College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 10E

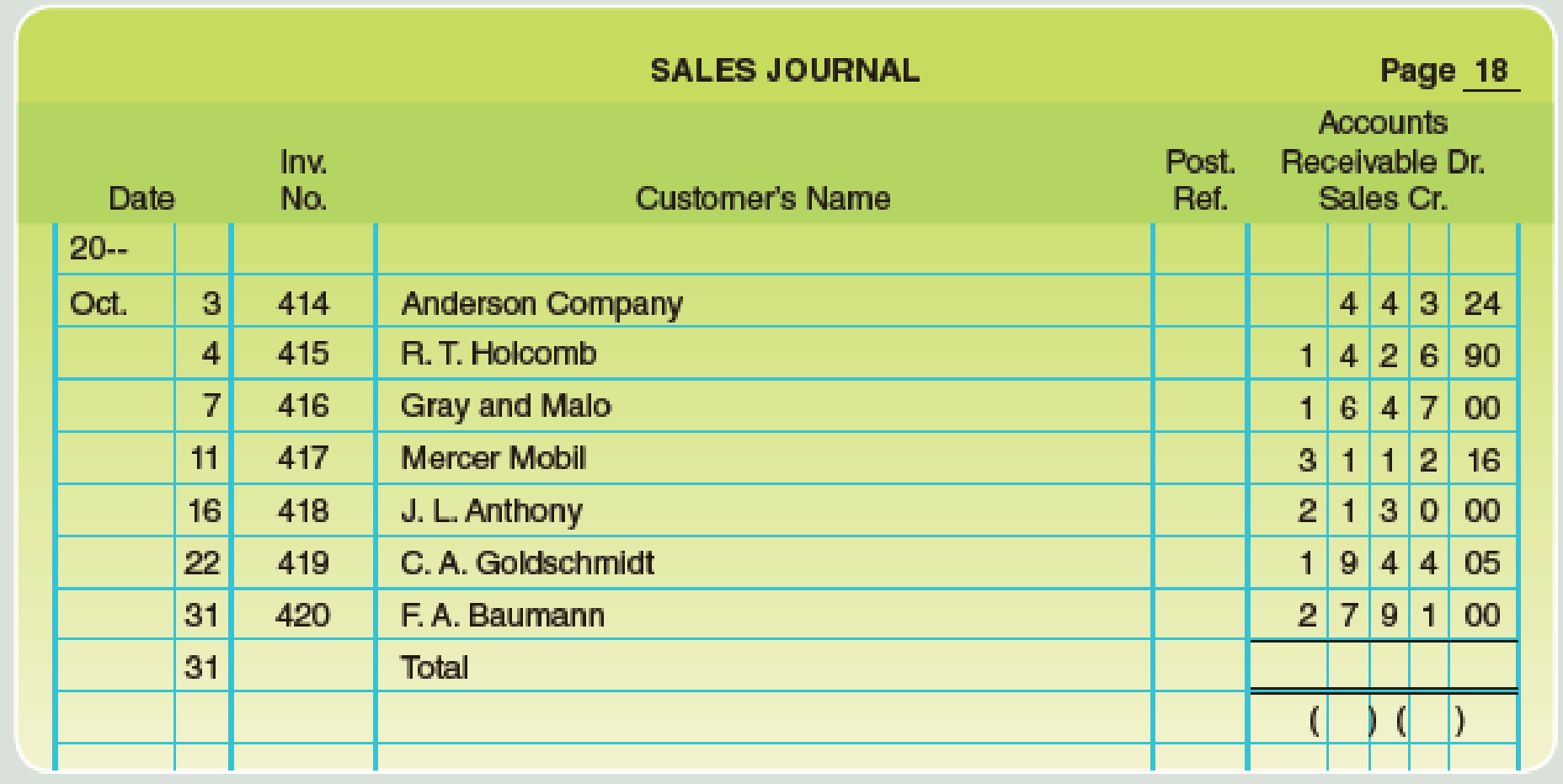

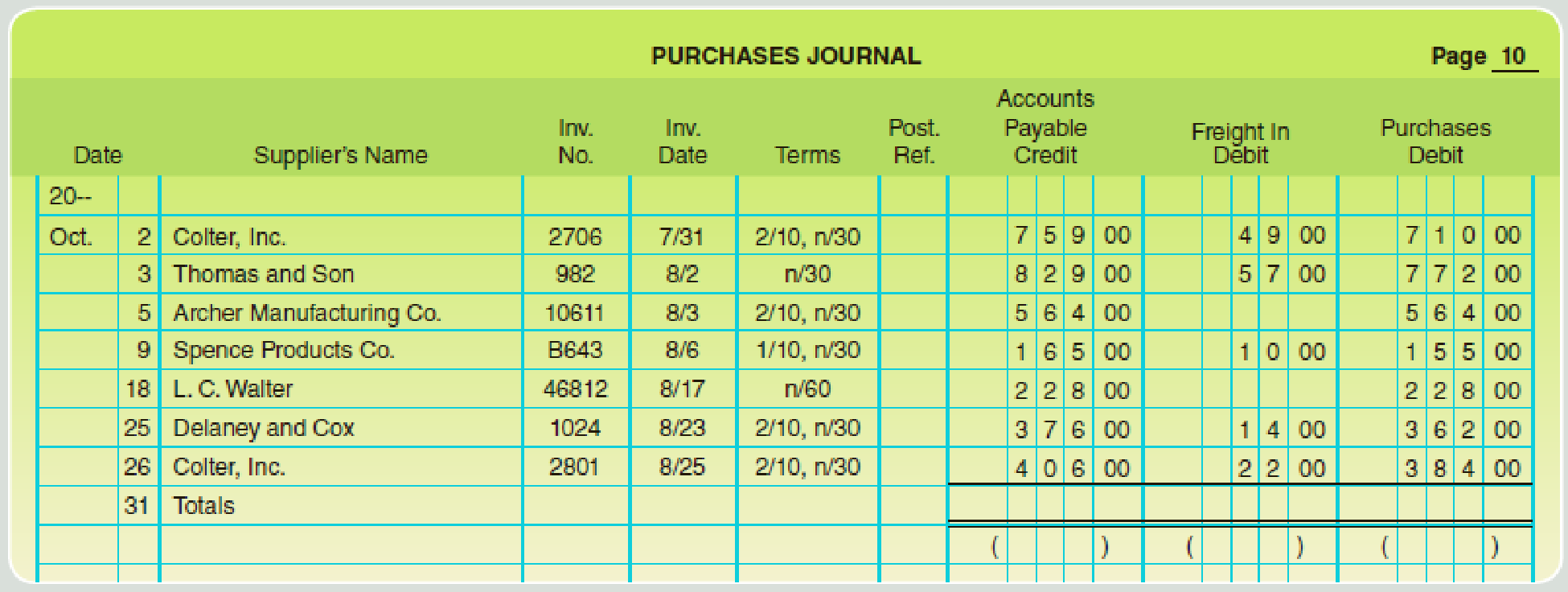

Kelley Company has completed the following October sales and purchases journals:

- a. Total and post the journals to T accounts for the general ledger and the

accounts receivable and accounts payable ledgers. - b. Complete a schedule of accounts receivable for October 31, 20--.

- c. Complete a schedule of accounts payable for October 31, 20--.

- d. Compare the balances of the schedules with their respective general ledger accounts. If they are not the same, find and correct the error(s).

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

correct answer please help me

need help this questions

Don't use ai given answer accounting questions

Chapter 9 Solutions

College Accounting (Book Only): A Career Approach

Ch. 9 - Which of the following is true about the Sales...Ch. 9 - What is the accounts receivable ledger? a. A...Ch. 9 - Using the information contained in the accounts...Ch. 9 - Prob. 4QYCh. 9 - What does the 2 in 2/10, n/30 mean? a. Pay in 2...Ch. 9 - Prob. 6QYCh. 9 - The schedule of accounts payable lists each...Ch. 9 - If the seller assumes the entire cost of...Ch. 9 - Under the perpetual inventory system, how does the...Ch. 9 - Purchases on account of merchandise for resale...

Ch. 9 - What is the difference between a wholesale...Ch. 9 - For each of the following accounts, identify...Ch. 9 - Prob. 3DQCh. 9 - Why is an accounts receivable ledger or an...Ch. 9 - Why is it a good practice to post daily to the...Ch. 9 - Prob. 6DQCh. 9 - Prob. 7DQCh. 9 - Prob. 8DQCh. 9 - Prob. 9DQCh. 9 - Prob. 10DQCh. 9 - Prob. 11DQCh. 9 - Prob. 12DQCh. 9 - Record the following transactions in general...Ch. 9 - Post the following entry to the general ledger and...Ch. 9 - Record the following transactions in general...Ch. 9 - Journalize the following transactions in general...Ch. 9 - Post the following entry to the general ledger and...Ch. 9 - Record the following transactions in general...Ch. 9 - Record the following transactions for a perpetual...Ch. 9 - Toby Company had the following sales transactions...Ch. 9 - Williams Corporation had the following purchases...Ch. 9 - Kelley Company has completed the following October...Ch. 9 - Bell Florists sells flowers on a retail basis....Ch. 9 - Berrys Pet Store records purchase transactions in...Ch. 9 - Shirleys Beauty Store records sales and purchase...Ch. 9 - The following transactions relate to Hawkins,...Ch. 9 - Gomez Company sells electrical supplies on a...Ch. 9 - Patterson Appliance uses a three-column purchases...Ch. 9 - Prob. 1PBCh. 9 - Lowerys Pet Depot records purchase transactions in...Ch. 9 - Mays Beauty Store records sales and purchase...Ch. 9 - The following transactions relate to Khan, Inc., a...Ch. 9 - Prob. 5PBCh. 9 - West Bicycle Shop uses a three-column purchases...Ch. 9 - Prob. 1ACh. 9 - You are the bookkeeper at a small merchandising...Ch. 9 - Following is a trial balance prepared just before...Ch. 9 - Sales and Purchases Ms. Valli of All About You Spa...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Describe and evaluate what Pfizer is doing with its PfizerWorks.

Management (14th Edition)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

Mary Williams, owner of Williams Products, is evaluating whether to introduce a new product line. After thinkin...

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Explain how to derive a total expenditures (TE) curve.

Macroeconomics

The flowchart for the process at the local car wash. Introduction: Flowchart: A flowchart is a visualrepresenta...

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial accountingarrow_forwardLinden Corporation uses a predetermined overhead rate of $18.75 per direct labor hour. This predetermined rate was based on a cost formula that estimated $225,000 of total manufacturing overhead for an estimated activity level of 12,000 direct labor hours. During the period, the company incurred actual total manufacturing overhead costs of $210,000 and 11,200 total direct labor hours worked. Required: Determine the amount of manufacturing overhead that would have been applied to all jobs during the period.helparrow_forwardprovide correct answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY