INTERM.ACCT.:REPORTING...-CENGAGENOWV2

3rd Edition

ISBN: 9781337909358

Author: WAHLEN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 6RE

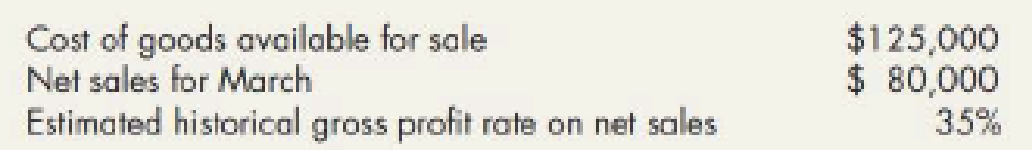

Kay’s Beauty Supply uses the gross profit method to estimate the cost of ending inventory for in-house interim financial statements. Based on the following information for March, calculate Kay’s’ ending inventory at March 31.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

For each of the transactions above, indicate the amount of the adjusting entry on the elements of the balance sheet and income statement.Note: Enter negative amounts with a minus sign.

Need help with this question solution general accounting

Don't use ai given answer accounting questions

Chapter 8 Solutions

INTERM.ACCT.:REPORTING...-CENGAGENOWV2

Ch. 8 - Under what circumstances will a company value...Ch. 8 - What is the conceptual justification for reducing...Ch. 8 - Define the terms cost, net realizable value, and...Ch. 8 - For companies that use either LIFO or the retail...Ch. 8 - What three implementation approaches may a company...Ch. 8 - Describe the two approaches to recording the...Ch. 8 - Prob. 7GICh. 8 - In applying the inventory valuation rules to...Ch. 8 - Prob. 9GICh. 8 - What are the exceptions to historical cost...

Ch. 8 - Prob. 11GICh. 8 - Prob. 12GICh. 8 - What is the basic assumption underlying the gross...Ch. 8 - Prob. 14GICh. 8 - Prob. 15GICh. 8 - Explain the meaning of the following terms:...Ch. 8 - Prob. 17GICh. 8 - Prob. 18GICh. 8 - The retail inventory method indicated an inventory...Ch. 8 - Prob. 20GICh. 8 - Indicate the effect of each of the following...Ch. 8 - Sienna Company uses the FIFO cost flow assumption....Ch. 8 - Moore Company uses the LIFO cost flow assumption...Ch. 8 - A company uses the LIFO cost flow assumption. The...Ch. 8 - Prob. 4MCCh. 8 - Hestor Companys records indicate the following...Ch. 8 - Under the retail inventory method, freight-in...Ch. 8 - The retail inventory method would include which of...Ch. 8 - At December 31, 2019, the following information...Ch. 8 - Estimates of price-level changes for specific...Ch. 8 - A company forgets to record a purchase on credit...Ch. 8 - Brown Company has the following information...Ch. 8 - Black Corporation uses the LIFO cost flow...Ch. 8 - Blue Corporation uses the FIFO cost flow...Ch. 8 - Paul Corporation uses FIFO and reports the...Ch. 8 - Using the information provided in RE8-4, prepare...Ch. 8 - Kays Beauty Supply uses the gross profit method to...Ch. 8 - Uncle Butchs Hunting Supply Shop reports the...Ch. 8 - Use the information in RE8-7. Calculate Uncle...Ch. 8 - Use the information in RE8-7. Calculate Uncle...Ch. 8 - Use the information in RE8-7. Calculate Uncle...Ch. 8 - Johnson Corporation had beginning inventory of...Ch. 8 - Borys Companys periodic inventory at December 31,...Ch. 8 - Refer to the information provided in RE8-4. If...Ch. 8 - Refer to the information provided in RE8-4. If...Ch. 8 - Inventory Write-Down Stiles Corporation uses the...Ch. 8 - Inventory Write-Down Stiles Corporation uses the...Ch. 8 - Inventory Write-Down Byron Company has five...Ch. 8 - Inventory Write-Down The following information for...Ch. 8 - Inventory Write-Down The following information is...Ch. 8 - Inventory Write-Down The inventories of Berry...Ch. 8 - Prob. 7ECh. 8 - Gross Profit Method: Estimation of Flood Loss On...Ch. 8 - Prob. 9ECh. 8 - Gross Profit Method: Estimation of Theft Loss You...Ch. 8 - Retail Inventory Method Harmes Company is a...Ch. 8 - Retail Inventory Method The following data were...Ch. 8 - Retail Inventory Method The following information...Ch. 8 - Dollar-Value LIFO Retail Johns Company adopts the...Ch. 8 - Dollar-Value LIFO Retail Wyatt Company adopts the...Ch. 8 - Dollar-Value LIFO Retail On December 31, 2018,...Ch. 8 - Errors A company that uses the periodic inventory...Ch. 8 - Errors During the course of your examination of...Ch. 8 - (Appendix 8.1) Inventory Write-Down The...Ch. 8 - Inventory Write-Down Palmquist Company has five...Ch. 8 - Inventory Write-Down The following are the...Ch. 8 - Inventory Write-Down The inventory records of...Ch. 8 - Gross Profit Method: Estimation of Fire Loss On...Ch. 8 - Gross Profit Method: Estimation of Flood Loss On...Ch. 8 - Retail Inventory Method Turner Corporation uses...Ch. 8 - Retail Inventory Method EKC Company uses the...Ch. 8 - Retail Inventory Method Red Department Store uses...Ch. 8 - Retail Inventory Method Weber Corporation uses the...Ch. 8 - Dollar-Value LIFO Retail The following information...Ch. 8 - Dollar-Value LIFO Retail Intella Inc. adopted the...Ch. 8 - Prob. 12PCh. 8 - Errors As controller of Lerner Company, which uses...Ch. 8 - Comprehensive: Inventory Adjustments Layne...Ch. 8 - (Appendix 8.1) Inventory Write-Down The following...Ch. 8 - (Appendix 8.1) Inventory Write-Down Frost Companys...Ch. 8 - Prob. 1CCh. 8 - Sandberg Paint Company, your client, manufactures...Ch. 8 - Prob. 3CCh. 8 - Inventory Valuation Issues Hanlon Company...Ch. 8 - Gross Profit Shelly Corporation is an importer and...Ch. 8 - Prob. 6CCh. 8 - Prob. 7CCh. 8 - Various Inventory Issues Hudson Company, which is...Ch. 8 - Analyzing Starbucks Inventory Disclosures Obtain...Ch. 8 - Analyzing Moet Hennessy Louis Vuittons (LVMH)...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I want to correct answer general accounting questionarrow_forwardKindly help me with accounting questionsarrow_forwardDuo Corporation is evaluating a project with the following cash flows: Year 0 1 2 3 Cash Flow -$ 30,000 12,200 14,900 16,800 4 5 13,900 -10,400 The company uses an interest rate of 8 percent on all of its projects. a. Calculate the MIRR of the project using the discounting approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. Calculate the MIRR of the project using the reinvestment approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. c. Calculate the MIRR of the project using the combination approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Discounting approach MIRR b. Reinvestment approach MIRR c. Combination approach MIRR % % %arrow_forward

- Provide correct answer general accounting questionarrow_forwardNeed help with this question solution general accountingarrow_forwardConsider a four-year project with the following information: Initial fixed asset investment = $555,000; straight-line depreciation to zero over the four-year life; zero salvage value; price = $37; variable costs = $25; fixed costs = $230,000; quantity sold = 79,000 units; tax rate = 24 percent. How sensitive is OCF to changes in quantity sold?arrow_forward

- Light emitting diodes (LED) light bulbs have become required in recent years, but do they make financial sense? Suppose a typical 60-watt incandescent light bulb costs $.39 and lasts 1,000 hours. A 15-watt LED, which provides the same light, costs $3.10 and lasts for 12,000 hours. A kilowatt-hour of electricity costs $.115. A kilowatt-hour is 1,000 watts for 1 hour. If you require a return of 11 percent and use a light fixture 500 hours per year, what is the equivalent annual cost of each light bulb? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.arrow_forwardRecently, Abercrombie & Fitch has been implementing a turnaround strategy since its sales had been falling for the past few years (11% decrease in 2014, 8% in 2015, and just 3% in 2016.) One part of Abercrombie's new strategy has been to abandon its logo-adorned merchandise, replacing it with a subtler look. Abercrombie wrote down $20.6 million of inventory, including logo-adorned merchandise, during the year ending January 30, 2016. Some of this inventory dated back to late 2013. The write-down was net of the amount it would be able to recover selling the inventory at a discount. The write-down is significant; Abercrombie's reported net income after this write-down was $35.6 million. Interestingly, Abercrombie excluded the inventory write-down from its non-GAAP income measures presented to investors; GAAP earnings were also included in the same report. Question: From an investor standpoint, do you think that the effect of the inventory write-down should be considered when…arrow_forwardFinancial accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Chapter 6 Merchandise Inventory; Author: Vicki Stewart;https://www.youtube.com/watch?v=DnrcQLD2yKU;License: Standard YouTube License, CC-BY

Accounting for Merchandising Operations Recording Purchases of Merchandise; Author: Socrat Ghadban;https://www.youtube.com/watch?v=iQp5UoYpG20;License: Standard Youtube License