Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 9, Problem 2PB

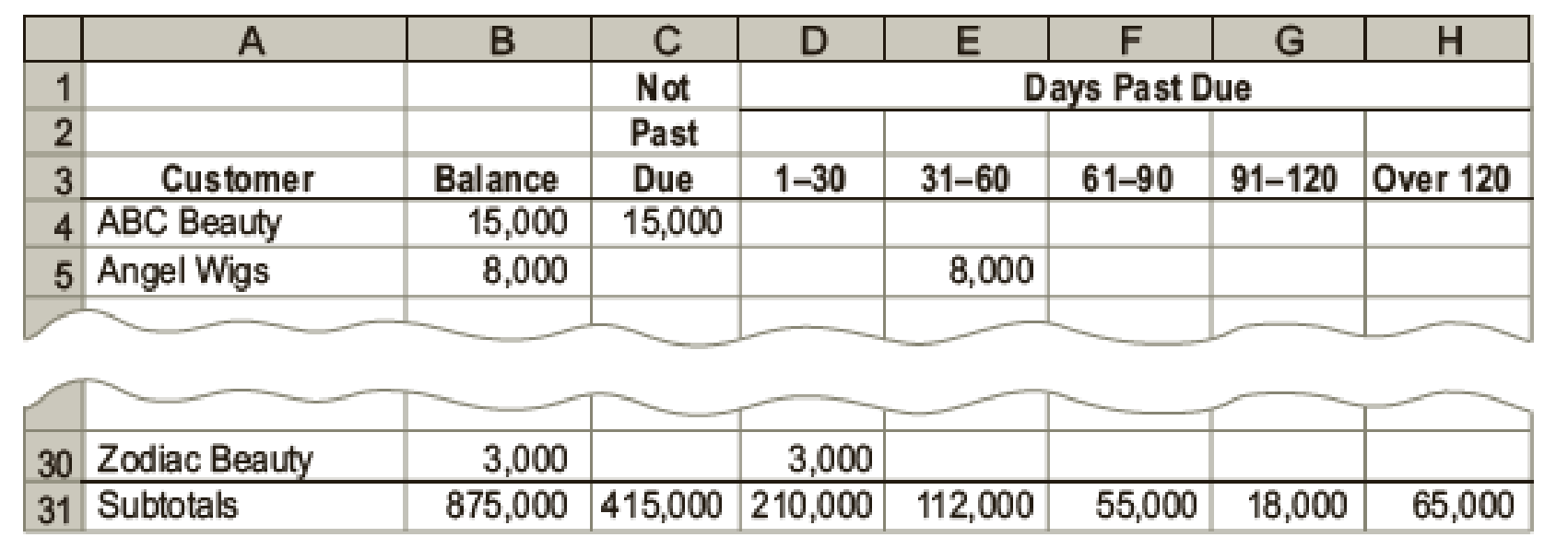

Wig Creations Company supplies wigs and hair care products to beauty salons throughout Texas and the Southwest. The

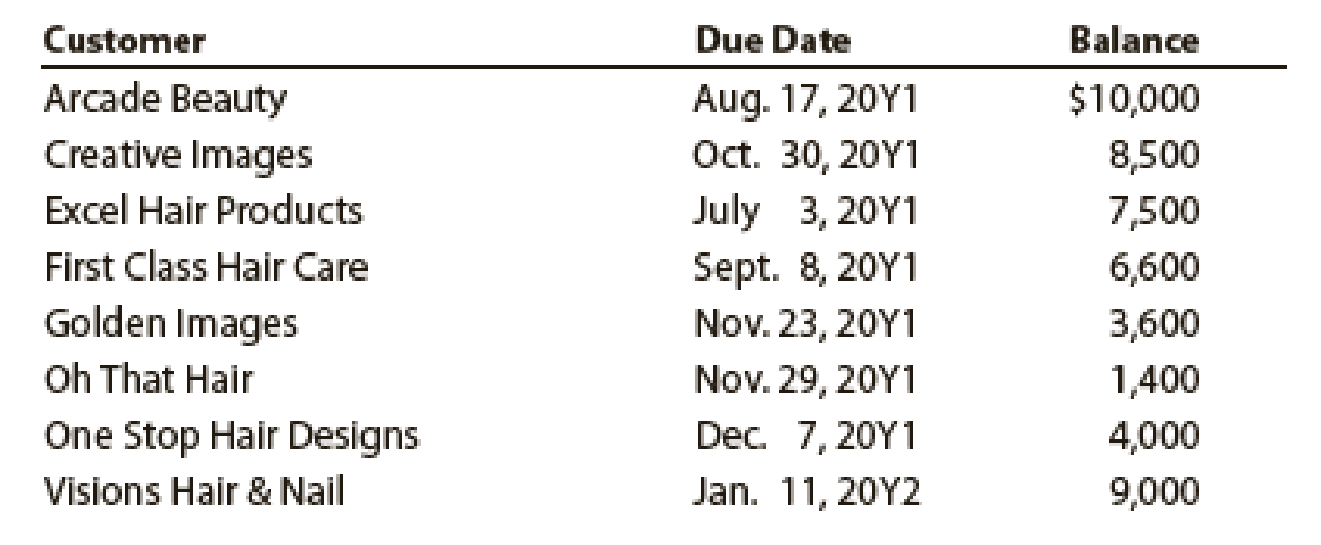

The following accounts were unintentionally omitted from the aging schedule:

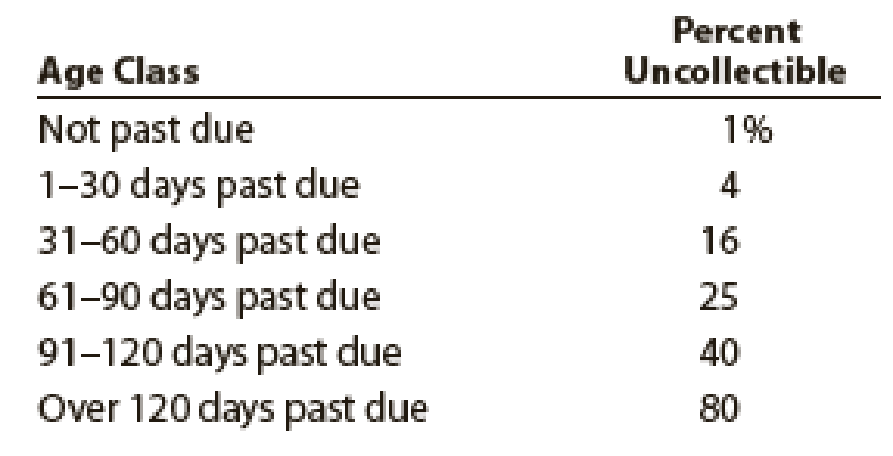

Wig Creations has a past history of uncollectible accounts by age category, as follows:

Instructions

- 1. Determine the number of days past due for each of the preceding accounts.

- 2. Complete the aging of receivables schedule by adding the omitted accounts to the bottom of the schedule and updating the totals.

- 3. Estimate the allowance for doubtful accounts, based on the aging of receivables schedule.

- 4. Assume that the allowance for doubtful accounts for Wig Creations has a credit balance of $7,375 before adjustment on December 31, 20Y1. Journalize the adjustment for uncollectible accounts.

- 5. Assuming that the

adjusting entry in (4) was inadvertently omitted, how would the omission affect thebalance sheet and income statement?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Earnings management is

Select one:a. the process of profit maximization.b. the process of managing a business.c. manipulating income to meet a targeted earnings level.d. always fraudulent.

General Accounting Question please solve this one

Please given correct option general accounting

Chapter 9 Solutions

Financial Accounting

Ch. 9 - What are the three classifications of receivables?Ch. 9 - Dans Hardware is a small hardware store in the...Ch. 9 - What kind of an account (asset, liability, etc.)...Ch. 9 - After the accounts are adjusted and closed at the...Ch. 9 - A firm has consistently adjusted its allowance...Ch. 9 - Which of the two methods of estimating...Ch. 9 - Neptune Company issued a note receivable to...Ch. 9 - If a note provides for payment of principal of...Ch. 9 - The maker of a 240,000, 6%, 90-day note receivable...Ch. 9 - The note receivable dishonored in Discussion...

Ch. 9 - Journalize the following transactions, using the...Ch. 9 - Journalize the following transactions, using the...Ch. 9 - Journalize the following transactions, using the...Ch. 9 - Journalize the following transactions, using the...Ch. 9 - At the end of the current year, Accounts...Ch. 9 - At the end of the current year, Accounts...Ch. 9 - At the end of the current year, Accounts...Ch. 9 - At the end of the current year, Accounts...Ch. 9 - Lundquist Company received a 60-day, 9% note for...Ch. 9 - Prefix Supply Company received a 120-day, 8% note...Ch. 9 - Financial statement data for years ending December...Ch. 9 - Financial statement data for years ending December...Ch. 9 - Prob. 1ECh. 9 - MGM Resorts International owns and operates hotels...Ch. 9 - Journalize the following transactions in the...Ch. 9 - Journalize the following transactions in the...Ch. 9 - Quantum Solutions Company, a computer consulting...Ch. 9 - At the end of the current year, the accounts...Ch. 9 - Toot Auto Supply distributes new and used...Ch. 9 - The accounts receivable clerk for Kirchhoff...Ch. 9 - Kirchhoff Industries has a past history of...Ch. 9 - Using data in Exercise 9-9, assume that the...Ch. 9 - Performance Bike Co. is a wholesaler of motorcycle...Ch. 9 - Using the data in Exercise 9-11, assume that the...Ch. 9 - The following selected transactions were taken...Ch. 9 - The following selected transactions were taken...Ch. 9 - Prob. 15ECh. 9 - Using the data in Exercise 9-15, assume that...Ch. 9 - Casebolt Company wrote off the following accounts...Ch. 9 - Seaforth International wrote off the following...Ch. 9 - Determine the due date and the amount of interest...Ch. 9 - Spring Designs Decorators issued a 120-day, 4%...Ch. 9 - The series of five transactions recorded in the...Ch. 9 - The following selected transactions were completed...Ch. 9 - Journalize the following transactions of Trapper...Ch. 9 - Journalize the following transactions in the...Ch. 9 - List any errors you can find in the following...Ch. 9 - Ralph Lauren Corporation designs, markets, and...Ch. 9 - The Campbell Soup Company manufactures and markets...Ch. 9 - Prob. 28ECh. 9 - Prob. 29ECh. 9 - The following transactions were completed by Daws...Ch. 9 - Trophy Fish Company supplies flies and fishing...Ch. 9 - Call Systems Company, a telephone service and...Ch. 9 - Flush Mate Co. wholesales bathroom fixtures....Ch. 9 - The following data relate to notes receivable and...Ch. 9 - Prob. 6PACh. 9 - The following transactions were completed by The...Ch. 9 - Wig Creations Company supplies wigs and hair care...Ch. 9 - Prob. 3PBCh. 9 - Gen-X Ads Co. produces advertising videos. During...Ch. 9 - The following data relate to notes receivable and...Ch. 9 - Prob. 6PBCh. 9 - Bud Lighting Co. is a retailer of commercial and...Ch. 9 - Prob. 2CPCh. 9 - Prob. 4CPCh. 9 - For several years, Xtreme Co.s sales have been on...Ch. 9 - Best Buy is a specialty retailer of consumer...Ch. 9 - Apple Inc. designs, manufactures, and markets...Ch. 9 - Prob. 8CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kingsman Inc. is developing a new process that it plans to sell. During 2019 and 2020, the company capitalized $1.1 million and $0.2 million respectively. An additional $0.3 million was spent in 2021. During 2021, it became apparent that, due to a lack of financial resources, the company would not be able to complete the project. The total amount of capitalized costs relating to this project at the end of 2021 is Select one: a. $1.6 million b. $1.0 million c. nil d. $1.3 millionarrow_forward16 At year end, other comprehensive income is closed out to Select one: a.share capital. b.retained earnings. c.net income. d.accumulated other comprehensive income.arrow_forwardGeneral accountingarrow_forward

- Xyz company has annual sales solution this general accounting questionarrow_forwardOn August 1, 2020, Peppa Inc. acquired $120,000 (face value) 10% bonds of George Corporation at 102 plus accrued interest. The bonds were dated May 1, 2020, and mature on April 30, 2023, with interest payable each October 31 and April 30. The bonds will be held to maturity. Assuming the amortized cost model is used, the entry to record the purchase of the bonds on August 1, 2020 is Select one: a.Bond Investment at Amortized Cost 125,400 Cash 125,400 b.Bond Investment at Amortized Cost 122,400Interest Income 3,000 Cash 125,400 c.Bond Investment at Amortized Cost 125,400Interest Income…arrow_forwardWhen describing “Materiality” the concept refers to Select one: a. the tangible nature of an item. b. representational faithfulness. c. the decision-making relevance of a piece of information. d. None of these describe materiality.arrow_forward

- Given answer accounting questionsarrow_forward5 From the options listed below, which of the following does NOT describe a cause of management bias? Select one: a. the desire for all stakeholders to have access to all information b. the tendency to downplay negative events c. the desire to meet financial analysts’ expectations d. the need to comply with contracts, such as debt covenantsarrow_forward3 Management’s primary responsibility with respect to financial statements is to Select one: a.prepare them, as they have the best insight and know what should be included. b.audit them, as they are distant enough from daily operations. c. rely on them to make decisions d. None of the above are true.arrow_forward

- Purchased goodwill should be Select one: a. expensed as soon as possible against retained earnings. b. amortized over the period benefited, but not more than 40 years. c. expensed as soon as possible to other comprehensive income. d. not expensed or amortized, but rather reduced only if impairment occurs.arrow_forwardHi expert provide correct option general accountingarrow_forwardThe sumit electric store bought solved this accounting questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Accounts Receivable and Accounts Payable; Author: The Finance Storyteller;https://www.youtube.com/watch?v=x_aUWbQa878;License: Standard Youtube License