Concept explainers

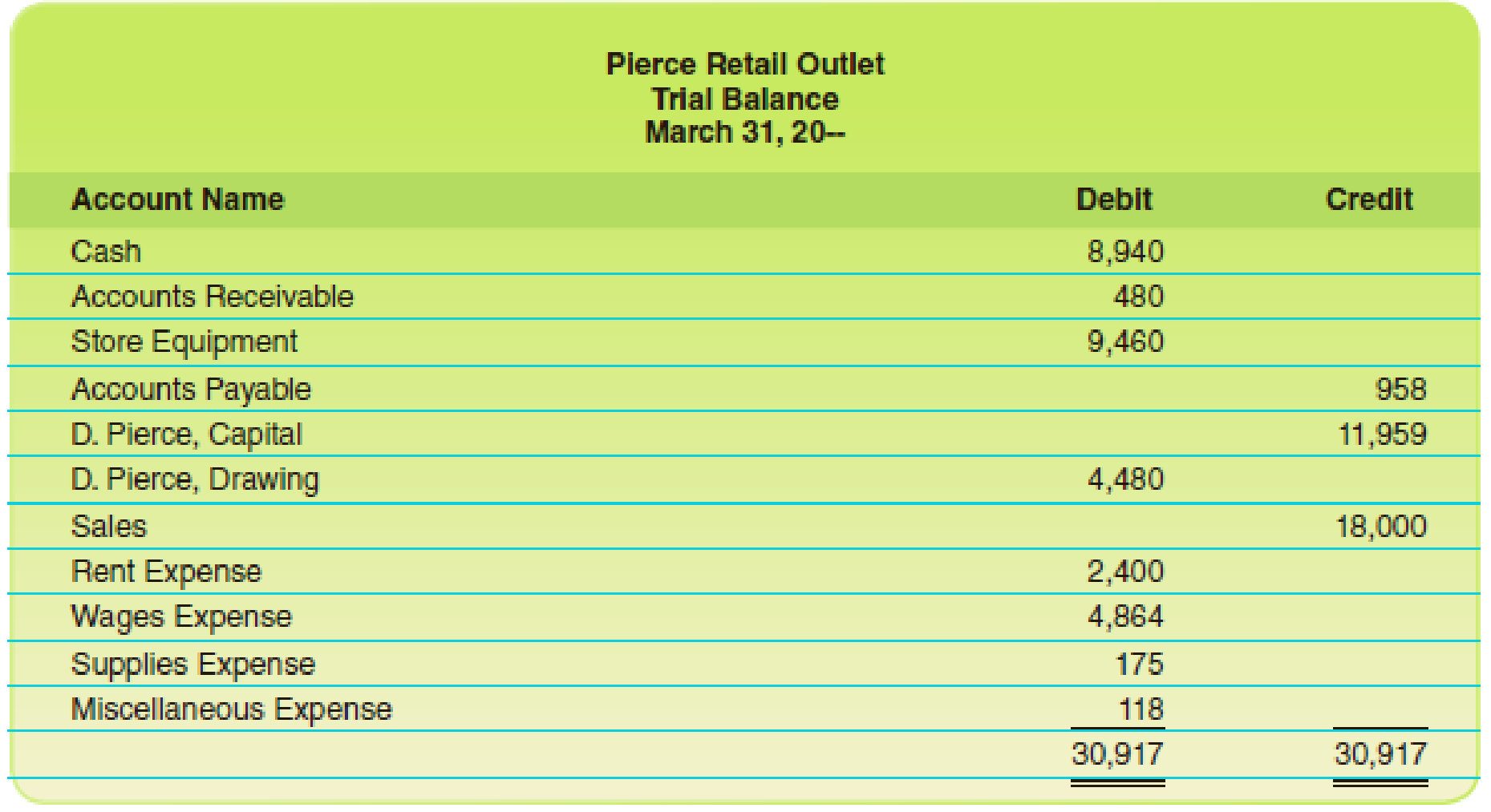

Following is a

- 1. Think about where these amounts might have been put, think about what accounts are missing, and use T accounts to solve the problems.

- 2. Prepare a corrected trial balance.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

FUNDAMENTALS OF CORPORATE FINANCE

Marketing: An Introduction (13th Edition)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Macroeconomics

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- General Accounting questionarrow_forwardHigh Return Manufacturing company has a beginning finished goods inventory of $19,600, raw material purchases of $28,000, cost of goods manufactured of $36,500, and an ending finished goods inventory of $22,800. The cost of goods sold for this company is?arrow_forwardCalculate the company's P/E ratio accounting questionarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub