Concept explainers

Coyote Loco, Inc., a distributor of salsa, has the following historical collection pattern for its credit sales.

70 percent collected in the month of sale.

15 percent collected in the first month after sale.

10 percent collected in the second month after sale.

4 percent collected in the third month after sale.

1 percent uncollectible.

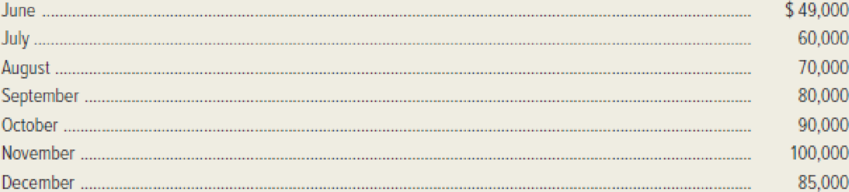

The sales on account have been budgeted for the last seven months as follows:

Required:

- 1. Compute the estimated total cash collections during October from credit sales.

- 2. Compute the estimated total cash collections during the fourth quarter from sales made on account during the fourth quarter.

- 3. Build a spreadsheet: Construct an Excel spreadsheet to solve both of the preceding requirements. Show how the solution will change if the following information changes: sales in June and July were $50,000 and $65,000, respectively.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

Additional Business Textbook Solutions

Foundations of Financial Management

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Fundamentals of Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

- Sunny Industries reports its accounts receivable on the balance sheet. The gross receivable balance is $42,000, and the allowance for uncollectible accounts is estimated at 15% of gross receivables. At what amount will accounts receivable be reported on the balance sheet?arrow_forwardWhat is the return on equity on these financial accounting question?arrow_forwardNet operating income to increase?arrow_forward

- UI Enterprises purchased a depreciable asset on October 1, Year 1 at a cost of $162,000. The asset is expected to have a salvage value of $18,000 at the end of its five-year useful life. If the asset is depreciated on the double-declining-balance method, what will the asset's book value be on December 31, Year 2?arrow_forwardAbcarrow_forwardDetermine the depreciation for the montharrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning