total |

| Sales revenue | $2,925,000 | $2,760,000 | $5,685,000 |

| Direct materials | $550,000 | $500,000 | $1,050,000 |

| Direct labor | $400,000 | $200,000 | $600,000 |

| Overhead costs: | |||

|

Add: Administration | $312,000 | $156,000 | $468,000 |

|

Add: Production setup | $360,000 | $720,000 | $1,080,000 |

|

Add: Quality control | $360,000 | $360,000 | $720,000 |

|

Add: Distribution | $288,000 | $1,152,000 | $1,440,000 |

| Total overhead costs | $1,320,000 | $2,388,000 | $3,708,000 |

|

Operating profit | $655,000 | ($328,000) | $327,000 |

Table: (1)

Working note 1:

Compute the percentage of direct labor applicable:

Working note 2:

Compute the rate per setup:

Working note 3:

Compute the rate per inspection:

Working note 4:

Compute the shipping cost per unit:

b.

Write a brief report indicating how management could use activity-based costing to reduce costs

Explanation of Solution

Activity-based costing:

Activity-based costing (ABC) refers to the method of costing where the overhead cost is assigned to various products. This costing method identifies the relationship between the manufacturing overhead costs and the activities. This relationship is then used to allocate indirect costs to the products.

ABC method for reducing the cost:

Reduction in the cost of activities may not be the direct result of implementing the ABC method of costing, but it can highlight the activities where the cost reduction can be made. Reducing the setup costs or other overhead costs specifically from the perspective of cost reduction can be identified using the ABC method of costing.

c.

Restate the income statement according to the information given in the question.

Explanation of Solution

Recompute the income statement according to the information given in the question:

| Particulars | Ergo | Standard | Total |

| Sales revenue | $2,925,000 | $2,760,000 | $5,685,000 |

| Direct materials | $550,000 | $500,000 | $1,050,000 |

| Direct labor | $400,000 | $200,000 | $600,000 |

|

Overhead costs | $2,472,000 | $1,236,000 | $3,708,000 |

| Operating profit | ($497,000) | $824,000 | $327,000 |

Table: (2)

Working note 5:

d.

Write a report to management stating why product line profits differ using activity-based costing compared to the traditional approach. Indicate whether activity-based costing provides more accurate information and provide a reason for the same.

Explanation of Solution

Purpose of the report:

To explain the difference between the implementation of ABC costing and traditional labor-based costing method for the computation of the product line profits.

The implication of both methods:

Direct costs do not differ in both the methods implemented. While using the labor-based method, all the overhead costs are computed under one single head, and while using ABC the bifurcation of cost drivers is relevant to their respective cost of allocation

Result using the traditional labor-based method of costing:

The result shows that the product Ergo has incurred a loss of $497,000 which is 17% percent of the sales revenue. And the product standard has attained a profit of $824,000 which is 30% of sales revenue.

Result using the ABC method of costing:

The result shows that the product Ergo has attained a profit of $655,000 which is 22% percent of the sales revenue. And the product Standard has incurred the loss of $328,000 which is 11% of sales revenue.

Conclusion:

The choice of the method adopted should be ABC costing as the results computed from the traditional labor-based method are very high as compared to ABC costing.

Want to see more full solutions like this?

Chapter 9 Solutions

FUNDAMENTALS OF COST ACCOUNTING

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardWhich is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiency no aiarrow_forwardPlease provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forward

- Please provide the correct answer to this financial accounting problem using valid calculations.arrow_forward20 Nelson and Murdock, a law firm, sells $8,000,000 of four-year, 8% bonds priced to yield 6.6%. The bonds are dated January 1, 2026, but due to some regulatory hurdles are not issued until March 1, 2026. Interest is payable on January 1 and July 1 each year. The bonds sell for $8,388,175 plus accrued interest. In mid-June, Nelson and Murdock earns an unusually large fee of $11,000,000 for one of its cases. They use part of the proceeds to buy back the bonds in the open market on July 1, 2026 after the interest payment has been made. Nelson and Murdock pays a total of $8,456,234 to reacquire the bonds and retires them. Required1. The issuance of the bonds—assume that Nelson and Murdock has adopted a policy of crediting interest expense for the accrued interest on the date of sale.2. Payment of interest and related amortization on July 1, 2026.3. Reacquisition and retirement of the bonds.arrow_forward13 Which of the following is correct about the difference between basic earnings per share (EPS) and diluted earnings per share? Question 13 options: Basic EPS uses comprehensive income in its calculation, whereas diluted EPS does not. Basic EPS is not a required disclosure, whereas diluted EPS is required disclosure. Basic EPS uses total common shares outstanding, whereas diluted EPS uses the weighted-average number of common shares. Basic EPS is not adjusted for the potential dilutive effects of complex financial structures, whereas diluted EPS is adjusted.arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,