Keep or Drop a Division

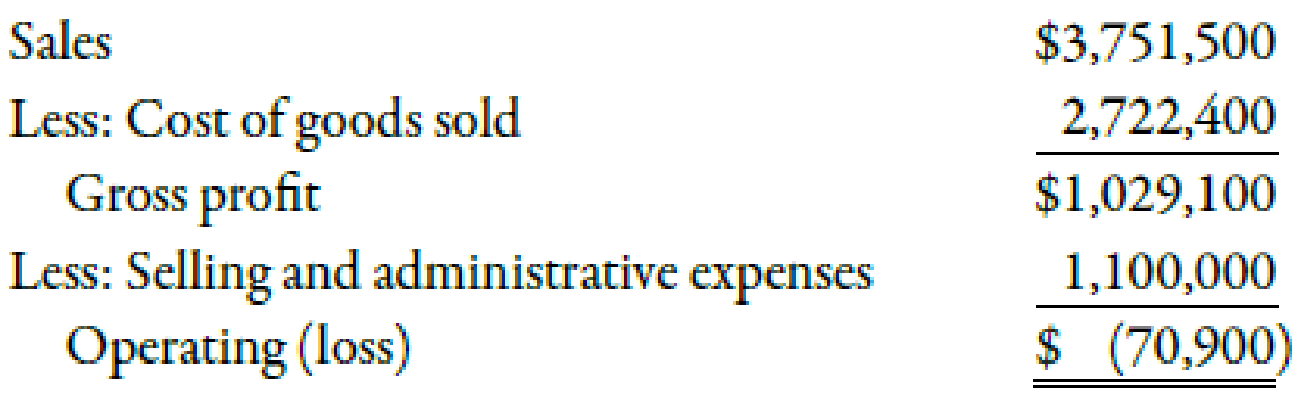

Jan Shumard, president and general manager of Danbury Company, was concerned about the future of one of the company’s largest divisions. The division’s most recent quarterly income statement follows:

Jan is giving serious consideration to shutting down the division because this is the ninth consecutive quarter that it has shown a loss. To help him in his decision, the following additional information has been gathered:

- The division produces one product at a selling price of $100 to outside parties. The division sells 50% of its output to another division within the company for $83 per unit (full

manufacturing cost plus 25%). The internal price is set by company policy. If the division is shut down, the user division will buy the part externally for $100 per unit. - The fixed

overhead assigned per unit is $20. - There is no alternative use for the facilities if shut down. The facilities and equipment will be sold and the proceeds invested to produce an annuity of $100,000 per year. Of the fixed selling and administrative expenses, 30% represent allocated expenses from corporate headquarters. Variable selling expenses are $5 per unit sold for units sold externally. These expenses are avoided for internal sales. No variable administrative expenses are incurred.

Required:

- 1. Prepare an income statement that more accurately reflects the division’s profit performance.

- 2. Should the president shut down the division? What will be the effect on the company’s profits if the division is closed?

1.

Make an income statement which shows the profit performance of the division.

Explanation of Solution

Income Statement:

The statement that shows revenue and expenses incurred over a period of time (usually one year) is called an income statement. It is used for external financial reporting as it helps the outsiders and investors in evaluating the firm’s financial health.

The following table represents the income statement of Company D:

| Company D | |

| Income Statement | |

| Amount ($) | |

| Sales revenue | 3,751,500 |

| Less: Variable expenses1 | 2,004,900 |

| Contribution margin | 1,746,600 |

| Less: Direct fixed expenses2 | 1,518,250 |

| Divisional margin | 228,350 |

| Less: Common fixed expenses3 | 299,250 |

| Operating income (loss) | (70,900) |

Table (1)

The amount of operating loss for Company D is $70,900.

Working Notes:

1.

First, calculate the number of units:

Hence, the number of units is 20,500 units.

Calculate variable cost per internal unit:

Hence, the variable cost per internal unit is $46.4.

Calculate the variable cost per external unit:

Hence, the variable cost per external unit is $51.4.

Now, calculate the amount of variable cost:

Hence, the amount of variable cost is $2,004,900.

2. First, calculate the fixed selling and administrative expenses in order to calculate direct fixed expenses:

Hence, the amount of fixed selling and administrative expense is $997,500.

Calculate direct fixed selling and administrative expenses:

Hence, the direct fixed selling and administrative expense is $698,250.

Calculate the number of units sold:

Let the number of units sold be x. The division sells 50% of its output to another division for $83 per unit. If the division shut down the part would be purchased externally at $100 per unit. Therefore, the equation is given below:

Hence, the number of units is 41,000 units.

Calculate direct fixed overhead:

Hence, the direct fixed overhead is $820,000.

Now, calculate the amount of total direct fixed expenses:

Hence, the amount of total direct fixed expense is $1,518,250.

3. Calculation of common fixed expense:

Hence, the amount of common fixed expense is $299,250.

2.

Describe whether the president should shut down the division. Also, determine the effect of profit, if the division is closed.

Explanation of Solution

The following table represents the appropriate decision regarding the division:

| Costs | Alternatives | |

| Keep ($) | Drop ($) | |

| Sales | 3,751,500 | |

| Variable cost4 | (2,004,900) | (2,050,000) |

| Direct fixed expenses | (1,518,250) | |

| Annuity | 100,000 | |

| Total | 228,350 | (1,950,000) |

Table (2)

The relevant benefit to keep the division is $228,350 whereas, if the company drops the division, then the relevant benefit will be ($1,950,000). Therefore, the company should keep the division.

Working Note:

4. Calculation of variable cost if the company drops the division:

Hence, the amount of variable cost if the company drops the division is $2,050,000.

Want to see more full solutions like this?

Chapter 8 Solutions

Managerial Accounting

- Financial Accountingarrow_forwardCUMULATIVE COMPREHENSION PROBLEM: ECHO SYSTEMS (This comprehensive problem was introduced in Chapter 2 and continues in Chapters 4 and 5. If the Chapter 2 segment has not been completed, the assignment can begin at this point. You need to use the facts presented in Chapter 2. Because of its length, this problem is most easily solved if you use the Working Papers that accompany this book.) After the success of of its first two months,Mary Graham has decided to continue operatine Echo Systems. (The that occurred in these months are described in Chapter 2.) Before proceeding in December, Gra- e new accounts to the chart of accounts for the ledger: hamadds these ne No. 105 210 Account Accumulated Depreciation Office Equipment ... Accumulated Depreciation, Computer Equipment ............ Wages Payable...... Uneamed Computer Services Revenue..... Depreciation Expense, orice Equipment............. Depreciation Expense. Computer Equipment........... Insurance Expense Rent Expense Computer…arrow_forwardWhat is the direct labor efficiency variance for October on these general accounting question?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub