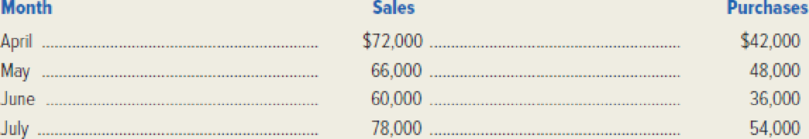

The following information is from Tejas WindowTint’s financial records.

Collections from customers are normally 70 percent in the month of sale, 20 percent in the month following the sale, and 9 percent in the second month following the sale. The balance is expected to be uncollectible. All purchases are on account. Management takes full advantage of the 2 percent discount allowed on purchases paid for by the tenth of the following month. Purchases for August are budgeted at $60,000, and sales for August are

Required: Prepare the following schedules.

- 1. Expected cash collections during August.

- 2. Expected cash disbursements during August.

- 3. Expected cash balance on August 31.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Additional Business Textbook Solutions

Financial Accounting, Student Value Edition (5th Edition)

Management (14th Edition)

Marketing: An Introduction (13th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Intermediate Accounting (2nd Edition)

Principles of Economics (MindTap Course List)

- Radium Tech Inc. has net sales of $320,000, cost of goods sold of $210,000, selling expenses of $15,000, and non-operating expenses of $6,000. What is the company's gross profit? Answerarrow_forwardWhat is the amount of cost of goods sold?arrow_forwardAlpha Corporation applies overhead costs to jobs on the basis of direct labor costs. Job O, which was started and completed during the current period, shows charges of $6,850 for direct materials, $10,300 for direct labor, and $6,710 for overhead on its job cost sheet. Job O, which is still in process at year-end, shows charges of $3,500 for direct materials and $5,800 for direct labor. a. Should any overhead cost be applied to Job O at year-end? b. How much overhead cost should be applied to Job O?arrow_forward

- Cullumber & Co. sold goods with a market price of $195,000 on April 1. They accepted a note from Marin Inc. for $195,000 due in two rears, with interest paid each year on April 1, bearing 8% interest. If 8% interest approximates the market rate of interest for this transaction, how much interest should be accrued at the company's December 31 year-end? $31,200 $7,800 $15,600 $11,700arrow_forwardPlease Need answer the financial accounting question not use ai please don'tarrow_forwardCompute the gross earnings for this financial accounting questionarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning