Concept explainers

Expected

Standard deviation is the financial measure of risk and stability on the

Coefficient of variance is a measure used to calculate the total risk per unit of return of an investment.

Explanation of Solution

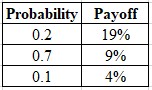

Calculate the expected return as follows:

Therefore, the expected return is

Calculate the standard deviation as follows:

Therefore, the standard deviation is

Calculate the coefficient of variance as follows:

Therefore, the coefficient of variance is

Want to see more full solutions like this?

Chapter 8 Solutions

CFIN (with Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

- What are the obstacles to work through emotional wellness coping methods, and increasing self-understanding, and how to work through them? What are the advantages and disadvantages of emotional wellness, coping methods, and increasing self-understanding?arrow_forwardWhat is the present value of $10,000 to be received in 5 years, assuming a discount rate of 10%?A) $6,210B) $6,810C) $7,580D) $8,100arrow_forwardDepreciation is:a) The increase in the value of an asset over time.b) The allocation of the cost of a tangible asset over its useful life.c) An amount paid for the maintenance of an asset.d) An asset's market value at the end of the accounting period.arrow_forward

- Depreciation is:a) The increase in the value of an asset over time.b) The allocation of the cost of a tangible asset over its useful life.c) An amount paid for the maintenance of an asset.d) An asset's market value at the end of the accounting period. Need helparrow_forwardWhat is the corporate finance how this is the part of finance?arrow_forwardExplain! Which of the following represents the primary goal of financial management?A) Maximizing net incomeB) Maximizing shareholder wealthC) Minimizing costsD) Maximizing market sharearrow_forward

- Which of the following represents the primary goal of financial management?A) Maximizing net incomeB) Maximizing shareholder wealthC) Minimizing costsD) Maximizing market sharearrow_forwardExplain! Which of the following is an example of a capital budgeting decision?A) Determining how to finance a new projectB) Deciding whether to pay dividends to shareholdersC) Deciding whether to purchase a new piece of equipmentD) Managing the company's cash balancesarrow_forwardExplain What does a beta coefficient of 1.5 indicate for a stock?A) The stock is less volatile than the marketB) The stock has no correlation with the marketC) The stock is 50% more volatile than the marketD) The stock is 50% less volatile than the marketarrow_forward

- What does a beta coefficient of 1.5 indicate for a stock?A) The stock is less volatile than the marketB) The stock has no correlation with the marketC) The stock is 50% more volatile than the marketD) The stock is 50% less volatile than the marketarrow_forwardWhat is the formula for calculating the net present value (NPV) of an investment?A) Future Cash Flows × Discount RateB) Present Value of Cash Inflows - Initial InvestmentC) Internal Rate of Return - Discount RateD) Net Income / Initial Investmentarrow_forwardWhich of the following is an example of a capital budgeting decision?A) Determining how to finance a new projectB) Deciding whether to pay dividends to shareholdersC) Deciding whether to purchase a new piece of equipmentD) Managing the company's cash balancesarrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning