Fundamentals Of Cost Accounting (6th Edition)

6th Edition

ISBN: 9781259969478

Author: WILLIAM LANEN, Shannon Anderson, Michael Maher

Publisher: McGraw Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 33E

Plantwide versus Department Allocation

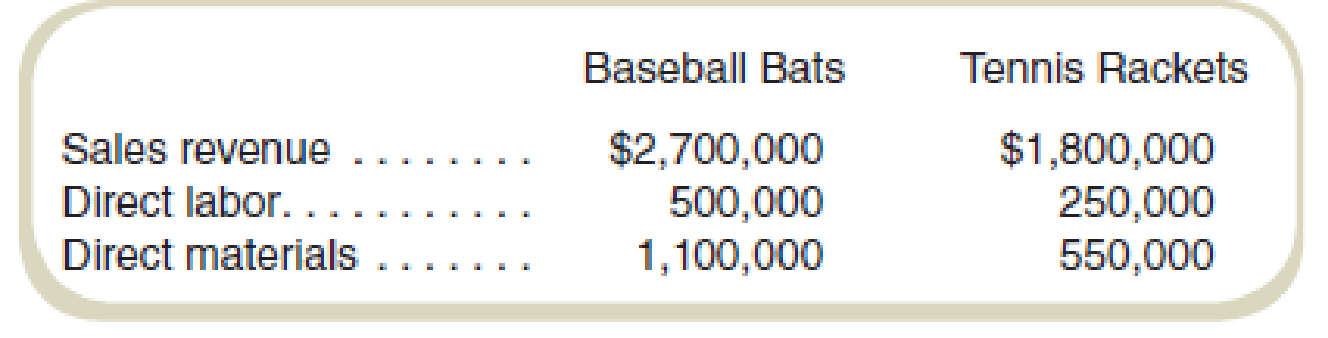

Munoz Sporting Equipment manufactures baseball bats and tennis rackets. Department B produces the baseball bats, and Department T produces the tennis rackets. Munoz currently uses plantwide allocation to allocate its

Required

- a. Compute the profit for each product using plantwide allocation.

- b. Maria, the manager of Department T, was convinced that tennis rackets were really more profitable than baseball bats. She asked her colleague in accounting to break down the overhead costs for the two departments. She discovered that had department rates been used, Department B would have had a rate of 150 percent of direct labor cost and Department T would have had a rate of 300 percent of direct labor cost. Recompute the profits for each product using each department’s allocation rate (based on direct labor cost).

- c. Why are the results different in requirements (a) and (b)?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Calculate the predetermined overhead allocation rate

Press Printing uses process costing. Department A had 3,700 units in beginning work in process (60% complete), added 8,200 units, and had 2,900 units in ending work in process (40% complete). If total processing costs were $89,000, Give the cost per equivalent unit. Need right Answer

?????

Chapter 9 Solutions

Fundamentals Of Cost Accounting (6th Edition)

Ch. 9 - Give examples of cost drivers commonly used to...Ch. 9 - What is the death spiral? How is it related to the...Ch. 9 - The product costs reported using either plantwide...Ch. 9 - Why do companies commonly use direct labor-hours...Ch. 9 - What are the costs of moving to an activity-based...Ch. 9 - What are the basic steps in computing costs using...Ch. 9 - Prob. 7RQCh. 9 - Prob. 8RQCh. 9 - What type of organization is most likely to...Ch. 9 - Prob. 10RQ

Ch. 9 - How does complexity lead to higher costs? Why is...Ch. 9 - Prob. 12RQCh. 9 - Prob. 13RQCh. 9 - Why are cost drivers based on direct labor widely...Ch. 9 - Prob. 15CADQCh. 9 - Activity-based costing could not be applied in a...Ch. 9 - Activity-based costing is the same as department...Ch. 9 - Prob. 18CADQCh. 9 - It is clear after reading this chapter that...Ch. 9 - Prob. 20CADQCh. 9 - Prob. 21CADQCh. 9 - Prob. 22CADQCh. 9 - Prob. 23CADQCh. 9 - Activity-based costing is just another inventory...Ch. 9 - Prob. 25CADQCh. 9 - Prob. 26CADQCh. 9 - Prob. 27CADQCh. 9 - One of the issues we identified with traditional...Ch. 9 - The cost accounting manager at your business says...Ch. 9 - Prob. 30CADQCh. 9 - Prob. 31ECh. 9 - Reported Costs and Decisions Kima Company...Ch. 9 - Plantwide versus Department Allocation Munoz...Ch. 9 - Plantwide versus Department Allocation Main Street...Ch. 9 - Unitwide versus Department...Ch. 9 - Prob. 36ECh. 9 - Prob. 37ECh. 9 - Upriver currently applies overhead on the basis of...Ch. 9 - Compute the unit costs for the two products, V-1...Ch. 9 - Prob. 40ECh. 9 - Prob. 41ECh. 9 - Activity-Based Costing in a Nonmanufacturing...Ch. 9 - Activity-Based versus Traditional Costing Maglie...Ch. 9 - Activity-Based Costing versus Traditional Costing...Ch. 9 - Activity-Based Costing in a Service Environment...Ch. 9 - Activity-Based versus Traditional Costing Isadores...Ch. 9 - Prob. 47ECh. 9 - Activity-Based Costing: Cost Flows through...Ch. 9 - Prob. 49ECh. 9 - Activity-Based Costing for an Administrative...Ch. 9 - Prob. 51ECh. 9 - Time-Driven Activity-Based Costing Kim...Ch. 9 - Time-Driven ABC for an Administrative Service The...Ch. 9 - Comparative Income Statements and Management...Ch. 9 - Comparative Income Statements and Management...Ch. 9 - Prob. 56PCh. 9 - Activity-Based Costing and Predetermined Overhead...Ch. 9 - Activity-Based Costing and Predetermined Overhead...Ch. 9 - Choosing an Activity-Based Costing System Pickle...Ch. 9 - Churchill Products is considering updating its...Ch. 9 - Utica Manufacturing (UM) was recently acquired by...Ch. 9 - Cain Components manufactures and distributes...Ch. 9 - Prob. 63PCh. 9 - Prob. 64PCh. 9 - Prob. 65PCh. 9 - Cawker Products has two manufacturing...Ch. 9 - MTI makes three types of lawn tractors: M3100,...Ch. 9 - Prob. 68PCh. 9 - Prob. 69PCh. 9 - Prob. 72IC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The analyst estimated of total assets general accountingarrow_forwardUsing the ACFR information for the City of Salem, indicate both financial statements that contained the information item and the dollar amount. Refer to Illustrations 2-2 through 2-16.arrow_forwardCalculate the firm's predetermined overhead ratearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY