Concept explainers

Using Past Information to Estimate Required Returns

Use online resources to work on this chapter's questions. Please note that website information changes over time, and these changes may limit your ability to answer some of these questions.

Chapter 8 discussed the basic trade-off between risk and return. In the

As mentioned in Web Appendix 8A, beta can be estimated by regressing the individual stock's returns against the returns of the overall market. As an alternative to running our own regressions, we can rely on reported betas from a variety of sources. These published sources make it easy for us to readily obtain beta estimates for most large publicly traded corporations. However, a word of caution is in order. Beta estimates can often be quite sensitive to the time period in which the data are estimated, the market index used, and the frequency of the data used. Therefore, it is not uncommon to find a wide range of beta estimates among the various Internet websites.

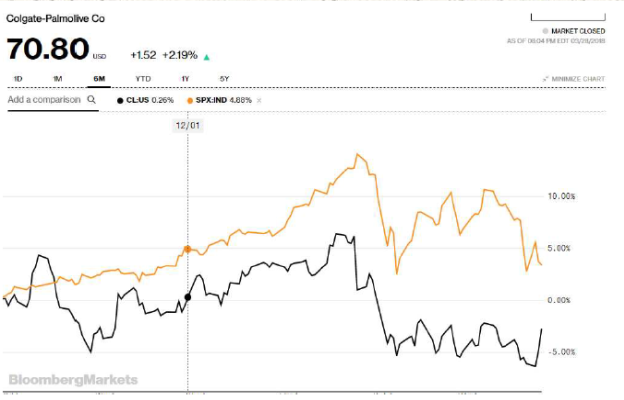

4. Select one of the four stocks listed in question 3 by entering the company's ticker symbol on the financial website you have chosen. On the screen you should see the interactive chart. Select the six-month time period and compare the stock's performance to the S&P 500's performance on the graph by adding the S&P 500 to the interactive chart. Has the stock outperformed or underperformed the overall market during this time period?

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Fundamentals of Financial Management (MindTap Course List)

- CARS Auto Co. Ltd – Alpha Branch Unadjusted Trial Balance December 31, 2024 Data presented for the adjusting entries include the following: Rent expense of $160,000 paid for the year was debited to CARS withdrawal account because of an oversight on the part of the Data Entry Clerk and this remained unadjusted as at year end. The company paid $24,330 on account for a credit purchase made earlier in the year but this entry was not recorded at year end. Supplies on hand at year end, $1,100. Depreciation on Leasehold improvement, $20,000. Depreciation on Furniture and Fixtures, $80,000. Salaries owed but not yet paid, $64,450. Accrued service revenue, $65,420. $44,000 of the unearned service revenue has been earned. Requirements: Explain why adjusting entries are required. Prepare the adjusting journal entries at December 31st, 2024. Open the ledger accounts in T-account form with their unadjusted balances then post the adjusting entries to the affected accounts, then balance off each…arrow_forwardPlease help me answer 7-3 and 7 -4.arrow_forwardHelp with questions 7-22.arrow_forward

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning