Managerial Accounting

7th Edition

ISBN: 9781337116008

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: South Western Educational Publishing

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 11MCQ

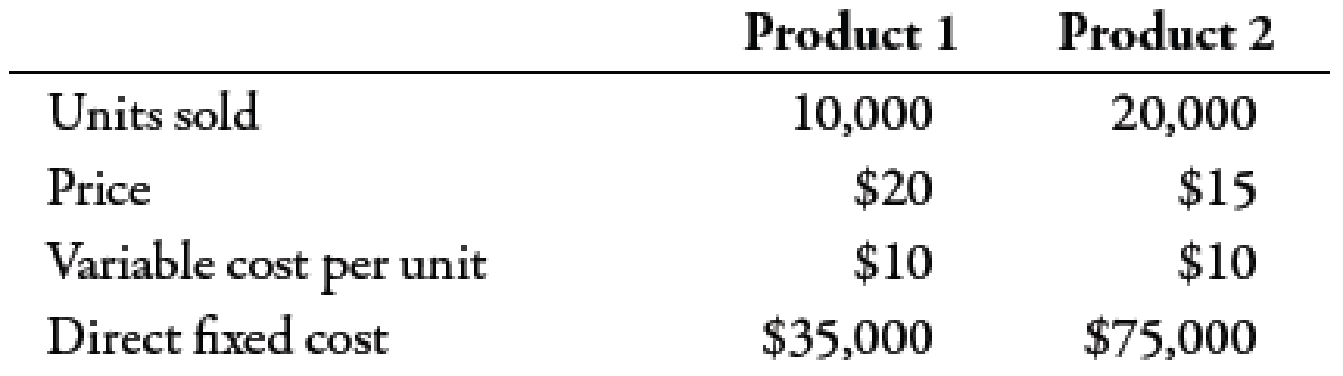

Garrett Company provided the following information:

Common fixed cost totaled $46,000. Garrett allocates common fixed cost to Product 1 and Product 2 on the basis of sales. If Product 2 is dropped, which of the following is true?

- a. Sales will increase by $300,000.

- b. Overall operating income will increase by $2,600.

- c. Overall operating income will decrease by $25,000.

- d. Overall operating income will not change.

- e. Common fixed cost will decrease by $27,600.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

need help this queations

Quick answer of this accounting questions

none

Chapter 8 Solutions

Managerial Accounting

Ch. 8 - What is the difference between tactical and...Ch. 8 - Prob. 2DQCh. 8 - What role do past costs play in relevant costing...Ch. 8 - Explain why depreciation on an existing asset is...Ch. 8 - Give an example of a future cost that is not...Ch. 8 - Can direct materials ever be irrelevant in a...Ch. 8 - Why would a firm ever offer a price on a product...Ch. 8 - What is a segment?Ch. 8 - Prob. 9DQCh. 8 - Discuss the importance of complementary effects in...

Ch. 8 - Prob. 11DQCh. 8 - Suppose that a product can be sold at split-off...Ch. 8 - Prob. 13DQCh. 8 - Which of the following is not a step in the...Ch. 8 - Costs that cannot be affected by any future action...Ch. 8 - Use the following information for Multiple-Choice...Ch. 8 - Use the following information for Multiple-Choice...Ch. 8 - Use the following information for Multiple-Choice...Ch. 8 - Which of the following statements is false? a....Ch. 8 - Prob. 7MCQCh. 8 - In a make-or-buy decision, a. the company must...Ch. 8 - Carroll Company, a manufacturer of vitamins and...Ch. 8 - Prob. 10MCQCh. 8 - Garrett Company provided the following...Ch. 8 - Jennings Hardware Store marks up its merchandise...Ch. 8 - Prob. 13MCQCh. 8 - Prob. 14MCQCh. 8 - In the sell-or-process-further decision, a. joint...Ch. 8 - Structuring a Make-or-Buy Problem Fresh Foods, a...Ch. 8 - Structuring a Special-Order Problem Harrison Ford...Ch. 8 - Segmented Income Statement Gorman Nurseries Inc....Ch. 8 - Prob. 19BEACh. 8 - Prob. 20BEACh. 8 - Structuring the Sell-or-Process-Further Decision...Ch. 8 - Use the following information for Brief Exercises...Ch. 8 - Use the following information for Brief Exercises...Ch. 8 - Calculating Price by Applying a Markup Percentage...Ch. 8 - Calculating a Target Cost Yuhu manufactures cell...Ch. 8 - Structuring a Make-or-Buy Problem Coed Scents, a...Ch. 8 - Structuring a Special-Order Problem Rabbit Foot...Ch. 8 - Prob. 28BEBCh. 8 - Use the following information for Brief Exercises...Ch. 8 - Use the following information for Brief Exercises...Ch. 8 - Structuring the Sell-or-Process-Further Decision...Ch. 8 - Prob. 32BEBCh. 8 - Prob. 33BEBCh. 8 - Prob. 34BEBCh. 8 - Brief Exercise 8-35 Calculating a Target Cost...Ch. 8 - Model for Making Tactical Decisions The model for...Ch. 8 - Prob. 37ECh. 8 - Use the following information for Exercises 8-38...Ch. 8 - Prob. 39ECh. 8 - Prob. 40ECh. 8 - Prob. 41ECh. 8 - Prob. 42ECh. 8 - Prob. 43ECh. 8 - Prob. 44ECh. 8 - Prob. 45ECh. 8 - Sell at Split-Off or Process Further Bozo Inc....Ch. 8 - Use the following information for Exercises 8-47...Ch. 8 - Prob. 48ECh. 8 - Calculating Price Using a Markup Percentage of...Ch. 8 - Target Costing H. Banks Company would like to...Ch. 8 - Keep or Buy, Sunk Costs Heather Alburty purchased...Ch. 8 - Use the following information for Exercises 8-52...Ch. 8 - Use the following information for Exercises 8-52...Ch. 8 - Prob. 54PCh. 8 - Prob. 55PCh. 8 - Segmented Income Statement, Management Decision...Ch. 8 - Make or Buy, Qualitative Considerations Hetrick...Ch. 8 - Sell or Process Further Zanda Drug Corporation...Ch. 8 - Keep or Drop AudioMart is a retailer of radios,...Ch. 8 - Accept or Reject a Special Order Steve Murningham,...Ch. 8 - Cost-Based Pricing Decision Jeremy Costa, owner of...Ch. 8 - Product Mix Decision, Single Constraint Sealing...Ch. 8 - Special-Order Decision, Qualitative Aspects Randy...Ch. 8 - Sell or Process Further, Basic Analysis Shenista...Ch. 8 - Product Mix Decision, Single Constraint Norton...Ch. 8 - Sell at Split-Off or Process Further Eunice...Ch. 8 - Differential Costing As pointed out earlier in...Ch. 8 - Prob. 68CCh. 8 - Keep or Drop a Division Jan Shumard, president and...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For each of the transactions above, indicate the amount of the adjusting entry on the elements of the balance sheet and income statement.Note: Enter negative amounts with a minus sign.arrow_forwardNeed help with this question solution general accountingarrow_forwardDon't use ai given answer accounting questionsarrow_forward

- I want to correct answer general accounting questionarrow_forwardKindly help me with accounting questionsarrow_forwardDuo Corporation is evaluating a project with the following cash flows: Year 0 1 2 3 Cash Flow -$ 30,000 12,200 14,900 16,800 4 5 13,900 -10,400 The company uses an interest rate of 8 percent on all of its projects. a. Calculate the MIRR of the project using the discounting approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. Calculate the MIRR of the project using the reinvestment approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. c. Calculate the MIRR of the project using the combination approach. Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. Discounting approach MIRR b. Reinvestment approach MIRR c. Combination approach MIRR % % %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY