Concept explainers

Project Evaluation. Aria Acoustics, Inc. (AAI), projects unit sales for a new seven-octave voice emulation implant as follows:

| Year | Unit Sales |

| 1 | 67,500 |

| 2 | 83,900 |

| 3 | 98,700 |

| 4 | 86,000 |

| 5 | 72,000 |

Production of the implants will require $1,500,000 in net working capital to start and additional net working capital investments each year equal to 15 percent of the projected sales increase for the following year. Total fixed costs are $1,950,000 per year, variable production costs are $230 per unit, and the units are priced at $355 each. The equipment needed to begin production has an installed cost of $18,500,000. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus qualifies as seven-year MACRS property. In five years, this equipment can be sold for about 20 percent of its acquisition cost. AAI is in the 35 percent marginal tax bracket and has a required return on all its projects of 15 percent. Based on these preliminary project estimates, what is the

To find: The net present value and the internal rate of return.

Introduction:

The variation between the present value of the cash outflows and the present value of the cash inflows is known as net present value. In capital budgeting, the net present value is utilized to analyze the profitability of a project or investment. The rate of return which equates the initial investment and the present value of net cash inflows are referred to as internal rate of return. This is also called as actual rate of return.

Answer to Problem 25QP

The net present value is $3,643,713.77 and the internal rate of return is 21.47%.

Explanation of Solution

Given information:

Company A projects the unit sale for the new 7-octave voice emulation implant as follows:

- The year 1 unit sales is 67,500.

- The year 2 unit sales is 83,900.

- The year 3 unit sales is 98,700.

- The year 4 unit sales is 86,000.

- The year 5 unit sales is 72,000.

The production implant needs $1,500,000 in the net working capital to begin their production activities. The extra net working capital investment for every year is equivalent to the 15% of the projected sales, which has to rise for the following year. The total fixed cost is $1,950,000 for a year, the unit price is $230, and the variable production cost is $355. The installation cost of the equipment is $18,500,000.

The equipment is qualified in the 7-Year MACRS depreciation under the property class. In 5 years, the equipment sale can be sold for 20% of its acquisition cost. The marginal tax bracket is 35% and has the required rate of return of 15%.

MACRS depreciation table for year 7:

| MACRS Depreciation table for seven year | |

| Year | Seven year |

| 1 | 14.29% |

| 2 | 24.49% |

| 3 | 17.49% |

| 4 | 12.49% |

| 5 | 8.93% |

| 6 | 8.92% |

| 7 | 8.93% |

| 8 | 4.46% |

Computation of the cash outflow:

Calculations:

The sales figure for every year along with the unit price is given. The variable cost for a unit is utilized to compute the total variable cost and the fixed cost are stated as $1,950,000 for a year.

The depreciation is calculated by using the initial cost of the equipment, which is $18,500,000 times the actual MACRS depreciation for every year. At the bottom of the of the income statement, the depreciation is added back to determine the operating cash flow for every year.

Table showing the cash inflows:

| Year | 1 | 2 | 3 | 4 | 5 |

| Ending book value | $15,856,350 | $11,325,700 | $8,090,050 | $5,779,400 | $4,127,350 |

| Sales | $23,962,500 | $29,784,500 | $35,038,500 | $30,530,000 | $25,560,000 |

| Less: Variable costs | 15,525,000 | 19,297,000 | 22,701,000 | 19,780,000 | 16,560,000 |

| Fixed costs | 1,950,000 | 1,950,000 | 1,950,000 | 1,950,000 | 1,950,000 |

| Depreciation | 2,643,650 | 4,530,650 | 3,235,650 | 2,310,650 | 1,652,050 |

| EBIT | 3,843,850 | 4,006,850 | 7,151,850 | 6,489,350 | 5,397,950 |

| Less: Taxes | 1,345,348 | 1,402,398 | 2,503,148 | 2,271,273 | 1,889,283 |

| Net income | 2,498,503 | 2,604,453 | 4,648,703 | 4,218,078 | 3,508,668 |

| Add: Depreciation | 2,643,650 | 4,530,650 | 3,235,650 | 2,310,650 | 1,652,050 |

| Operating cash flow | $5,142,153 | $7,135,103 | $7,884,353 | $6,528,728 | $5,160,718 |

| Net cash inflows: | |||||

| Operating cash flow | $5,142,153 | $7,135,103 | $7,884,353 | $6,528,728 | $5,160,718 |

| Change in net working capital | –873,300 | –788,100 | 676,275 | 745,500 | 1,739,625 |

| Capital spending | 3,849,573 | ||||

| Total cash inflows | $4,268,853 | $6,347,003 | $8,560,628 | $7,274,228 | $10,749,915 |

After the calculations of the operating cash flows for every year, it is essential to account for other cash flows. The other cash flows are the net working capital and the capital spending, that is, the after-tax salvage of the equipment.

Formula to calculate the net working capital:

Computation of the net working capital:

Note: The total net working capital in year 1 will be 15% of the sales, which may increase in year 1 or year 2. The net working capital cash flow is negative because of the increasing sales; thus the company will spend more money on the net working capital to maximize it. In year 3, the net working capital is positive because of the decline in sales. In year 5, the net working capital is the recovery of all the net working capital of the project.

Computation of the ending book value:

Formula to calculate the after-tax salvage value:

Computation of the after-tax salvage value:

Note: The market value of the equipment is 20% of the purchase price of the equipment and it is $3,700,000.

Formula to calculate the net present value:

Computation of the net present value:

Hence, the net present value is $3,643,713.77.

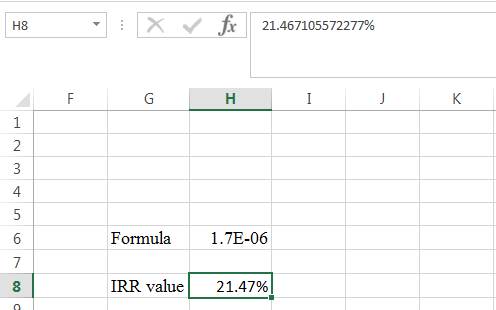

Computation of the internal rate of return:

The internal rate of return is calculated by the spreadsheet method.

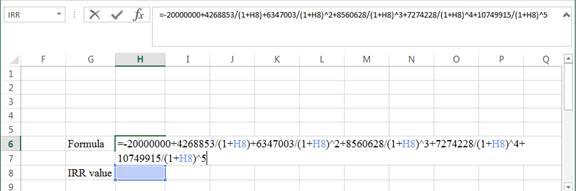

Step 1:

- Type the formula of the internal rate of return in H6 in the spreadsheet and consider the IRR value as H8.

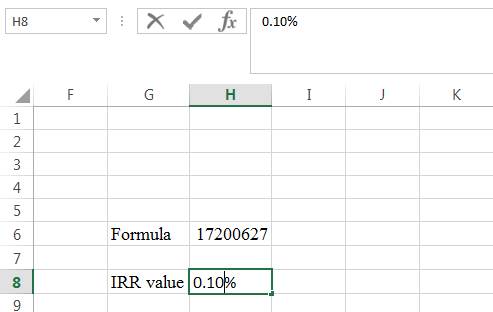

Step 2:

- Assume the IRR value as 0.10%.

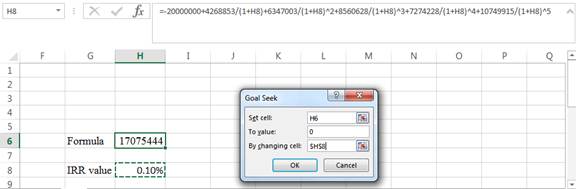

Step 3:

- In the spreadsheet, go to data and select What-if analysis.

- In What-if analysis, select Goal Seek.

- In ‘Set cell’ select H6 (the formula).

- The ‘To value’ is considered as 0.

- The H8 cell is selected for ‘By changing cell’.

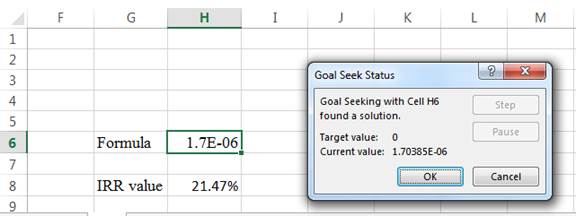

Step 4:

- Following the previous step, click OK in the Goal Seek Status. The Goal Seek Status appears.

Step 5:

- The IRR value appears to be 21.467105572277%.

Hence, the internal rate of return is 21.47%.

Want to see more full solutions like this?

Chapter 9 Solutions

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

- Scenario three: If a portfolio has a positive investment in every asset, can the expected return on a portfolio be greater than that of every asset in the portfolio? Can it be less than that of every asset in the portfolio? If you answer yes to one of both of these questions, explain and give an example for your answer(s). Please Provide a Referencearrow_forwardHello expert Give the answer please general accountingarrow_forwardScenario 2: The homepage for Coca-Cola Company can be found at coca-cola.com Links to an external site.. Locate the most recent annual report, which contains a balance sheet for the company. What is the book value of equity for Coca-Cola? The market value of a company is (# of shares of stock outstanding multiplied by the price per share). This information can be found at www.finance.yahoo.com Links to an external site., using the ticker symbol for Coca-Cola (KO). What is the market value of equity? Which number is more relevant to shareholders – the book value of equity or the market value of equity?arrow_forward

- FILE HOME INSERT Calibri Paste Clipboard BIU Font A1 1 2 34 сл 5 6 Calculating interest rates - Excel PAGE LAYOUT FORMULAS DATA 11 Α΄ Α΄ % × fx A B C 4 17 REVIEW VIEW Alignment Number Conditional Format as Cell Cells Formatting Table Styles▾ Styles D E F G H Solve for the unknown interest rate in each of the following: Complete the following analysis. Do not hard code values in your calculations. All answers should be positive. 7 8 Present value Years Interest rate 9 10 11 SA SASA A $ 181 4 $ 335 18 $ 48,000 19 $ 40,353 25 12 13 14 15 16 $ SA SA SA A $ Future value 297 1,080 $ 185,382 $ 531,618arrow_forwardB B Canning Machine 2 Monster Beverage is considering purchasing a new canning machine. This machine costs $3,500,000 up front. Required return = 12.0% Year Cash Flow 0 $-3,500,000 1 $1,000,000 2 $1,200,000 3 $1,300,000 4 $900,000 What is the value of Year 3 cash flow discounted to the present? 5 $1,000,000 Enter a response then click Submit below $ 0 Submitarrow_forwardFinances Income Statement Balance Sheet Finances Income Statement Balance Sheet Materia Income Statement Balance Sheet FY23 FY24 FY23 FY24 FY23 FY24 Sales Cost of Goods Sold 11,306,000,000 5,088,000,000 13,206,000,000 Current Current Assets 5,943,000,000 Other Expenses 4,523,000,000 5,283,000,000 Cash 211,000,000 328,600,000 Liabilities Accounts Payable 621,000,000 532,000,000 Depreciation 905,000,000 1,058,000,000 Accounts 502,000,000 619,600,000 Notes Payable 376,000,000 440,000,000 Earnings Before Int. & Tax 790,000,000 922,000,000 Receivable Interest Expense 453,000,000 530,000,000 Total Current Inventory 41,000,000 99,800,000 997,000,000 972,000,000 Taxable Income 337,000,000 392,000,000 Liabilities Taxes (25%) 84,250,000 98,000,000 Total Current 754,000,000 1,048,000,000 Long-Term Debt 16,529,000,000 17,383,500,000 Net Income Dividends 252,750,000 294,000,000 Assets 0 0 Fixed Assets Add. to Retained Earnings 252,750,000 294,000,000 Net Plant & 20,038,000,000 21,722,000,000…arrow_forward

- Do you know what are Keith Gill's previous projects?arrow_forwardExplain why long-term bonds are subject to greater interest rate risk than short-term bonds with references or practical examples.arrow_forwardWhat does it mean when a bond is referred to as a convertible bond? Would a convertible bond be more or less attractive to a bond holder than a non-convertible bond? Explain in detail with examples or academic references.arrow_forward

- Alfa international paid $2.00 annual dividend on common stock and promises that the dividend will grow by 4% per year, if the stock’s market price for today is $20, what is required rate of return?arrow_forwardgive answer general accounting.arrow_forwardGive me answers in general financearrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College