Engineering Economy (17th Edition)

17th Edition

ISBN: 9780134870069

Author: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 13P

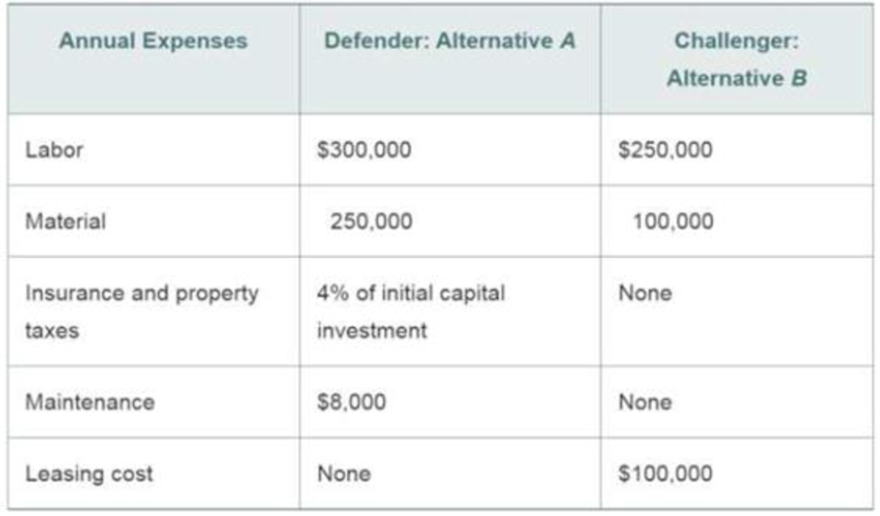

Use the PW method to select the better of the following alternatives:

Assume that the defender was installed five years ago. The MARR is 10% per year.

Definition of alternatives:

A: Retain an already owned machine (defender) in service for eight more years.

B: Sell the defender and lease a new one (challenger) for eight years.

Alternative A (additional information):

Cost of defender five years ago = $500,000

BV now = $111,550

Estimated MV eight years from now = $50,000

Present MV = $150,000

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What happens to consumer surplus and producer surplus when the sale of a good is taxed?

Economics Grade

3

CONDUCT RESEARCH ON (the various) MARKET STRUCTURES

Research Project/May

Explain the concept market structure and explain why there are perfect and

imperfect market structures.

(5)

• Provide reasons as to why the taxi industry is regarded as operating in a

monopolistic competitive structure.

(10)

• How do monopolies impact consumers and the economy.

(10)

• Use graph(s) to explain the long run equilibrium price and output in a

perfect market.

(10)

• Evaluate the effectiveness of South Africa's competition policy in curbing

anticompetitive tendencies in the market. Make use of practical examples.

(10)

GRAND TOTAL:50

Please turn

Copyright

UGD KCQ 2: Microeconomic Essentials (page 11 of 20) - Google Chrome

mancosaconnect.ac.za/mod/quiz/attempt.php?attempt=1958913&cmid=436375&page=10

MANCOSA

Microeconomic Essentials Jan25 Y1 S1

Back

Refer to the diagram below to answer the question that follows:

Price

PH

P1

D₁

ㅁ

X

Quiz navigation

3 4 5 6

Time left 0:58:34

1

2

Question 11

7 8

Not yet answered

Marked out of 1.00

13

33

14

S₁

Flag question

Q Q1

Quantity

Which of the following may result in a shift of the supply curve from S to S1?

OA. An increase in price of the good.

B. An increase in wages.

O C. A decrease in price of the good.

O D. An improvement in the technique of production.

https://mancosaconnect.ac.za/mod/quiz/attempt.php?attempt=1958913&cmid=436375&page=10#question-2064270-11

19 20

6

10

10

11 12

15 Question 11- Not yet answered

Finish attempt...

7:31 PM

Chapter 9 Solutions

Engineering Economy (17th Edition)

Ch. 9 - Prob. 1PCh. 9 - Prob. 2PCh. 9 - Prob. 3PCh. 9 - Prob. 4PCh. 9 - Prob. 5PCh. 9 - Prob. 6PCh. 9 - Prob. 7PCh. 9 - A city water and waste-water department has a...Ch. 9 - Prob. 9PCh. 9 - Prob. 10P

Ch. 9 - Prob. 11PCh. 9 - Prob. 12PCh. 9 - Use the PW method to select the better of the...Ch. 9 - Prob. 14PCh. 9 - Prob. 15PCh. 9 - Prob. 16PCh. 9 - Prob. 17PCh. 9 - Prob. 18PCh. 9 - Prob. 19PCh. 9 - Prob. 20PCh. 9 - Prob. 21PCh. 9 - Prob. 22PCh. 9 - Prob. 23PCh. 9 - Prob. 24PCh. 9 - Prob. 25PCh. 9 - Prob. 26PCh. 9 - Prob. 27SECh. 9 - Prob. 28SECh. 9 - Prob. 29CSCh. 9 - Prob. 30CSCh. 9 - Prob. 31CSCh. 9 - Prob. 32FECh. 9 - Prob. 33FECh. 9 - Prob. 34FECh. 9 - Prob. 35FECh. 9 - Prob. 36FE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Euros per U.S. Doler Consider the model below, showing the supply and demand curves for the exchange market of U.S. Dollars and Euros. If the inflation rate in the U.S. increases (and in the European Union stays the same), how will that change the original equilibrium shown in the graph? 1.10- 1.00- 0.90 0.80- 0.70 0.60 0.50- 0.40- 0.30 0.20 E 4.7 48 49 50 51 52 53 54 55 56 Quantity of U.S. Dollars traded for Euros (trillionsday) O It will decrease the demand for Dollars and increase the supply, so the exchange rate decreases and the impact on the quantity traded is unknown. O It will decrease the demand for Dollars and increase the supply, so the exchange rate decreases, and the quantity traded increases. It will increase the demand for Dollars and decrease the supply, so the exchange rate decreases, and the quantity traded increases. It will increase the demand for Dollars and decrease the supply, so the exchange rate increases and the impact on the quantity traded is unknownarrow_forwardIf the US Federal Reserve increases interests on reserves, how will that change the original equilibrium shown in the graph? Euros par US alar 1.10 1.00 0.90- E 0.80- 0.70 0.60 0.50 0.40- 0.30 0.20 47 48 49 50 51 52 53 54 55 56 Quantity of US Dollars traded for Euros (trillions/day) It will increase the demand for Dollars and decrease the supply, so the exchange rate decreases, and the quantity traded increases. O It will decrease the demand for Dollars and increase the supply, so the exchange rate decreases and the impact on the quantity traded is unknown. O It will increase the demand for Dollars and decrease the supply, so the exchange rate increases and the impact on the quantity traded is unknown O It will decrease the demand for Dollars and increase the supply, so the exchange rate decreases, and the quantity traded increases. Question 22 5 ptsarrow_forward1. Based on the video, answer the following questions. • What are the 5 key characteristics that differentiate perfect competition from monopoly? Based on the video. • How does the number of sellers in a market influence the type of market structure? Based on the video. • In what ways does product differentiation play a role in monopolistic competition? Based on the video. • How do barriers to entry affect the level of competition in an oligopoly? Based on the video. • Why might firms in an oligopolistic market engage in non-price competition rather than price wars? Based on the video. Reference video: https://youtu.be/Qrr-IGR1kvE?si=h4q2F1JFNoCI36TVarrow_forward

- 1. Answer the following questions based on the reference video below: • What are the 5 key characteristics that differentiate perfect competition from monopoly? • How does the number of sellers in a market influence the type of market structure? • In what ways does product differentiation play a role in monopolistic competition? • How do barriers to entry affect the level of competition in an oligopoly? • Why might firms in an oligopolistic market engage in non-price competition rather than price wars? Discuss. Reference video: https://youtu.be/Qrr-IGR1kvE?si=h4q2F1JFNoCI36TVarrow_forwardExplain the importance of differential calculus within economics and business analysis. Provide three refernces with your answer. They can be from websites or a journals.arrow_forwardAnalyze the graph below, showing the Gross Federal Debt as a percentage of GDP for the United States (1939-2019). Which of the following is correct? FRED Gross Federal Debt as Percent of Gross Domestic Product Percent of GDP 120 110 100 60 50 40 90 30 1940 1950 1960 1970 Shaded areas indicate US recessions 1980 1990 2000 2010 1000 Sources: OMD, St. Louis Fed myfred/g/U In 2019, the Federal Government of the United States had an accumulated debt/GDP higher than 100%, meaning that the amount of debt accumulated over time is higher than the value of all goods and services produced in that year. The debt/GDP is always positive during this period, so the Federal Government of the United States incurred in budget deficits every year since 1939. From the mid-40s until the mid-70s, the debt/DGP was decreasing, meaning that the Federal Government of the United States was running a budget surplus every year during those three decades. During the second half of the 1970s, the Federal Government…arrow_forward

- An imaginary country estimates that their economy can be approximated by the AD/AS model below. How can this government act to move the equilibrium to potential GDP? LRAS Price Level P Y Real GDP E SRAS AD The AD/AS model shows that a contractionary fiscal policy is suitable, but the choice of increasing taxes, decreasing government expenditure or doing both simultaneously is mostly political The AD/AS model shows that increasing taxes is the best fiscal policy available. The AD/AS model shows that decreasing government expenditure is the best fiscal policy available. The AD/AS model shows that an expansionary fiscal policy capable of shifting the AD curve to the potential GDP level would decrease Real GDP but increase inflationary pressuresarrow_forwardQuestion 1 Coursology Consider the four policies bellow. Classify them as either fiscal or monetary policy: I. The United States Government promoting tax cuts for small businesses to prevent a wave of bankruptcies during the COVID-19 pandemic II. The Congress approving a higher budget for the Affordable Health Care Act (also known as Obamacare) III. The Federal Reserve increasing the required reserves for commercial banks aiming to control the rise of inflation IV. President Joe Biden approving a new round of stimulus checks for households I. fiscal, II. fiscal, III. monetary, IV. fiscal I. fiscal, II. monetary, III. monetary, IV. monetary I. monetary, II. fiscal, III. fiscal, IV. fiscal I. monetary, II. monetary, III. fiscal, IV. monetaryarrow_forwardConsider the following supply and demand schedule of wooden tables.a. Draw the corresponding graphs for supply and demand.b. Using the data, obtain the corresponding supply and demand functions. c. Find the market-clearing price and quantity. Price (Thousand s USD Supply Demand 2 96 1104 196 1906 296 2708 396 35010 496 43012 596 51014 696 59016 796 67018 896 75020…arrow_forward

- Consider a firm with the following production function Q=5000L-2L2.a. Find the maximum production level.b. How many units of labour are needed at that point. c. Obtain the function of marginal product of labour (MRL) d. Graph the production function and the MRL.arrow_forwardExercise 4A firm has the following total cost function TC=100q-5q2+0.5q3. Find the average cost function.arrow_forwardA firm has the following demand function P=200 − 2Q and the average costof AC= 100/Q + 3Q −20.a. Find the profit function. b. Estimate the marginal cost function. c. Obtain the production that maximizes the profit. d. Evaluate the average cost and the marginal cost at the maximising production level.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Difference between Renewable and Nonrenewable Resources; Author: MooMooMath and Science;https://www.youtube.com/watch?v=PLBK1ux5b7U;License: Standard Youtube License