CFIN (with Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

5th Edition

ISBN: 9781305661653

Author: Scott Besley, Eugene Brigham

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

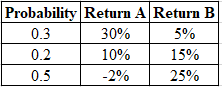

Chapter 8, Problem 3PROB

Summary Introduction

Expected

Standard deviation is the financial measure of risk and stability on the

Coefficient of variance is a measure used to calculate the total risk per unit of return of an investment.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Hello tutor give correct answer

Need assistance urgently by the expert.

Fake answers will be rate as unhelpful.

please don't use ai and if you cant understand given values please don't answer question otherwise unhelpful will be given.

Chapter 8 Solutions

CFIN (with Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- finance subjectarrow_forwardCould you help explain, what is the complete salary survey analysis, and ensuring the data is relevant and up-to-date? What is the job evaluation and compensation plan? How to ensure the final report is comprehensive, clearly structured, and aligned with the company vision?arrow_forwardThe maturity value of an $35,000 non-interest-bearing, simple discount 4%, 120-day note is:arrow_forward

- Carl Sonntag wanted to compare what proceeds he would receive with a simple interest note versus a simple discount note. Both had the same terms: $18,905 at 10% for 4 years. Use ordinary interest as needed. Calculate the simple interest note proceeds. Calculate the simple discount note proceeds.arrow_forwardWhat you're solving for Solving for maturity value, discount period, bank discount, and proceeds of a note. What's given in the problem Face value: $55300 Rate of interest: 10% Length of note: 95 days Date of note: August 23rd Date note discounted: September 18th Bank discount rate:9 percentarrow_forwardAll tutor giving incorrect solnarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY